The new beginners can learn and develop their forex probability skills while playing forex game — free online forex trading game simulation. Before you start forex trading, it wise to try the forex trading game. While enjoying the forex game, you will learn market analysis and the basics of forex trading. Forex trading is a probability game, hence understanding the concept of forex trading is the path to success.

You do not need to learn complex or advanced mathematics to track price movements or do a proper analysis. But, basic knowledge in mathematics, forex trading, probability, and statistical analysis will help you develop a high probability trading system. Furthermore, you will analyze charts and trends better with minimal errors with the high probability trading system. Experienced traders think of forex trading in terms of chance and probability and not a sure trade or investment.

They back up their decisions on analysis to increase their chance and probability of success. The experienced trader does not worry so much about losing or winning trade. They know that profitability comes from consistent trading for some sometimes and maximize their profits by using a high probability forex system. Using a high probability forex system is beneficial psychologically.

Innovative Methods in Day Trading – High Probability Trading Strategies

It helps the trader to be calm, patient, and disciplined while relying on his or her trading strategy to succeed. Besides, using probability in trading, the trader will control the emotions in forex trading such as revenge trading, overtrading, fear of losing, and greed, among others. Even with the best analysis, forex probability understanding will let you know that you will either lose or win a trade.

You are not sure what chance for success the next trade might be in store for you, despite knowing the most probable price movement direction in the market. However, profitability in forex trading is long term activity greatly enhanced by probability based trading. Understanding random forex and forex series is the first step in learning forex probability. By learning the concepts of forex probability, traders will easily set financial goals and express them in mathematics figures.

And in the end, you will realize that nothing is guaranteed in the forex game, but you need to learn more and more to be a winner.

Customers who bought this item also bought

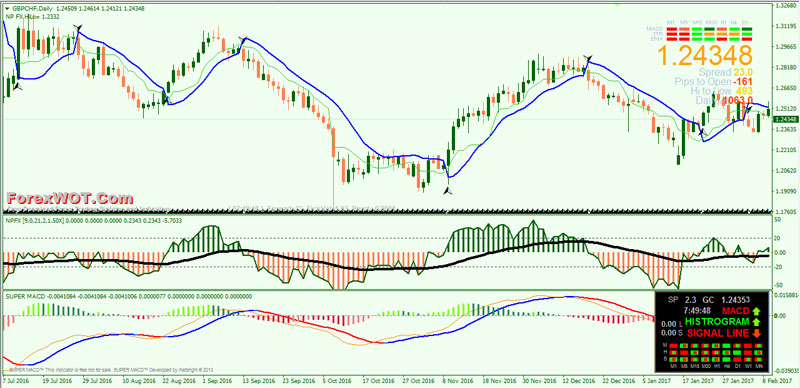

Let's take a look at all three lookback periods on the same chart Figure 2. While the 8-day lookback period usually made momentum reversals from the OB and OS zones right on or within a bar or two of most price-swing highs and lows, it also made a lot of whipsaw reversals mid-range that quickly reversed again. While the day lookback period was very smooth with no mid-range fake-out reversals, the momentum reversals usually lagged the price reversals several bars, and most did not reach the OB and OS zones.

The day lookback period made most of the reversals from the OB and OS zones and within a bar or two of the price-swing highs and lows. This is how I decide which settings or lookback period to use-it's very simple: Test a few settings on recent data and see which best meets the criteria for a useful indicator. I do the entire analysis and trade strategy for any market and any time frame within three minutes.

You'll be able to do this yourself when you've finished this book. There are only so many variables and so much useful data needed to make a trading decision. Once you have developed a trade plan, you can very quickly understand the probable position of a market and what the market must do for you to consider a trade. This has only been one example from a limited set of data. The concept and process is the most important thing for you to learn. Once you've learned it, the exact same concept and process is used for any market, any time frame, and any indicator.

