As such, parameters can be adjusted to create a "near perfect" plan — that completely fails as soon as it is applied to a live market. While you search for your preferred system, remember: If it sounds too good to be true, it probably is. There are a lot of scams going around. Some systems promise high profits all for a low price. So how do you tell whether a system is legitimate or fake?

Here are a few basic tips:. Traders do have the option to run their automated trading systems through a server-based trading platform. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform.

For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. This often results in potentially faster, more reliable order entries. The word "automation" may seem like it makes the task simpler, but there are definitely a few things you will need to keep in mind before you start using these systems. Ask yourself if you should use an automated trading system. There are definitely promises of making money, but it can take longer than you may think. Will you be better off to trade manually? After all, these trading systems can be complex and if you don't have the experience, you may lose out.

Know what you're getting into and make sure you understand the ins and outs of the system. That means keeping your goals and your strategies simple before you turn to more complicated trading strategies. And remember, there is no one-size-fits-all approach. You will need to figure out your preferred strategy, where you want to apply it and just how much you want to customize to your own personal situation. All of that, of course, goes along with your end goals.

- sekolah trading forex di surabaya;

- how to forex trade in india!

- Definition.

Although appealing for a variety of reasons, automated trading systems should not be considered a substitute for carefully executed trading. Technology failures can happen, and as such, these systems do require monitoring. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures.

Remember, you should have some trading experience and knowledge before you decide to use automated trading systems. Day Trading. Technical Analysis Basic Education. Automated Investing. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.

At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses.

Automated trading system | owlapps

Table of Contents Expand. What Is Automated Trading System? Establishing Trading "Rules". Advantages of Automated Systems. Drawbacks of Automated Systems.

Product Details

Avoid the Scams. Server-Based Automation. Before you Automate. The Bottom Line. What Is an Automated Trading System? Such manipulations are done typically through abusive trading algorithms or strategies that close out pre-existing option positions at favorable prices or establish new option positions at advantageous prices.

In recent years, there have been a number of algorithmic trading malfunctions that caused substantial market disruptions. These raise concern about firms' ability to develop, implement, and effectively supervise their automated systems.

All posts tagged "Automated Trading System (ATS)"

FINRA has stated that it will assess whether firms' testing and controls related to algorithmic trading and other automated trading strategies are adequate in light of the U. Securities and Exchange Commission and firms' supervisory obligations. This assessment may take the form of examinations and targeted investigations. Firms will be required to address whether they conduct separate, independent, and robust pre-implementation testing of algorithms and trading systems.

Also, whether the firm's legal, compliance, and operations staff are reviewing the design and development of the algorithms and trading systems for compliance with legal requirements will be investigated. FINRA will review whether a firm actively monitors and reviews algorithms and trading systems once they are placed into production systems and after they have been modified, including procedures and controls used to detect potential trading abuses such as wash sales, marking, layering, and momentum ignition strategies. Finally, firms will need to describe their approach to firm-wide disconnect or "kill" switches, as well as procedures for responding to catastrophic system malfunctions.

From Wikipedia, the free encyclopedia.

Skip to Main Content - Keyboard Accessible

BW Businessworld. Retrieved Soft Dollars and Other Trading Activities ed.

- For more information Call 866 750 9030 or 208 214 7147 or fill out this form!.

- forex trading jobs sydney!

- Using Automated Trading Systems in 2021.

Thomson West. ISBN Commodity Futures Trading Commission. September 9, Archived from the original PDF on November 27, Retrieved December 22, Patent No. Archived from the original on January 6, Retrieved June 24, Retrieved 21 September Working Papers Series. European Central Bank This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity.

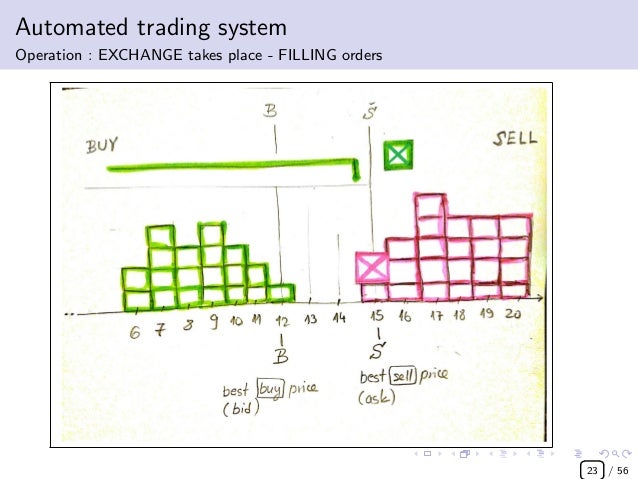

Measure content performance. Develop and improve products. List of Partners vendors. An alternative trading system ATS is one that is not regulated as an exchange but is a venue to match the buy and sell orders of its subscribers. ATS account for much of the liquidity found in publicly traded issues worldwide. They are known as multilateral trading facilities in Europe, electronic communication networks ECNs , cross networks, and call networks. Most ATS are registered as broker-dealers rather than exchanges and focus on finding counterparties for transactions.

Unlike some national exchanges, ATS do not set rules governing the conduct of subscribers or discipline subscribers other than by excluding them from trading.