The tail lower shadow , must be a minimum of twice the size of the actual body. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. Volume can also help hammer home the candle. To be certain it is a hammer candle, check where the next candle closes.

1. Head and Shoulders/Inverse Head and Shoulders

It must close above the hammer candle low. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. This makes them ideal for charts for beginners to get familiar with. Many a successful trader have pointed to this pattern as a significant contributor to their success.

Look out for: At least four bars moving in one compelling direction. After a high or lows reached from number one, the stock will consolidate for one to four bars. The high or low is then exceeded by am.

Firstly, the pattern can be easily identified on the chart. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. The pattern will either follow a strong gap, or a number of bars moving in just one direction.

Know the 3 Main Groups of Chart Patterns

In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Check the trend line started earlier the same day, or the day before. Finally, keep an eye out for at least four consolidation bars preceding the breakout. There are some obvious advantages to utilising this trading pattern.

The stock has the entire afternoon to run. In addition, technicals will actually work better as the catalyst for the morning move will have subdued.

In few markets is there such fierce competition as the stock market. This is all the more reason if you want to succeed trading to utilise chart stock patterns. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders.

Know the 3 Main Groups of Chart Patterns -

Put simply, price action is how price is likely to respond at certain levels of resistance or support. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. So, how do you start day trading with short-term price patterns? One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions.

There is no clear up or down trend, the market is at a standoff. If you want big profits, avoid the dead zone completely. No indicator will help you makes thousands of pips here. This is where things start to get a little interesting. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. It could be giving you higher highs and an indication that it will become an uptrend.

This will be likely when the sellers take hold. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. This is where the magic happens. With this strategy you want to consistently get from the red zone to the end zone.

Draw rectangles on your charts like the ones found in the example. Then only trade the zones. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. One common mistake traders make is waiting for the last swing low to be reached. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Forget about coughing up on the numerous Fibonacci retracement levels.

The main thing to remember is that you want the retracement to be less than Trading with price patterns to hand enables you to try any of these strategies. Find the one that fits in with your individual trading style. Will you be trading the NFP this coming Friday? These are perhaps the most popular patterns, frequently used by traders across all timeframes. The single candlestick pattern comes in two well-known formations: the hammer and the hanging man. Hammers indicate a downtrend, in a bullish reversal movement, while the hanging man shows the peak of a price gain, indicating an increase in the number of sellers of a currency pair, against a potential number of buyers.

Candlesticks also make engulfing patterns, which are useful to track sudden and strong changes in price movements. Technical analysis helps traders to make sensible decisions during live trading sessions and therefore knowing the different chart patterns you might come across is of great importance. How will the Spanish Congress Vote? Awesome Oscillator and Daily Pivot point strategy. Evaluating your Strategy — Counterintuitive Results.

Leave A Reply Cancel Reply. Save my name, email, and website in this browser for the next time I comment. Get our exclusive daily market insights!

How to Read Forex Chart Patterns

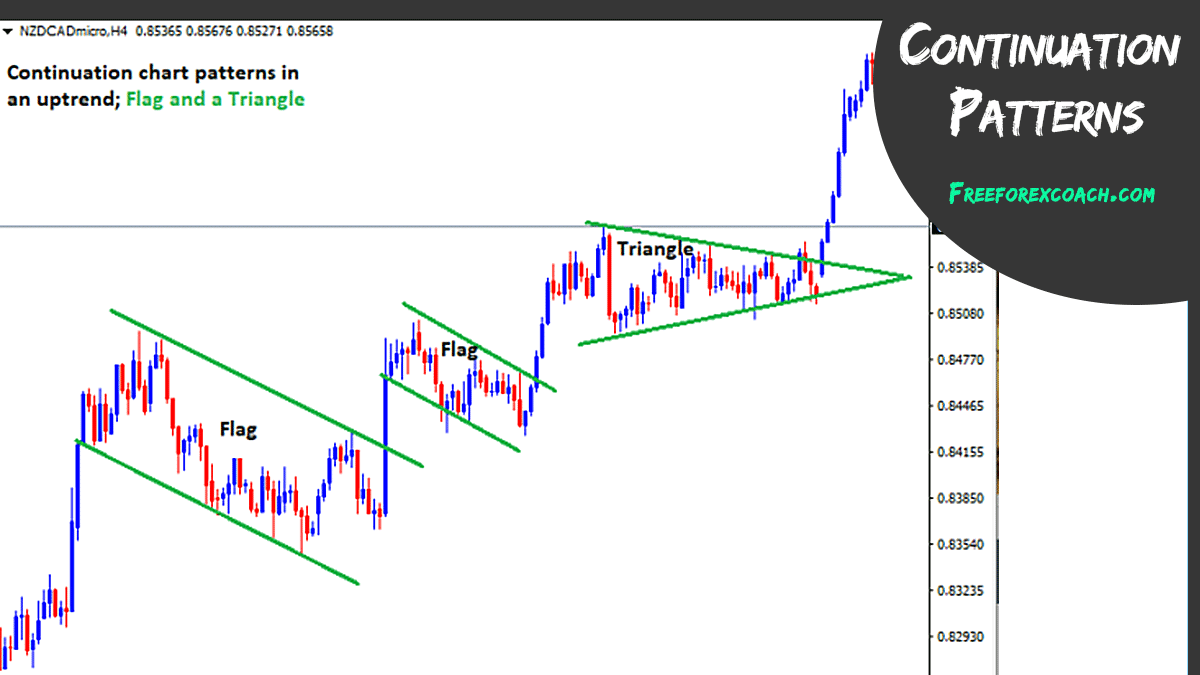

With Stavros Tousios. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis now. Open Live Account. Follow Us. Join Us. By Orbex Last updated Dec 10, When the price closes a candle beyond the signal line, a pattern is confirmed. Triangle Patterns These are a type of continuation pattern, indicating that an ongoing trend will likely resume its course in the same direction. Candlestick Patterns These are perhaps the most popular patterns, frequently used by traders across all timeframes.

You might also like More from author.

EXPERIENCE LEVEL

Trading Strategies. Leave A Reply. More Stories. Jul 12,