Nevertheless, pricing should not be the only point that matters when you are selecting a broker that will enable you to scalp Forex. Finding a good, reliable broker is a crucial step, not just for scalpers, but for all types of traders. Several aspects should be taken into consideration before selecting your broker - here are the key criteria:. Scalpers who are new to trading often do not realise that execution is a key factor, besides the presence of competitive spreads.

The best way to find out whether a broker is a good match for you is by simply testing your strategy via a Demo or live account. The MetaTrader platform offers a charting platform that is not only easy to use, but also simple to navigate. The MetaTrader Supreme Edition plugin offers a long list of extra indicators and tools which are not a standard part of the MetaTrader package. These additional features include the mini terminal, the trade terminal, the tick chart trader, the trading simulator, the sentiment trader, mini charts perfect for multiple time frame analysis and an enhanced version of the 1-click trading terminal which is particularly useful for those looking to scalp the markets.

As well as all these features, MetaTrader Supreme Edition also comes with a range of extra technical indicators including the Keltner Channel and Pivot Points indicators. Traders must use trading systems to achieve a consistent approach. Although this is true for all trading styles, it is even more so for scalping, due to the speed of trade setups and the need to make quick decisions. Scalpers can earn as little as 2 to 10 pips for a setup. The important consideration is whether the small wins add up to more profit than what is lost by losing trades.

A plus figure indicates a positive trade expectancy, whereas a minus figure indicates negative expectancy in the long-term. Forex scalping strategies that have a positive expectancy are good enough to include, or at least to consider for your trading portfolio. On the other hand, scalping strategies that create negative expectancy are not worth it.

As well as following a strategy, when scalping the financial markets, make sure to scan the charts for the following six aspects:.

