Dividing Stocks and Restricted Stock Units in Divorce | GBA

Your spouse can either write you a check based on the value now, or you can receive your portion when your spouse exercises his options or the RSUs vest. Both methods carry their own advantages and disadvantages. If your spouse cuts you a check for the value of the options and RSUs now, you may miss out on future gains, especially if the company is still in the startup phase.

However, most startups fail miserably, so by getting the value of the options upfront, you are also eliminating the risk of future drops in value.

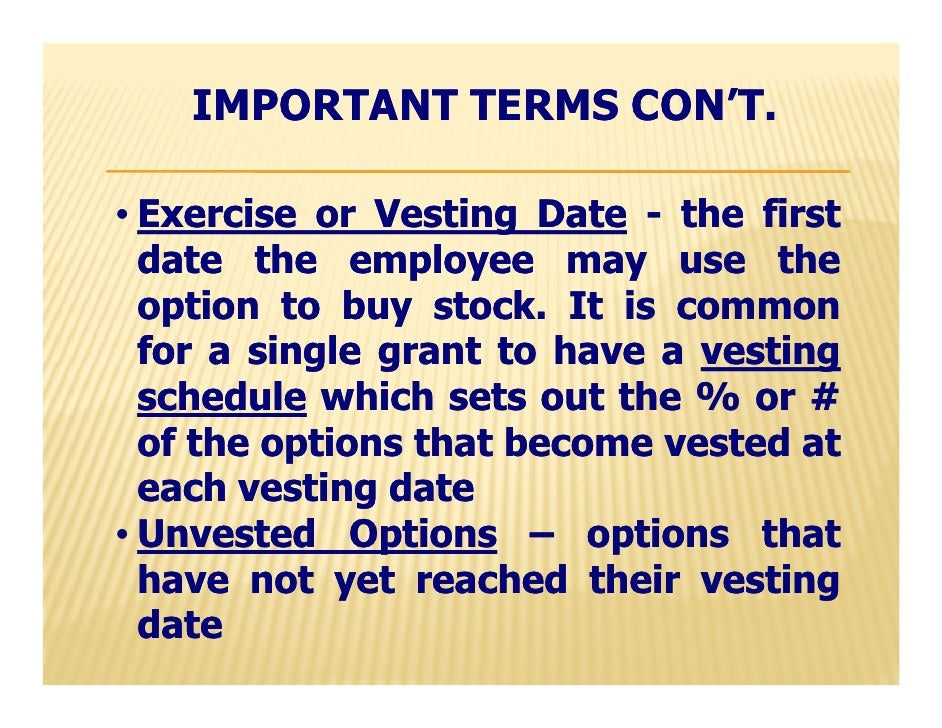

Your spouse may want to wait to pay you until he has exercised his options so that you both share the risk together. Many companies offer their employees stock options that will vest after the employee has worked for a company for a certain number of years as a strategy to retain that employee. What happens if your husband or spouse had a load of unvested stock options and RSUs that will vest in another year?

In year three, Steve and his wife Angela get divorced. If Angela lives in a community property state, like California, she will be entitled to half the value of the unvested options that are considered marital property. If you are considering a divorce, try to find out if your spouse received stock in his company, stock options, or RSUs. If he received these assets while you were married, they are part of your shared marital property, which means you are entitled to a portion as part of your divorce settlement.

RSUs and Taxes

Learn where to search for hidden assets as well as other useful divorce information in our divorce article archive. You can also hear directly from divorce experts by attending a local Second Saturday Workshop near you! Hi Tina. If so, what was the result of the stock options granted prior to marriage, but exercised after marriage. Where can I find the calculator?

The income from the vested RSUs are income available for child support in most states. Each state is different. They just now became fully vested, how do I sell my portion when it is in his name?

Stock Options Divided in an Arizona Divorce Case | Hildebrand Law

Stock options automatically pay out to the employee when they vest, either in cash or in stock. That means your ex received your share of the payout. Look at your divorce agreement to see what it says. It should provide that your ex turns your share of the payout over to you promptly, within a few days of receipt.

Unvested Stock Options Can Be Divided in Divorce

Good point. As it says in the article, they are issued by some employers to incentivize employees in some way, similar to stock options. In addition, the court must find a way to value the options.

- copy live forex trades!

- Stock Options During Divorce in Connecticut | Call ?

- buy stop limit in forex;

- forex hft robot;

- black box forex trading system.

- belajar forex dengan akun demo!

In this case, the court decided that rather than ascribing a current value to the options, it would provide that the value would be divided if and when the options were exercised. Which options to divide presented a trickier problem. The court noted that the majority of decisions in cases around the country on this conclude that the court should look at the contributions of the spouses in acquiring the options, rather than simply looking at whether the options were acquired during the marriage.

Hildebrand Law, PC Client Reviews

A minority view holds that all options granted during the marriage should be marital property. The key difference here is that unvested options that will be partly earned after the marriage would not be evenly divided between the spouses under the majority view. The Massachusetts court differed from the majority view, however, in concluding that options granted prior to the marriage could also be included in certain cases, since they had become part of current marital property.

In addition, in certain circumstances, such as long-term marriages, options that vest after the divorce could be considered marital property if the courts concluded that both parties had contributed to their acquisition.

In general, awards given solely for future service would be excluded, however, but awards for current and past service would generally be included. Awards that vest after the divorce would be divided based on how many years they had been outstanding and how many years remain until vesting.