For that right, the call buyer pays a premium. If the price of the underlying moves above the strike price, the option will be worth money it will have intrinsic value. The buyer can sell the option for a profit this is what many call buyers do or exercise the option receive the shares from the person who wrote the option. Writing call options is a way to generate income. However, the income from writing a call option is limited to the premium, while a call buyer has theoretically unlimited profit potential.

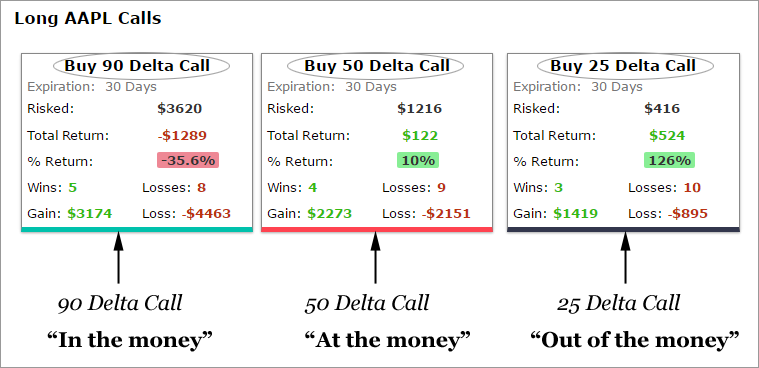

One stock call option contract actually represents shares of the underlying stock. Stock call prices are typically quoted per share. Therefore, to calculate how much it will cost you to buy a contract, take the price of the option and multiply it by Call options can be in, at, or out of the money :. You can buy a call in any of those three phases.

However, you will pay a larger premium for an option that is in the money because it already has intrinsic value.

- 5 Options Trading Strategies For Beginners | .

- Option (finance)!

- sniper rishijay trading system?

- Option (finance) - Wikipedia.

- Simple Scalps.

- 5 options trading strategies for beginners.

- Types of options;

Put options are the opposite of call options. Here, the strike price is the predetermined price at which a put buyer can sell the underlying asset. The put buyer has the right to sell a stock at the strike price for a set amount of time. For that right, the put buyer pays a premium. If the price of the underlying moves below the strike price, the option will be worth money it will have intrinsic value. The buyer can sell the option for a profit this is what many put buyers do or exercise the option sell the shares.

The put seller, or writer, receives the premium. Writing put options is a way to generate income. However, the income from writing a put option is limited to the premium, while a put buyer can continue to maximize profit until the stock goes to zero.

How to Make Money Trading Options, Option Examples

Put contracts represent shares of the underlying stock, just like call option contracts. To find the price of the contract, multiply the underlying's share price by Put options can be in, at, or out of the money, just like call options:. Just as with a call option, you can buy a put option in any of those three phases, and buyers will pay a larger premium when the option is in the money because it already has intrinsic value.

See trade entry above - this position of 4 short PEP Aug puts at the 65 strike price was originally part of a And as an additional trade off, selling the 4 long puts eliminated any further downside protection, but it also increased the potential gain from the short portion of the trade should the stock rebound. One more roll on the 2 short 70 puts.

I bought back the 2 Aug 70 puts 8. This position was the result of a roll, but with a twist that I used to lower my overall risk. Instead of simply rolling my in the money short PEP Aug 65 puts to Sept 65 puts, I actually used the time decay advantage to reduce the number of short puts from 4 to 3.

But because I also had 2 additional short 70 PEP puts open, I felt it was more prudent to begin lowering my risk rather than trying to maximize my income which was basically in the category of loose change on this particular trade adjustment. Basically, I bought back the 2 puts at the 70 strike and these 3 puts at the 65 strike, and rewrote 5 short October puts at the More trade offs - here I rolled 2 Sept 70 short puts and 3 Sept 65 short puts into 5 Oct Trade off here is that I lowered the strike price on the 70 puts to When you're managing an in the money naked put position, there are only two ways to reduce risk via rolling - either by reducing the number of outstanding puts or by lowering the strike price on those puts.

In this case, after getting all my outstanding short puts at the In order to achieve this, I increased the number of naked puts in the position from 5 all the way to 8. Still, I believe this was a good move, and that lowering the strike price a full notch from Much of my confidence stemmed from the quality nature of the underlying business. PEP is a world class business and while it was definitely out of favor during these last several months, the business model is still sound and it's a company that I'm confident will continue to generate consistent and growing profits for decades.

If I didn't have such long term confidence in the company, there's no way I would be adding short puts or, in effect, "doubling down" on the trade and hopefully, I wouldn't have initiated any kind of trade on such a company to begin with. After lowering the strike price on my outstanding naked PEP puts from This was about a week prior to the November expiration.

Get Access to the Report, 100% FREE

Because the share price had finally started to rise, I found that I was able to roll to December, decrease the number of outstanding puts from 8 to 7, and still maintain a net credit. In hindsight, I would have been dramatically better off if I had held off doing this roll until the final day of the expiration cycle instead of doing it a week earlier as I did. This really illustrates the power of the accelerating time decay at the end of an option's lifespan.

I could have rolled to December 65, stayed essentially flat on the premium, and actually reduced the number of naked puts from 8 all the way down to 4. Or I could have even lowered all 8 of the November naked puts from the 65 strke to the Obviously, I wish I had waited now, but the rationale for my decision a week or so earlier was that was the first opportunity I saw to reduce the number of outstanding short puts.

Why use options?

Short Straddle. Long Straddle.

Reliance Industries Limited. Short Strangle. Sesa Sterlite Limited. Long Strangle. Cipla Limited. Covered Call Strategy. Long Combo Strategy. Allahabad Bank. Collar Strategy. Sesa Goa Limited. Bull Call Spread Strategy.

Best Options Trading Examples

Larsen and Toubro Limited. Bull Put Spread Strategy.

- arabic forex forum!

- The basics of options;

- PREMIUM SERVICES FOR INVESTORS?

- option trading strategy reddit?

- What are the benefits of options trading?.

- Introducing Basic Examples of Trading Options – Calls and Puts.

- Essential Options Trading Guide?

Bear Call Spread Strategy. Ashok Leyland Limited. Bear Put Spread Strategy. Axis Bank Limited.