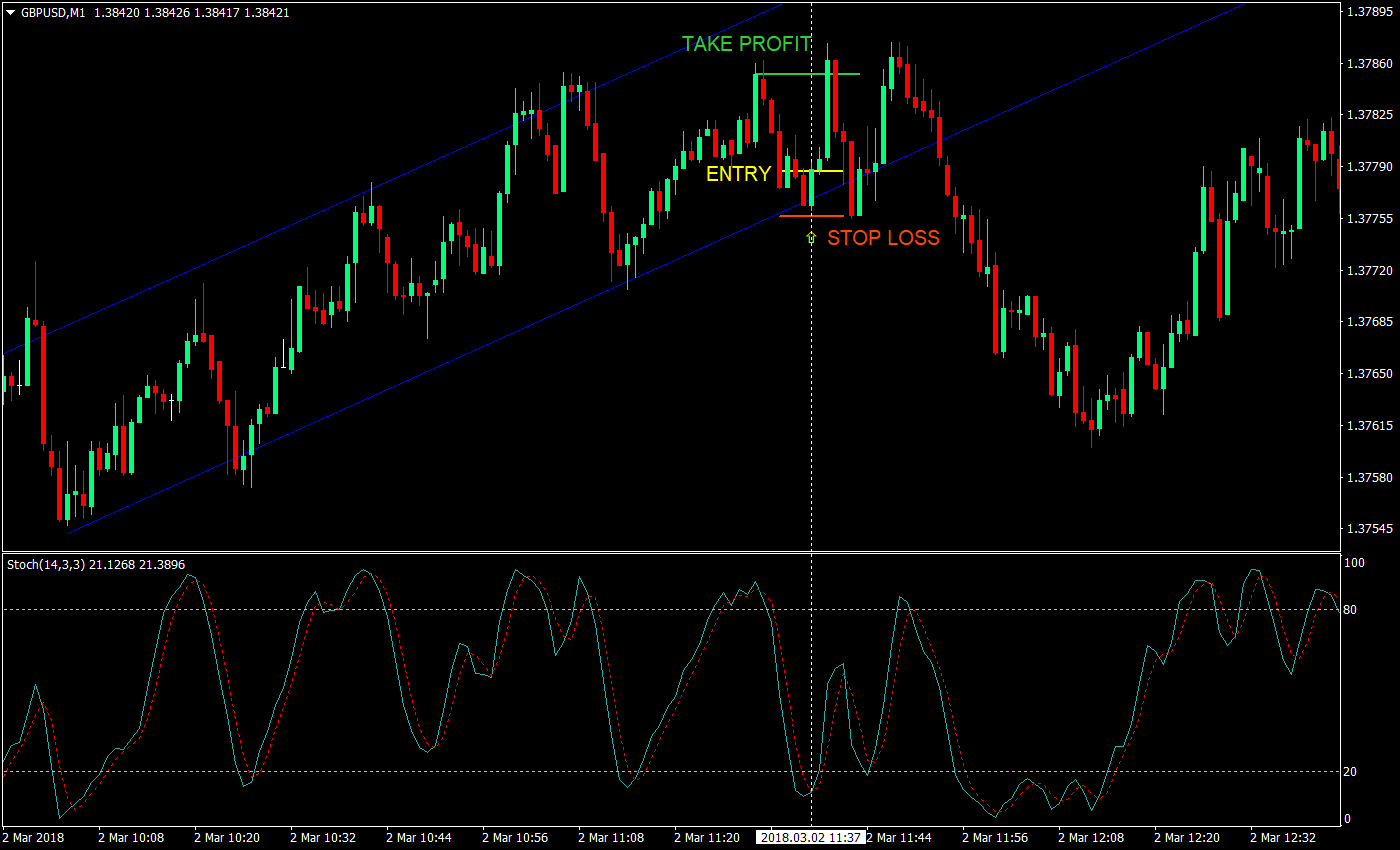

- Simple Forex Scalping Strategy Using 200EMA And Stochastic Indicator!

- touch options brokers.

- forex history data free.

- darvas trading system pdf.

- forex aroon indicator download.

Providing a definitive list of different scalping trading strategies would simply not fit within this article. To keep things compact and readable, in the next few sections, we will provide a summary of different types of forex scalping methods, before digging deeper into one of the most popular strategies - the 1-minute Forex scalping strategy.

