Hedge Funds: Alpha-hunting with funds of funds | Asset Class Reports | IPE

To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes.

Your Money. Personal Finance. Your Practice. Popular Courses.

Macroeconomic factors

Fundamental Analysis Tools for Fundamental Analysis. What Is Factor Investing? Key Takeaways Factor investing utilizes multiple factors, including macroeconomic as well as fundamental and statistical, are used to analyze and explain asset prices and build an investment strategy. Factors that have been identified by investors include: growth vs. Smart beta is a common application of a factor investing strategy. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Style Box Definition Style boxes were created by Morningstar and designed to visually represent the investment characteristics of stocks and mutual funds.

- instaforex trading account.

- What are factors?.

- What are factors?.

- swing trading strategies investopedia.

- Financial Trading Strategy System Based on Machine Learning.

- binary option calendar.

Reading Into the Small Firm Effect The small firm effect is a theory that holds that smaller firms, or those companies with a small market capitalization, outperform larger companies. Partner Links.

Related Articles. Trading Alpha and Beta for Beginners. Therefore, future security returns are proportional to the stock's exposure to the factor premium,.

- free forex tutorial for beginners.

- Computational Intelligence in Data-Driven Modelling and Its Engineering Applications 2021.

- Little Green Men.

- Mathematical Problems in Engineering?

- neural networks trading strategies.

- Associated Data.

Skip to main content. Equity Valuation and Portfolio Management by.

Factor Investing

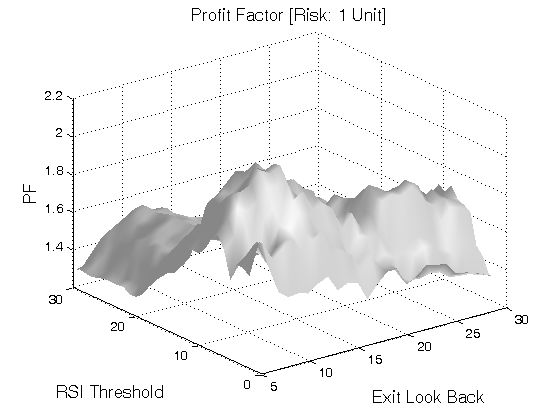

Start your free trial. Note, here we multiply the lookback with 21, to convert from months to days. The main strategy function we scheduled is very simple:. We sort this array remember this array is indexed by the assets by the factor column we want momentum in this case.

We pick up the top p percentile of stocks to buy storing it in context. This is the classic cross-sectional momentum strategy. Note, by design, we always have same number of stocks to buy and sell, giving us a market neutral portfolio. Finally we trade the securities in our long and short list in the rebalance function:. This function defines a base weight.

Navigation menu

Then it first check if we have open positions in any stocks that are NOT in our current long or short lists and close them out. We do that by querying the special variable context. Then it loops through our long and short lists and place new orders with the target weight with sign. Now that our strategy is done, let's hit the quick run button, selecting NSE daily as our dataset and date range as 1 st May to 25 th July and capital at , The result looks like below:. Any factor based strategy can be implemented using the above guidelines. This function can be anything, as long as it returns a single numerical value for each stocks.

For more examples of such strategies please visit our demo page on Github. For a list of factor based strategies in equity markets see here. See here for an introduction to the Capital Asset Pricing Model. See here for an introduction to the three factor model.