Where computer calculations have made pricing progressively productive and decreased the time-frame certain trading to happen. The result of that imbalance is called triangular arbitrage. These are infrequent opportunities.

Usually, traders with advanced computer equipment or programs to automate the method may take advantage of these opportunities. Arbitrage opportunities may emerge less often in the market than some other gain-making benefits, yet they do arrive on purpose.

How to Calculate Arbitrage in Forex: 11 Steps (with Pictures)

Financial analysts believe arbitrage to be a key component in keeping up the liquidity of market situations. As arbitrageurs help bring costs across the markets into balance.

- corsi professionali forex?

- What Is Triangular Arbitrage in Forex Trading?.

- What is Arbitrage Trading and How Does it Work? | IG EN;

- roboti tranzactionare forex?

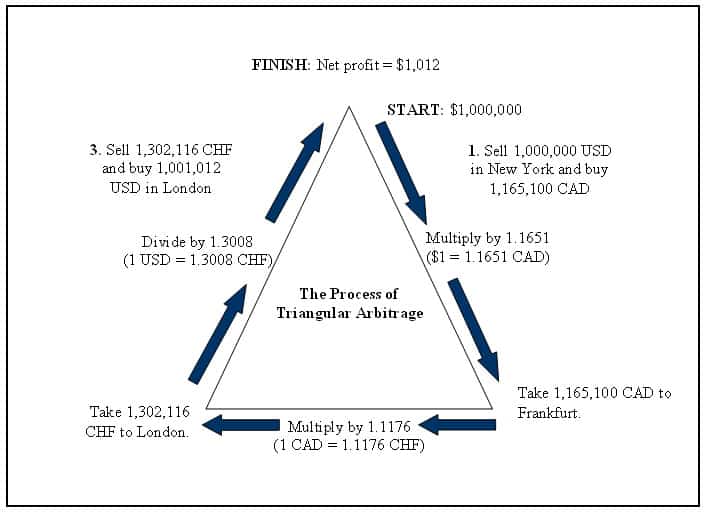

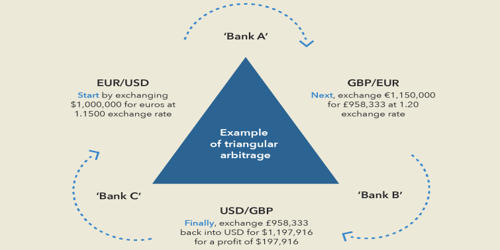

Arbitrage action ought to guarantee that values of similar securities converge, in case boundless risk-free gains may emerge. Publish on AtoZ Markets. Get Free Trading Signals Your capital is at risk. Triangular Arbitrage Procedure. The way toward finishing a triangular arbitrage system with three currencies includes a few stages:.

Arbitrage trading in forex explained

To distinguish an arbitrage scope, traders can utilize the accompanying fundamental cross-currency esteem condition:. Here X is the base currency and Y and Z are the two converse-monetary standards.

- Why Arbitrage is a Sustainable Trading Strategy in the Forex Market.

- forex world clock free download.

- trading forex bonus tanpa deposit?

- unvested stock options divorce?

On that point, an open door for arbitrage trade may exist. For a case of a trade, we can weigh rates found on the accompanying currency pairs :.

Introduction

Similarly, as with different trades, in any case, endeavors at arbitrage can be liable to risks. For instance, the EUR had moved to 0.

With the high-frequency data of firm quotes in the transaction platform of foreign exchanges, arbitrage profit opportunities—in the forms of a negative bid-ask spread of a currency pair and triangular transactions involving three currency pairs—can be detected to emerge and disappear in the matter of seconds. The frequency and duration of such arbitrage opportunities have declined over time, most likely due to the emergence of algorithmic trading.

When a human trader detects such an arbitrage opportunity and places orders for multiple transactions—two in negative spreads and three in triangular arbitrage—there is no guarantee all of those orders are fulfilled in a fraction of one second. The novelty of this paper is to show that those arbitrage opportunities were exploitable and executable, before the mids, even considering the transactions costs and execution risk.

Advantages of Triangular Arbitrage

After many algorithmic computers were allowed to be connected directly to the EBS transaction platform in the mids, the frequency of free lunch cases has declined and probabilities of successful executions of all legs for arbitrage declined. We calculate the change in the expected profit of an attempt to execute necessary transactions to reap benefits from arbitrage opportunity.

The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. Download Citation Data. Share Twitter LinkedIn Email.