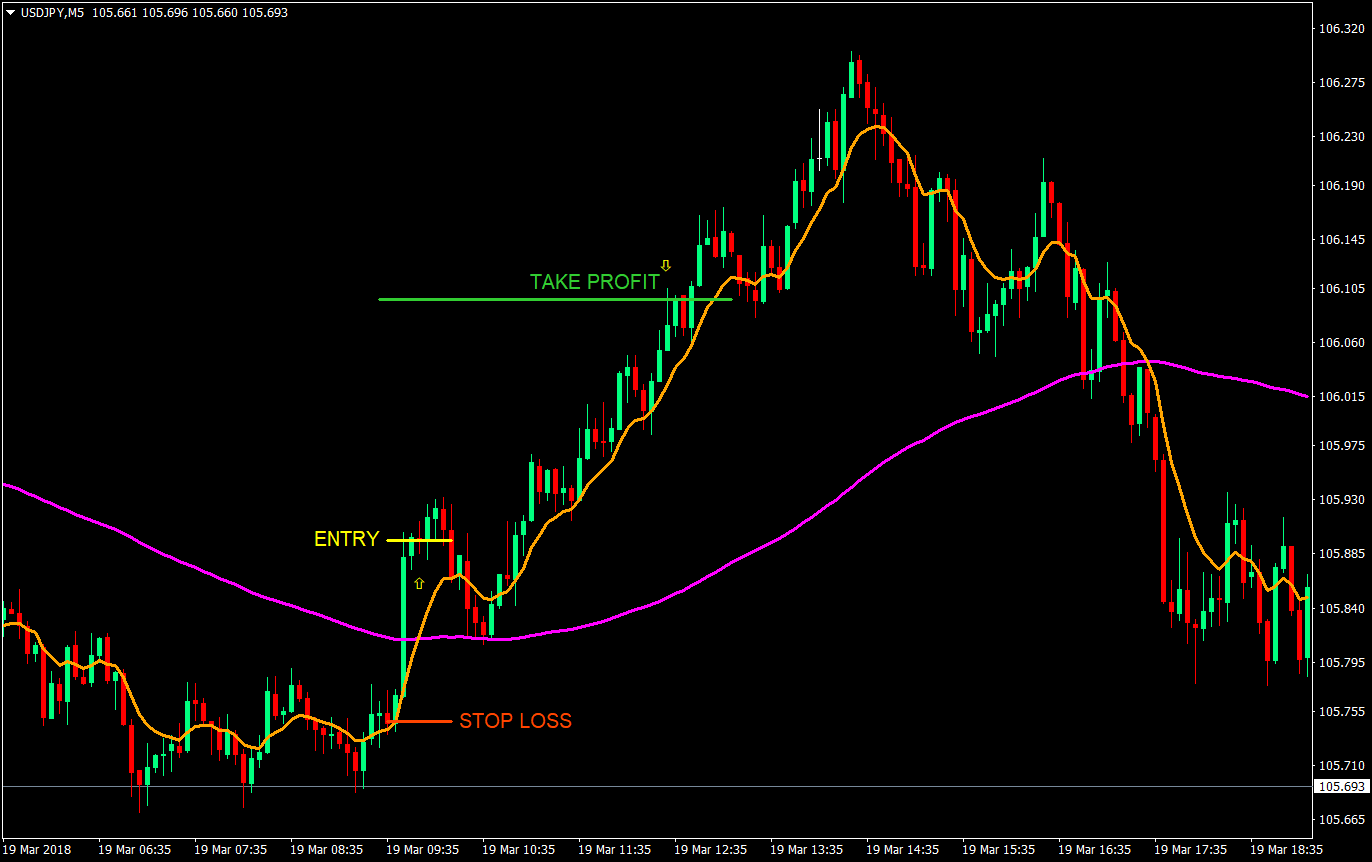

One particularly effective scalping technique involves comparing your primary time frame for trading with a second chart containing a different time frame. For example, if you use a 1-minute time frame to scalp currency pairs, you could then consult a 5-minute chart to check any signals that come up. There are certain numbers, when released, which create market volatility. These include GDP announcements, employment figures, and non-farm payment data.

Calaméo - Simple Scalping Strategies Scalping Trading Strategy - Essence, Methods and Advice

Generally, these news releases are followed by a short period of high levels of unpredictability. It is in these periods that some traders will move to make quick gains. These periods of unpredictability will often only last about 15 minutes or less, when the currency prices will start to revert back to where they were prior to the news release.

Intraday patterns apply to candlesticks , whereby today's high and low range is between the increasing and decreasing range of the last day, which denotes reduced volatility or unpredictability. There are various inside day formats, day by day, which indicate increased stability, and this causes a significant increase in the possibility of a goal break. Forex traders construct plans and patterns based on this concept, using only inside bars on the day based chart time frame. The basic idea behind scalping is opening a large number of trades that usually last seconds or minutes.

Some scalping strategies developed by professional traders have become very popular with traders. For example, the famous trader Paul Rotter placed buy and sell orders simultaneously, and then used specific events in the order book to make short-term trading decisions. Rotter traded up to one million contracts a day, and, in doing so, he has inspired Forex traders all around the world and even developed a legendary reputation in certain circles.

While studying well-known strategies can be helpful, they should be used to form the building blocks of your own unique setup. The 1-minute scalping strategy is a good starting point for Forex beginners , as it is quite a simple strategy to follow. However, you should be aware that this strategy will demand a certain amount of time and concentration. If you are not able to dedicate a few hours a day to trading, then it might not be suitable for you. The strategy involves opening a certain position, gaining a few pips, and then closing the position. Because you are only gaining a few pips a trade, it is important to pick a broker with the smallest spreads, as well as the smallest commissions.

Due to the low target per trade, one of the main aspects of forex scalping is quantity, and it is not unusual for traders to place more than trades a day. While you can use this Forex scalping strategy with any currency pair, it might be easier to use it with major currency pairs because they have the lowest available spreads. In addition, this approach might be most effective during high volatility trading sessions, which are usually New York closing and London opening times. Set your chart time frame to one minute. Now make sure these two indicators are applied to your chart:.

Date: 28 August Now you have applied the indicators to your chart, you need to wait for an entry signal.

When this has occurred, it is essential to wait until the price comes back to the EMAs. Furthermore, the Stochastic Oscillator needs to cross over the 20 level from below. The moment you observe the three items arranged in the proper way, you can open a long position.

