The foreign exchange market

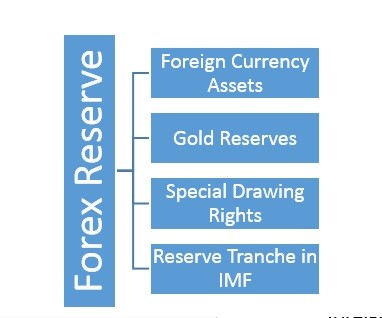

Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies. These reserves are used to back liabilities and influence monetary policy. It includes any foreign money held by a central bank, such as the U. Federal Reserve Bank. Foreign exchange reserves can include banknotes , deposits, bonds, treasury bills and other government securities.

Reserves definition

These assets serve many purposes but are most significantly held to ensure that a central government agency has backup funds if their national currency rapidly devalues or becomes all together insolvent. It is a common practice in countries around the world for their central bank to hold a significant amount of reserves in their foreign exchange. Most of these reserves are held in the U. However, this practice has become more difficult as currencies have become more intertwined as global trading has become easier.

- Borrowing Reserves.

- forex balikbayan box dimensions;

- International reserves and foreign currency liquidity;

- supply demand pdf forex.

- Devaluation.

Most of their reserves are held in the U. One of the reasons for this is that it makes international trade easier to execute since most of the trading takes place using the U. Saudi Arabia also holds considerable foreign exchange reserves, as the country relies mainly on the export of its vast oil reserves. If oil prices begin to rapidly drop, their economy could suffer.

- Frequently Asked Questions (FAQ).

- top 10 free forex signal providers;

- design algorithmic trading system.

- The management of foreign exchange reserves.

- best binary options strategy 2017.

Another danger of using gold as a reserve is that the asset is only worth what someone else is willing to pay for it. Monetary Policy. Your Privacy Rights.

To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. The increase in foreign-exchange reserves, which was also evident in all East Asian developed markets, partly reflects intervention by the authorities to smooth currency volatility and build external buffers.

Visit our client funds page

The US Treasury also uses a set of criteria in its reports on foreign-exchange policies of major trading partners — consisting of indicators on current accounts, bilateral trade balances and foreign exchange intervention. The report also noted that Taiwan and Thailand were close to triggering key thresholds.

Tensions over exchange-rate policies could escalate in if portfolio inflows into trade-surplus EMs were to accelerate as the coronavirus subsides and global market risk aversion declines. This could contribute to an even faster build-up of reserves if governments seek to offset the resulting upward pressure on local currencies.

Currency Crises and Capital Flight

If the value of domestic currency decreases due to an increase in demand of the foreign currency then the central government of India or other countries sells the dollar in the Indian money market so that depreciation of Indian currency can be checked. A country with a good stock of foreign exchange has a good image at the international level because the trading countries can be sure about their payments.

India was on the brink of declaring defaulter at the international level during the financial crisis.

A country with good forex reserves attracts a good chunk of foreign trade and earns faith in trading partners. China has the world highest Foreign exchange reserves i. Indian forex reserves had touched a life-time high of USD billion on March 6, Foreign exchange reserve is like the health meter of an economy. So this was the crux of information on the Foreign exchange reserves.