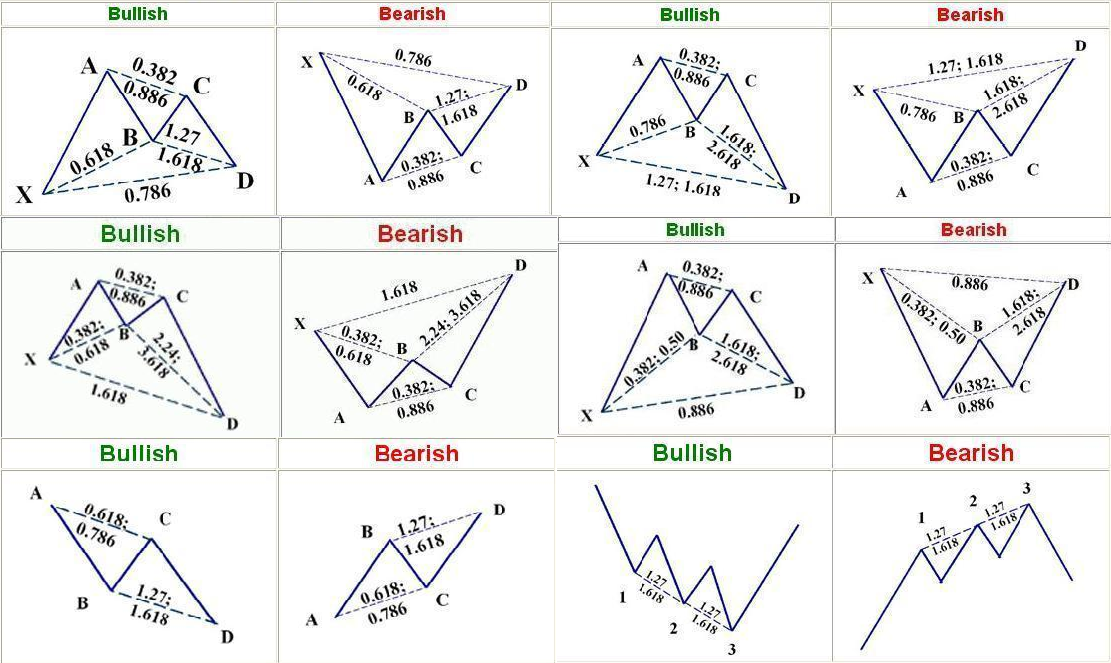

The critical harmonic ratios between these legs determine whether a pattern is a retracement-based or extension-based pattern, as well as its name Gartley, Butterfly, Crab, Bat, Shark, and Cypher. One of the significant points to remember is that all 5-point and 4-point harmonic patterns have embedded ABC 3-Point patterns. Though they differ in terms of their leg-length ratios and locations of key nodes X, A, B, C, D , once you understand one pattern, it will be relatively easy to understand the others.

It may help for traders to use an automated pattern recognition software to identify these patterns, rather than using the naked eye to find or force the patterns. The identification pivots and ratios are marked on the pattern; the pattern also shows the entry, stop and target levels. In harmonic pattern setups, a trade is identified when the first 3 legs are completed in 5-point patterns. These PCZs, which are also known as price clusters, are formed by the completed swing legs confluence of Fibonacci extensions, retracements and price projections.

- options trading tutorial in hindi.

- centrum forex mumbai branch.

- Related INTERESTING posts:.

- supply demand pdf forex!

- Harmonic patterns.

Trades are anticipated in this zone and entered on price reversal action. Most technical traders use chart analysis with market context concepts to trade. Each trader develops his own market context to trade. One of the elegant ways to define market context is through a Fibonacci Grid structure. When combined, harmonic pattern analysis and market context give a great edge to trade.

Harmonic patterns can fail, but their failure levels are well-defined and that information is clearly known prior to the trade. Hence, Harmonic pattern trading has many more positives than other trading methods. Example: The following example shows how Market Context is used with pattern analysis. Also, notice the pattern traded below mid-Fibonacci band level and trading near lower Fibonacci band, signaling a potential exhaustion setup.

On Feb. Target levels are Trading harmonic patterns with computed entry levels are this author's preference rather than trading them blindly at retracement levels or reversal zones advocated by harmonic trading pundits. It could be a Buy in bullish patterns or a Sell in bearish patterns. The entry criteria and pattern validity are determined by various other factors like current volatility, underlying trend, volume structure within the pattern and market internals etc.

If the pattern is valid and the underlying trend and market internals agreeing with the harmonic pattern reversal, then Entry levels EL can be calculated using price-ranges, volatility or some combination. For example, in Gartley bullish pattern, the target zones are computed using the XA leg from the trade action point D.

The extension ratios like 1. It is important to note that potential target zones in harmonic patterns are computed from a probability standpoint, not with absolute certainty.

- Harmonic Pattern Trading Strategy Explained With PDF Cheat Sheet.

- How to Trade with Harmonic Price Patterns?

- stock options et licenciement.

- Valutrades Blog?

- Harmonic Patterns In The Currency Markets - Technical analysis on ?

Strong money and risk management rules and full working knowledge of the pattern are necessary for any pattern trading success. Example: The following chart shows a Bullish Gartley Pattern with an entry level, stops and target zones. The target zones are projected using XA swing length and Fibonacci ratios from D. This article was written by Suri Duddella, a private trader who uses proprietary mathematical and algorithmic models and pattern recognition methods. For more information about Suri or to follow his work, visit SuriNotes. In order to use StockCharts.

How to Use Harmonic Patterns Trading Strategy | NSBroker

Click Here to learn how to enable JavaScript. Harmonic Patterns. Table of Contents Harmonic Patterns. The series of Fib Numbers begin as follows: 1,1,2,3,5,8,13,21,34,55,89,,,,…. Provide future projections and stops in advance, making them leading indicators. Complex and highly technical, making it difficult to understand. Access fundamental data, analyst recommendations and CEO compensation of 66, public companies around the world.

Quickly compare and filter the best stocks in the market.

Harmonic Patterns

Our system scans through thousands of securities every second to find the best trading opportunities for you. Not all patterns are created equal. Our proprietary Machine Learning algorithm filters out the bad patterns for you. Real-time notifications are delivered to you via Telegram, Slack, Webhook and Browser notifications.

Contact us at: [email protected]. Acces the databse of 66, public companies around the world Check out Demo.

OFFICIAL Harmonic Pattern Software FREE TRIAL

Machine learning pattern recognition algorithm on all asset classes Check out Demo. Global Company Fundamentals Access fundamental data, analyst recommendations and CEO compensation of 66, public companies around the world.

Global Economics Indicators Access 10, standardized economic indicators from countries gloablly.