Since inception, the gold mini futures contracts saw delivery of 52 tonne and it hopes the new mini options will attract the small and mid-sized players into the gold market. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. Register Now! MCX gets Sebi nod to launch gold, sliver mini options The exchange will launch the gold mini options from August expiry onwards with expiry matching with gold mini futures. Learn more about options in this Options Trading Guide. Options traders may find that they were right about the direction of the gold market but still lost money on their trade.

Many options traders use options strategies to hedge or cover other trades.

See our options strategy guide to see what these terms mean. If you already trade on the foreign exchange forex , an easy way to get into gold trading is with metal currency pairs.

Download ET App:

But instead of two currencies, there is a metal and its spot price in a particular currency. The following regulated brokers offer bullion , CFDs , mining stocks, metal ETFs and other financial products that allow traders to speculate on gold prices. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. There are countless gold trading strategies used to determine when to buy and sell gold.

Some gold and silver traders choose to track this ratio and develop pairs trading strategies based on which asset is cheaper relative to the other. When the ratio is high, it may indicate that gold is overvalued or that silver is undervalued. Learn more about bullion trading and what other precious metals you can purchase physically.

These include silver, palladium, and platinum. Before trading gold, traders should consider the following factors to create a personal trading strategy:. Important: This is not investment advice. We present a number of common arguments for and against investing in this commodity. Please seek professional advice before making investment decisions.

Top Stories

However, the price of gold has varied widely for hundreds of years. If we look only since the s, gold reached its highest level in inflation-adjusted dollars in Before the introduction of fiat currencies, historical gold prices were higher.

Like all commodities, gold has some disadvantages. Some forms of it can be costly to trade or store in case of trading gold physically, like bullion bars and coins. But the biggest disadvantage of gold for some traders is that its price is historically volatile. Looking at gold prices since , there were close to as many opportunities to lose money as to gain it despite the fact that the current price is much higher.

Unlike other daytime markets, gold trading is open to traders hours-a-day. That said, brokers like IG. Yes, gold coins are worth slightly more than gold bullion. This is due to the additional minting costs to create gold coins.

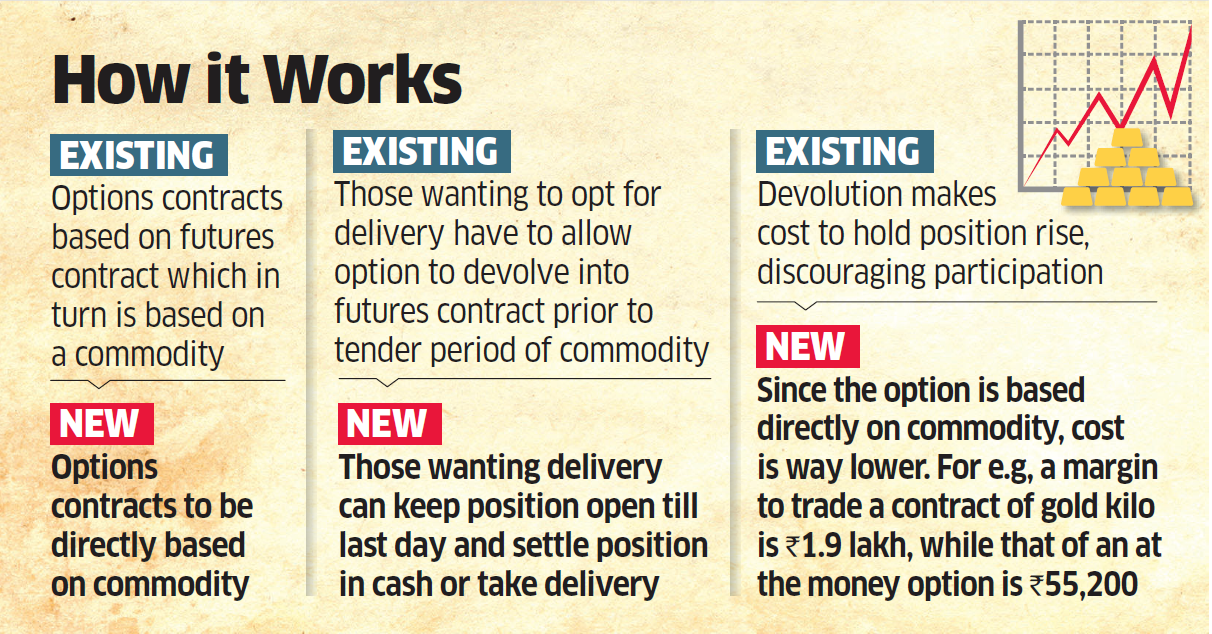

FM launches options trading in gold on MCX : The Tribune India

Buyer has a limited risk in this case. Options are available in two types, call and put. Call options is for buying the underlying asset at a specific price for a certain period of time. If the gold price fails to meet the specific price before the expiry date, the options expire automatically. Put options give rights to a holder for selling an underlying asset at a specific price strike price.

MCX gets Sebi nod to launch gold, sliver mini options

Put option can be tried any time before the expiry of the option. They sell it when they feel the price will rise. Suppose gold future contract of gold is costing Rs. Suppose you feel that price of gold will increase, in that case, you will buy the option by paying Rs. If the contract value increases to Rs. You can square off your position and take off the profit of Rs. On the other hand, If the price falls you lose your money and call seller make money. If you think that price of gold will fall. You will sell gold option at Rs.

If price increases the put seller get profit.