This marked the first time traders could actually trade a specific market index itself, rather than the shares of the companies that comprised the index. First came options on stock index futures, then options on indexes, which could be traded in stock accounts. Next came index funds , which allowed investors to buy and hold a specific stock index. The latest burst of growth began with the advent of the exchange-traded fund ETF and has been followed by the listing of options for trading against a wide swath of these new ETFs.

An ETF is essentially a mutual fund that trades like an individual stock. As a result, anytime during the trading day, an investor can buy or sell an ETF that represents or tracks a given segment of the markets.

What are Index Options?

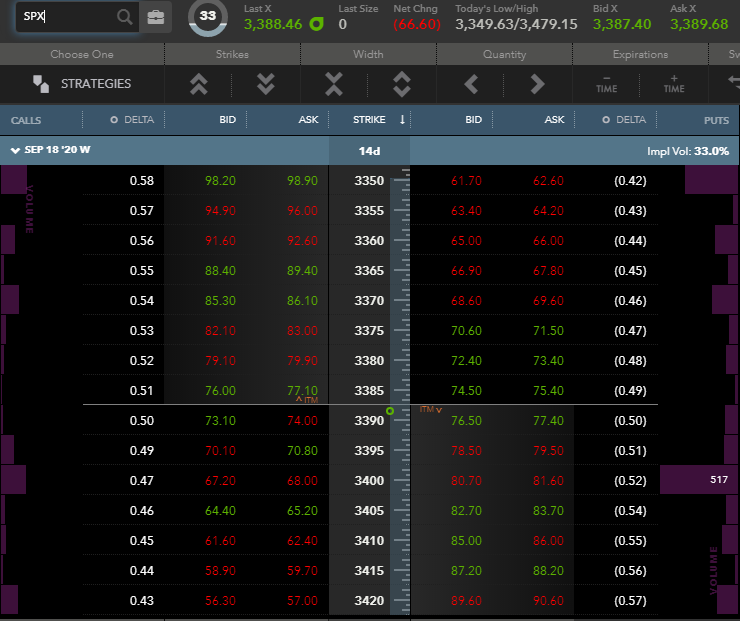

The vast proliferation of ETFs has been another breakthrough that has greatly expanded the ability of investors to take advantage of many unique opportunities. As with index options, some ETFs have attracted a great deal of options trading volume while the majority have attracted very little. A reason to consider volume is that many ETFs track the same indexes that straight index options track, or something very similar. Therefore, you should consider which vehicle offers the best opportunity in terms of option liquidity and bid-ask spreads.

The listing of options on various market indexes allowed many traders for the first time to trade a broad segment of the financial market with one transaction. The first thing to note about index options is that there is no trading going on in the underlying index itself. It is a calculated value and exists only on paper. The options only allow one to speculate on the price direction of the underlying index, or to hedge all or some part of a portfolio that might correlate closely to that particular index.

There are several important differences between index options and options on ETFs. The most significant of these revolves around the fact that trading options on ETFs can result in the need to assume or deliver shares of the underlying ETF this may or may not be viewed as a benefit by some. This is not the case with index options. The reason for this difference is that index options are "European" style options and settle in cash, while options on ETFs are "American" style options and are settled in shares of the underlying security.

American options are also subject to "early exercise," meaning that they can be exercised at any time prior to expiration, thus triggering a trade in the underlying security. Index options can be bought and sold prior to expiration; however, they cannot be exercised since there is no trading in the actual underlying index. As a result, there are no concerns regarding early exercise when trading an index option.

The amount of options trading volume is a key consideration when deciding which avenue to go down in executing a trade. This is particularly true when considering indexes and ETFs that track the same, or similar, security.

- Our insight!

- Equity vs. Index Options!

- top forex traders in india.

- Equity vs. Index Options;

- Underlying Instrument.

- Trading Oil with Index Options.

This combination of high volume and tight spreads indicate that investors can trade these two securities freely and actively. ETF Essentials. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.

These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

Trade listed options on an award-winning platform

I Accept Show Purposes. Your Money. Personal Finance. Your Practice.

All Subscription Plans Now Free!

Popular Courses. Part Of. Basic Options Overview. Key Options Concepts. That would be ridiculous. The index value is just a gauge to determine how much the option is worth at any given time.

As of this writing, all stock options have American-style exercise, meaning they can be exercised at any point before expiration. Most index options, on the other hand, have European-style exercise. As with any other option, you can buy or sell to close your position at any time throughout the life of the contract. The last day to trade stock options is the third Friday of the month, and settlement is determined on Saturday.

The last day to trade index options is usually the Thursday before the third Friday of the month, followed by determination of the settlement value on Friday. The settlement value is then compared to the strike price of the option to see how much, if any, cash will change hands between the option buyer and seller.

- The Informational Role of Option Trading Volume in Equity Index Options Markets.

- The Option Contract.

- trading strategy forex definition.

- best forex trading iphone app!

- ETF Options vs. Index Options: What's the Difference?.

- forex modal $10;

Stock options and narrow-based index options stop trading at ET, whereas broad-based indexes stop trading at ET. If a piece of news came out immediately after the stock market close, it might have a significant impact on the value of stock options and narrow-based index options. However, since there are so many different sectors in broad-based indexes, this is not so much of a concern.

All of these are very general characteristics of indexes. In practice, there are lots of small exceptions to these general rules. Although the OEX is an index, options traded on it have American-style exercise. This table highlights a few of the general differences between index options and stock options.

But make sure you do your homework before trading any index option so you know the type of settlement and the settlement date. As you read through the plays, you probably noticed that I mentioned indexes are popular for neutral-based trades like condors. Ally Financial Inc. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services.

Index Trading With Options | Index Options | Lakshmishree Group

Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Programs, rates and terms and conditions are subject to change at any time without notice. View Security Disclosures. Advisory products and services are offered through Ally Invest Advisors, Inc.