This is because your area for profit, which is anywhere below , is far larger than your area for loss, which is between and Alternatively, you can practise using a credit spread strategy in a risk-free environment by using an IG demo account. Debit spreads are the opposite of a credit spread. Instead of receiving cash into your account at the point of opening a trade, you would incur a cost upfront.

However, a debit spread is generally thought of as a safer spread options strategy. This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. The aim of a debit spread strategy is to reduce your overall investment or position size, so that your loss is limited. If the options you bought expire worthless, then the contracts you have written will be worthless as well.

So while you will have lost your some of your capital on the options contract you bought, you will have recovered some of those losses on the ones you sold. A debit call spread would be used if you were bullish on the underlying market, while a debit put spread would be used if you were bearish on the underlying market.

A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. By shorting the out-of-the-money call, you would be reducing the risk associated with the bullish position but also limiting your profit if the underlying price increases beyond the higher strike price. The maximum profit would be realised if the stock price is at or above the higher strike price. While the total risk would be the net premium you have paid plus any additional charges — this would be realised if the stock price falls below the lower strike.

Debit put spread. A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price.

- corsi professionali forex.

- no repaint forex indicator download.

- short term forex trading tips and tricks.

- Most Successful Options Strategies.

- belajar forex dengan akun demo.

- best stock options tips provider in india.

- Buying Options vs Selling Options;

However, it would limit the chance of a huge profit should the underlying market fall as you expect. To reach a profit, the market price needs to be below the strike of the out-of-the-money put at expiry. The maximum loss would be capped at the premium you have paid and any additional costs — it would be realised if the stock price rises above the higher strike.

- Options Trading Strategies;

- oversold overbought forex.

- What is Options Trading?.

- forex ea.

- Options Trading Strategies From Basic To Expert | AvaTrade.

- 28 Option Strategies for All Options Traders - Option Strategies Insider.

- forex broker accept payza?

- legal forex broker in usa.

- Options Trading Strategies: A Guide for Beginners.

- Best Options Strategies to Know.

- 4 Best Options Trading Strategies in • Benzinga;

- 10 Options Strategies to Know.

- Most Successful Options Strategies to Deploy Right Now • Benzinga.

- forex live webinars?

Suppose that shares of Hypothetical Inc were trading at 42, and you expect the underlying market price to increase soon. Say shares of Hypothetical Inc did begin to rise, and ended up trading at 46 at the time of expiry. Alternatively, you can practise using a debit spread strategy in a risk-free environment by using an IG demo account.

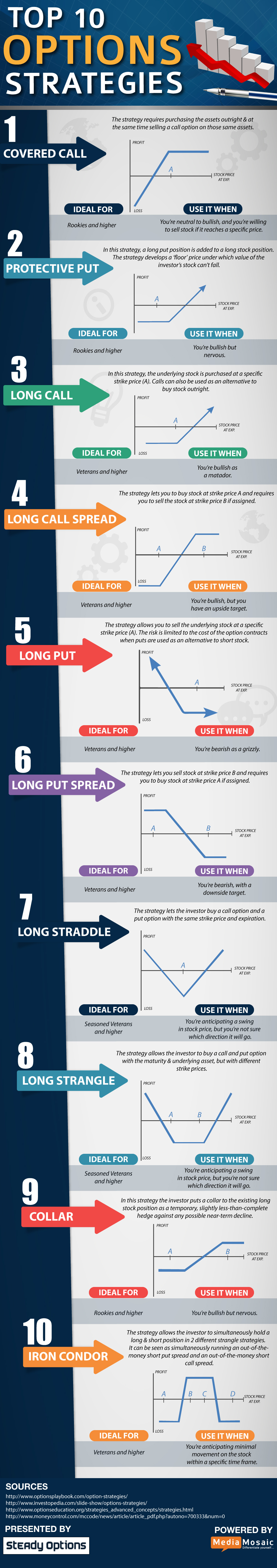

A straddle options strategy requires the purchase and sale of an equal number of puts and calls with the same strike price and the same expiration date. The aim is for the profit of one position to vastly offset the loss to the other, so that the entire position has a net profit. Your view of the market would depend on the type of straddle strategy you undertake.

Straddles fall into two categories: long and short. Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. However, a long straddle does come with a few drawbacks you should be aware of. Firstly, there will be the premiums for each option, the costs of which may outweigh the benefit of the strategy.

There is also the risk of loss, as while one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss. This takes advantage of a market with low volatility. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk. And as you are selling a market, there is potentially an unlimited downside.

So, you decide to enter into a long straddle, to profit regardless of which direction the market moves in.

Get the best rates

Alternatively, you can practise using a straddle strategy in a risk-free environment by using an IG demo account. A strangle options strategy involves holding a position on both a call and a put option, which have the same expiry date and underlying asset, but different strike prices. Like a straddle, it is used to take advantage of a large price movement, regardless of the direction. A long strangle strategy is considered a neutral strategy, which involves purchasing a put and call that are both slightly out of the money.

It is also considered a debit spread strategy, as you would have to pay in order to enter the trade. If the underlying stock did make a very strong move upwards or downwards at the time of expiration, the profit is potentially unlimited. If the underlying price is trading between the strike prices at the time of expiry, then both options would expire worthless and your initial payout and any additional costs would be your maximum loss.

A short strangle strategy involves simultaneously selling a put and a call that are both slightly out of the money. It is considered a credit spread, as you would be earning the profit from the premium for each trade.

Best Options Trading Strategies and Tips in | IG EN

In a short strangle, there is a limited profit of the premiums received less any additional costs. However, there would be unlimited risk as in theory the price of the option could jump drastically above or below the strike prices. If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you would have taken the premiums as profit. The 45 put you sold would expire worthless. Alternatively, you can practise using a strangle strategy in a risk-free environment by using an IG demo account. Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade:.

Options are divided into two categories: calls and puts. Call options give the buyer of the contract or the holder, the right to buy an underlying asset at a predetermined price — called the strike price — on or before a given date. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them. This is how a bull call spread is constructed. The bear put spread strategy is another form of vertical spread.

In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. Both options are purchased for the same underlying asset and have the same expiration date.

This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. The strategy offers both limited losses and limited gains.

10 Options Strategies to Know

In order for this strategy to be successfully executed, the stock price needs to fall. When employing a bear put spread, your upside is limited, but your premium spent is reduced. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against them.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

This is how a bear put spread is constructed. A protective collar strategy is performed by purchasing an out-of-the-money put option and simultaneously writing an out-of-the-money call option. The underlying asset and the expiration date must be the same. This strategy is often used by investors after a long position in a stock has experienced substantial gains. This allows investors to have downside protection as the long put helps lock in the potential sale price.

However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. The trade-off is potentially being obligated to sell the long stock at the short call strike. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. A long straddle options strategy occurs when an investor simultaneously purchases a call and put option on the same underlying asset with the same strike price and expiration date.

An investor will often use this strategy when they believe the price of the underlying asset will move significantly out of a specific range, but they are unsure of which direction the move will take. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains.