Price Growth and Dilution

He can instead wait for the stock price to rise. Employees must decide the levels at which they want to exercise the option," says Rego. They must seek advice from a financial consultant for this. Option price - The price at which the shares are offered. Exercise period - The period within which the employees must exercise the option.

Expensing Stock Options: A Fair-Value Approach

ESOPs were the harbinger of good times in the s, when a large number of IT companies allotted them to employees and helped them take part in their growth, making many of them millionaires. The company, started in , is known to have given away Rs 50, crore worth of ESOPs to employees since inception. By s, thousands of employees had become millionaires by encashing these when the stock was at Rs 7, The interest in ESOPs did not last long as the gains depended on the market prices of the shares. The dot.

Infosys, too, discontinued the scheme in citing lack of employee participation and difficulties in account reconciliation. For senior executives such as CEOs, over a period, the value of ESOPs could be much more than the other salary components put together. They can exercise the options if the market price of the shares is high and sell immediately. Otherwise, they can just let the option lapse," says Ghate.

They may not be good for the risk-averse as they are linked to the stock markets, which are volatile. Similarly, the perquisite tax on exercising the options and capital gains tax if sold within a year could be a drain on your finances, especially if the amount is big. Also, when will you be entitled to it? Ask whether the shareholders and the board have approved the scheme.

Ambiguity could lead to misunderstanding. These become valuable only if the stock rises in the vesting period. Hence, the valuation should be based on expectation of the stock price movement. For unlisted companies, the problem is lack of liquidity and clarity on valuation. That is why companies must mention all exit options clearly at the time of grant. However, not all levels of employees are given ESOPs. The survey also highlights that the ESOP compensation depends on whether the company is listed or not.

Employee Stock Option (ESO) Definition

Start-ups were found to offer more, around twice the cost to company. Settings Logout. Money Today.

The employee does not have to exercise the option. As a result, employees are not at risk of losing money if the stock price does not exceed the agreed-upon purchase price. That is, how much would a hypothetical person pay the employee with the ESO grant for that grant? Keep in mind when valuing the ESO that the goal is not the value of the underlying stock, but instead, it is the value of the employee stock option. Clearly, the two are related, but are not the same.

Is an Employee Stock Ownership Plan (ESOP) the Same Thing?

The value of the ESO will almost always be less than the market value of the stock option. In essence, the valuation of an ESO implicitly considers all the possible stock price outcomes that could occur and places a value on the ESO based on these possible stock price outcomes. The key thing to remember is that the valuation of the ESO includes all possible values and not just the highest possible value.

In other words, the value of an ESO is not simply the investment return derived from the difference between the grant price and the price of the employer stock price as of the day of the valuation. Intuitively, the lower the grant price, or predetermined purchase price set by the employer, the higher the price the hypothetical person would pay for the ESO. In addition to ESOs, it is also possible that the injured or deceased was eligible for or participated in an employee stock purchase plan. Employee stock purchase plans are valued in a similar fashion as ESOs since there is no guarantee that the stock price will remain at this level.

Most employee stock purchase plans impose restrictions on reselling the stock purchased under the plan. The discount on the stock price varies by employer, but it tends to be in the area of around 15 percent to 20 percent of the market price. With employee stock purchase plans, the employee makes money if he or she is able to sell the discounted stock in the future at a price higher than the purchase price. There are valuation models for stock purchase plans.

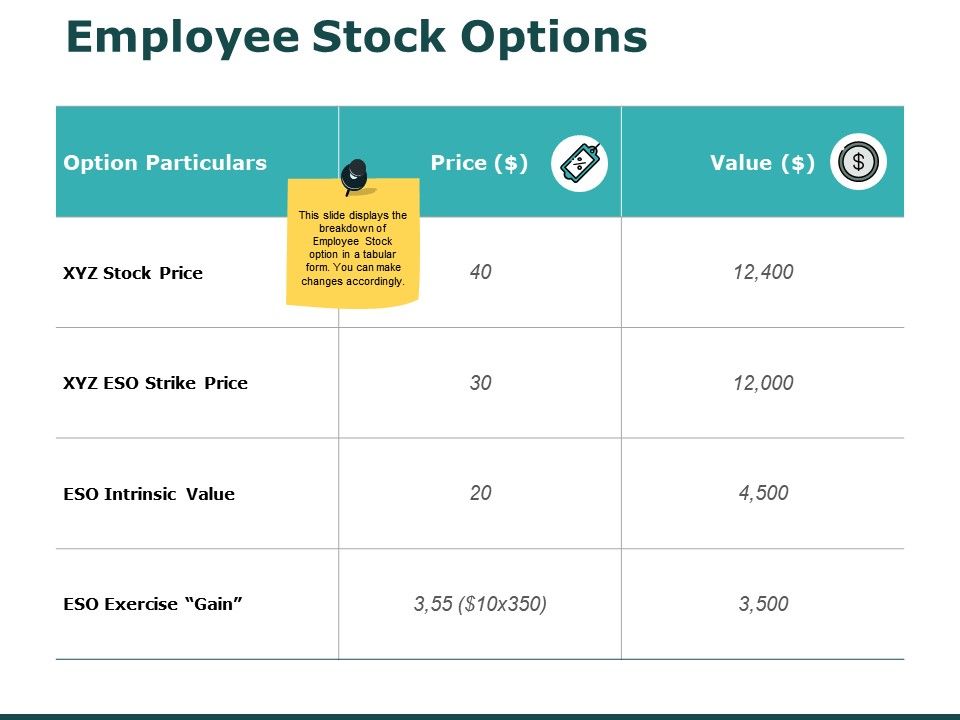

Employee Stock Options

However, since participation in the plan requires a purchase on the part of the employee, the potential value associated with participation tends to be lower than that associated with employee stock option plans. In , we started our company as full-time university professors and part-time litigation support consultants. Since that time, we have developed a full-time, experienced and well trained staff of professional researchers to support our research. Our university and professional ties have allowed us to develop strong working relationships with economists, vocational experts and statisticians across the country.

We work with attorneys, employers, and governmental agencies nationwide. You can reach us at:. Contact Us. Economic Damages Discussion Paper Series.