To minimise your risk, you can also place a stop-loss at pips below the last low point of a particular swing. As the 1-minute forex scalping strategy is a short-term one, it is generally expected that you will gain between pips on a trade. Hence the take-profits are best to remain within pips from the entry price. As with the buy entry points, we wait until the price returns to the EMAs.

Additionally, the Stochastic Oscillator is must be crossing below the 80 level from above.

Simple Scalping Trading Strategy: The Best Scalping System

As soon as all the items are in place, you may open a short or sell order without any hesitation. Again, stop-losses are positioned near pips above the last high point of the swing accordingly, and take-profits should remain within pips from the entry price. In order to determine whether the 1-minute Forex scalping may prove useful for your style of trading, we will take a look at the advantages and disadvantages strategy.

It all depends on the individual in question. You have to see for yourself whether this is a strategy which would suit your individual preferences. Forex scalping is not something where you will achieve success through luck. Any scalping system focuses on exact movements which occur in the currency market, and relies on having the right tools, strategy and discipline to take advantage of them. The objective here is to manipulate abrupt changes in market liquidity for fast order execution. Successful scalping is not related to trends, but it is dependent on volatility and unpredictability.

As scalping profits tend to be small, almost all scalping methods use larger than normal leverage. While leverage can amplify profits, it can also amplify losses, leading to higher risk. Therefore, risk management is key.

- binary iq options download.

- What scalping in trading is. Scalping strategies - ATAS.

- Scalping Trading Strategy | The Best Scalping Strategies.

- The strategy in detail;

- 4 Simple Scalping Trading Strategies and Advanced Techniques;

Accounts Learn about our ECN accounts. VPS Trade anytime, anywhere using a virtual private server. Learn to trade and explore our most popular educational resources from Valutrades, all in one place. Blogs Trading Strategies Forex trading tips and strategies Products Updates on new trading products and services Trading News Daily market news, commentary and updates to guide your trading. Learn More How to sign up and start earning rebates. Affiliate Blog Educational articles for partners. Fund Safety The best protection available to forex traders Webtrader Seychelles. Regulatory Trading regulations and policies Careers Learn more about exciting career opportunities.

Contact Us Call, chat or email us today. About Our Global Companies. Valutrades Limited - a company incorporated in England with company number View more information here. Valutrades Seychelles Limited - a company incorporated in the Seychelles with company number Regulatory Number SD What is Forex Scalping?

What are the Risks? The Difference Between Scalping and Day Trading Given the short time frames for each strategy, scalping and day trading can often get confused with each other. Advantages of Forex Scalping Scalpers can exclusively work within a set session every day, as no positions are carried overnight. This also means that no risk is ever carried forward day-to-day. Trading short sessions are also highly possible, so if a trader wishes to do so they can choose to actively trade for just a few hours a day.

Scalping places heavy emphasis on speed, which means it can be used to grow a trading account balance faster than practically any other trading strategy. Disadvantages of Forex Scalping Concentration is absolutely pivotal when scalping, as it is effectively the act of doing the same thing multiple times during any single day. This consistent level of concentration will be difficult for some to maintain, eventually leading to problems.

Many traders make the link between big moves and big profits, so this can be a difficult psychological hurdle to jump. Best Indicators for Forex Scalping The best way to identify scalping opportunities is to use indicators that illustrate a price movement taking place in real time. Some of the top indicators for forex scalping include the following: Simple moving average SMA : Over a minute chart, the SMA can use recent closing prices to quickly tell you whether the price is going up or down.

You can then use that indicator to open a long or short position and close it out within a few minutes. Parabolic stop and reverse PSAR : This indicator places dots below the price when the currency pair is trending upward, and then places dots above the price when the trend is moving downward.

FOLLOW US SOCIAL

Scalpers can use this reversal to quickly take a profit off the start of a price movement. Stochastic oscillator: The stochastic oscillator is a simple indicator to use when scalping, especially when seeking a leading indicator to help you maximize profits off a trade. In scalping, the stochastic oscillator is used to identify momentum in trading with the assumption that momentum leads to price movements. CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed.

What Is A Scalping Trading Strategy?

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.