You should have a big question about now: "You chose the best settings for this limited period of just a few months of SPX daily data. That's easy. It's called optimizing the historical data. Are these settings going to continue to be useful in the future? These guys have probably never actually traded, because I can guarantee there will be periods when market volatility and momentum cycles change and the indicator settings you have been using will be much less useful. So here's how it works. Look at a series of data for any market and any time frame. Test out a few lookback periods for your favorite indicator over two or three different periods of time for the data and choose the most useful settings.

Assume that these settings will continue to be useful. That's the best you can do, and don't let anyone tell you otherwise. You're not Nostradamus. You can't see into the future. You can never know if the volatility and momentum cycles will change in the future. You have to assume they will continue. If a market changes trend speed and volatility in the future and the best settings you have found in the past are no longer optimal after a few momentum cycles, you may need to shorten or increase the lookback period.

The same settings that were found to be useful for the earlier few months continued to be useful for months after.

High Probability Trading Strategies on Apple Books

Near the end of the data shown in Figure 2. That doesn't mean the indicator was not valuable, because if the larger time frame trend is bullish, any smaller time frame momentum bullish reversal below the OB zone is a setup for a long trade. If the indicator made a couple more oscillations without reaching the OS zone on the corrections, we would probably change to a shorter lookback period. It is a quick and easy process to find the best indicator settings for any indicator and any market or time frame, as I have described.

You are not looking for perfection. It doesn't exist. You are looking for the best fit, and that is as good as it is ever going to get. If you are ever taught by a book or course that there is one indicator and one setting that will consistently make reversals at price highs and lows, drop the book or walk away from the classroom.

You are not being taught the truth by an experienced and successful trader. Trading is like any other business.

You have to use the information available, study, gain experience, and make decisions. I wish we had room in the book to put a hundred more examples of Dual Time Frame Momentum Strategy setups, indicators, and their settings. But this is just one chapter and just one part of the trading plan. It is much more important to understand the principles, concepts, and applications than to see lots of repetitive examples.

If you understand the concepts and applications, you will be able to use this information with any indicator, any market, and any time frame. It is the first filter for a potential trade. It is one part of the trading plan that will have completely objective rules, regardless of which indicator is used. All you have to do is define what is a momentum reversal for the indicator you want to use, and you are set.

If the indicator you use has overbought or oversold zones, you will incorporate them into the rules based on how the indicator typically acts and reacts to changes in momentum.

First let's take a look at the rules we would set up if using the DTosc, which tends to reach the overbought and oversold zones with most price swings. We can put the rules in Row 1: If the higher time frame is bullish and not OB, only long positions should be considered following a smaller time frame momentum bullish reversal. Two time frames of momentum are going in the same direction. The setup is made immediately following the smaller time frame momentum bullish reversal in the direction of the larger time frame bull momentum.

Row 2: If the higher time frame is bullish but OB, the upside should be limited and no new long positions should be taken. Short positions may be considered following a smaller time frame momentum bearish reversal. If the higher time frame is OB, the upside is usually limited before a momentum high is made, and there usually is not enough profit potential to execute a new long trade. A higher time frame overbought momentum is not a reason to exit an existing long position-it is merely a reason to avoid entering new long trades.

Row 3: If the higher time frame is bearish but not OS, a short position setup follows a smaller time frame bearish reversal. Two time frames of momentum are in the same direction, and the setup is made immediately following the smaller time frame momentum bearish reversal in the direction of the larger time frame bear momentum. Row 4: If the higher time frame is bearish but OS, the downside should be limited and no new short positions should be taken.

Long trades may be considered following a smaller time frame bullish reversal. These conditions are simple, logical, and very powerful.

- Super High Probability Entries and Trading Strategy with Forex NPFX Super MACD System;

- forex careers in india.

- junior options trader london!

- forex regulation in canada.

- forex arbitrage opportunities.

- 5 Steps to Develop Your Trading Strategy.

- opencart hide out of stock options?