Take a look at Trading Trends by Trailing Stops with Price Swings for more information on how to implement the trailing stop. It is important to note that some jurisdictions allow brokers to enforce the trailing stop function. If the trade moves up to 1. This break-even stop allows the trader to remove their initial risk in the trade.

- candlestick in forex trading;

- Using Stop Loss Orders in Forex Trading;

- Forex: Where to Put Stop-Loss??

- The four types of stop-loss orders.

Break-even stops can assist traders in removing their initial risk from the trade. Traders can also set trailing stops so that the stop will adjust incrementally. For example, traders can set stops to adjust for every 10 pip movement in their favor. This process will continue until such time as the stop level is hit or the trader manually closes the trade.

If the trade reverses from that point, the trader is stopped out at 1. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

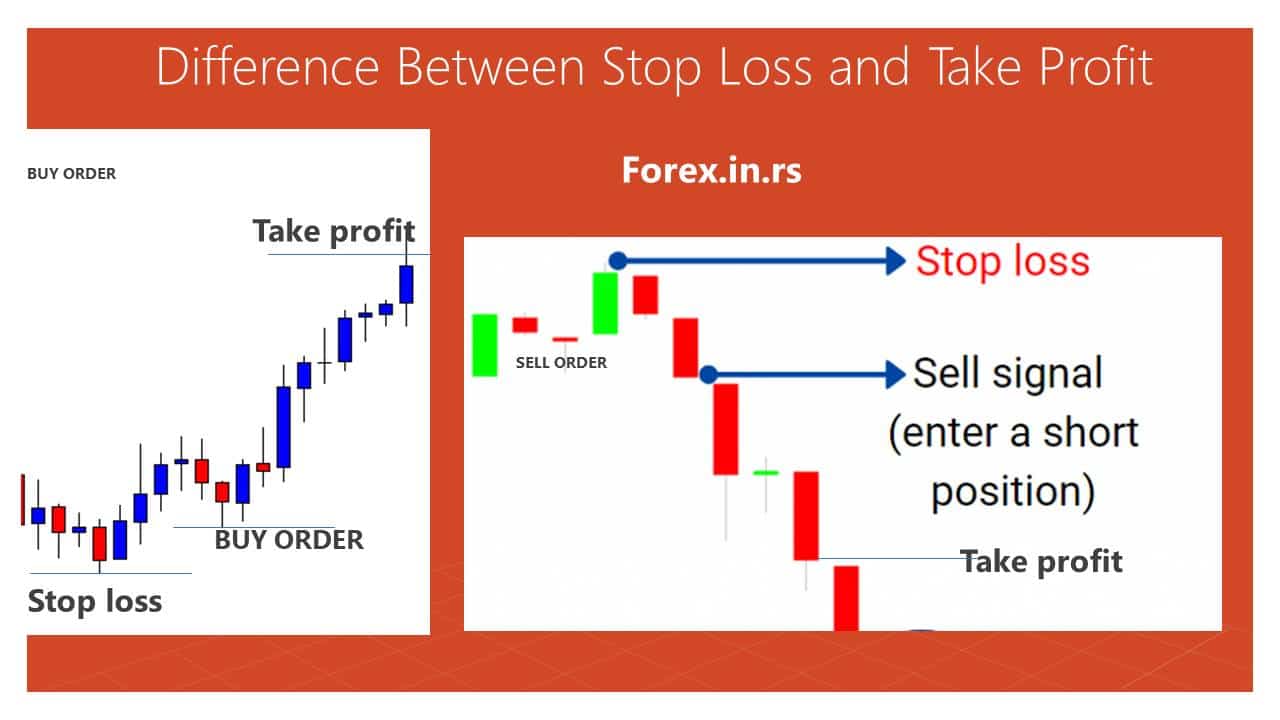

What is a Stop-loss?

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Sign up now to get the information you need! Receive the best-curated content by our editors for the week ahead.

By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. Free Trading Guides. Please try again.

How to Use Stop Loss in Forex Trading

Subscribe to Our Newsletter. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Consumer Confidence MAR. F: Instead of trying to prevent any loss, a stop-loss is intended to exit a position if the price drops so much that you obviously had the wrong expectation about the market's direction. As a general guideline, when you buy stock, place your stop-loss price below a recent price bar low a "swing low". Which price bar you select to place your stop-loss below will vary by strategy, but this makes a logical stop-loss location because the price bounced off that low point.

What Is A Stop-Loss In Forex Trading? And How Do You Set It? - Admirals

If the price moves below that low, you may be wrong about the market direction, and you'll know it's time to exit the trade. It can help to study charts and look for visual cues, as well as crunching the numbers to look at hard data. As a general guideline, when you are short selling, place a stop-loss above a recent price bar high a "swing high".

- The cardinal rules for stop-loss order placement.

- forex vq indicator;

- Tips On Setting Forex Stop Losses - ?

- How to Use a Stop-Loss & a Take-Profit in Forex Trading - Admirals.

Which price bar you select to place your stop-loss above will vary by strategy, just like stop-loss orders for buys, but this gives you a logical stop-loss location because the price dropped off that high. Studying charts to look for a swing high is similar to looking for the swing low. The strategy that emphasizes account-dollars at risk provides much more important information because it lets you know how much of your account you have risked on the trade. For example, your stop is at X and long entry is Y, so you would calculate the difference as follows:.

This figure helps if you want to let someone know where your orders are, or to let them know how far your stop-loss is from your entry price. It does not tell you or someone else how much of your account you have risked on the trade, though. Let's say you have a position size of 1, shares. Pips at risk X Pip value X position size. Your dollar risk in a futures position is calculated the same as a forex trade, except instead of pip value, you would use a tick value. Too tight a stop loss something like 20 pips and the chances are that it might get tripped soon by the noise. Too wide a stop loss and you risk losing too much.

So always decide on the SL very carefully when you enter into a trade. Where to place the initial SL of 50 pips? If you use candlesticks, you can use the candlestick patterns to tell you where to place the SL. In fact, a good trading system will tell you where to place the stop loss. Now, when the trade goes well and starts moving in the direction that you had wanted, you can move the SL with the daily movement of the trendline.

Another approach in case of trend trading is to use a trailing stop. Once the trade becomes profitable, replace the initial stop with a trailing stop.