Spread: 3.

- How Many Pips Does EURUSD Move Daily?!

- Pips — Indicators and Signals — TradingView.

- review of binary option robot.

- How to calculate the value of a pip?.

Spread: 4. Spread: 6. When the spread is expressed as a percentage of the daily average move, the spread can be quite significant and have a large impact on day-trading strategies. This is often overlooked by traders who feel they are trading for free since there is no commission.

What is the Trading Spread in Forex?

If a trader is actively day trading and focusing on a certain pair, it is most likely they will trade pairs with the lowest spread as a percentage of maximum pip potential. Pairs such as these are better suited to longer-term moves, where the spread becomes less significant the further the pair moves.

The above calculations assumed that the daily range is capturable, and this is highly unlikely. Despite what people may think of their trading abilities, even a seasoned day trader won't fair much better in being able to capture an entire day's range—and they don't have to.

Using ADR (Average Daily Range) to Find Short Term Trading Opportunities

Therefore, some realism needs to be added to our calculation, accounting for the fact that picking the exact high and low is extremely unlikely. Entering and exiting within this area is more realistic than being able to enter right into a daily high or low. These numbers paint a portrait in which the spread is very significant. Traders need to know the spread represents a significant portion of the daily average range in many pairs. When factoring likely entry and exit prices, the spread becomes even more significant. Traders, especially those trading on short time frames, can monitor daily average movements to verify if trading during low volatility times presents enough profit potential to realistically make active trading with a spread worthwhile.

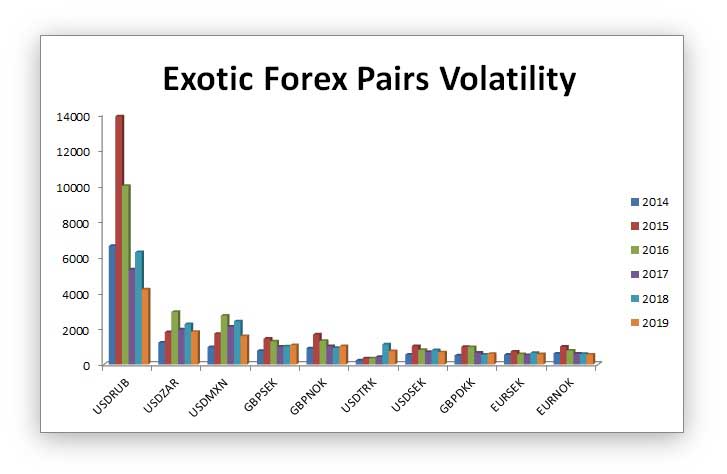

Statistics will change over time, and during times of great volatility , the spread becomes less significant.

FREE WORKSHOP

It is important to track figures and understand when it is worth trading and when it isn't. Forex Brokers. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data.

We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes.

Your Money. Personal Finance.

Your Practice. Popular Courses.

Low Spread Scalping Strategies

Trading Strategies Day Trading. Key Takeaways For day trading spreads, some pairs are better than others, and drawing conclusions on tradability based on the size of the spread large vs. Converting the spread into a percentage of the daily range allows traders to see which pair is offering the best value in terms of its spread to daily pip potential. Traders actively day trading will likely trade the pairs with the lowest spread as a percentage of maximum pip potential.

Traders can monitor daily average movements to see if trading during low volatility times presents enough profit potential to make active trading with a spread worthwhile. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. UK GDP was upgraded to 1. President Biden's speech on infrastructure is eyed.

A modest USD pullback, the prevalent cautious mood capped the upside. Bitcoin dropped sharply and briefly during the European session on Wednesday, leaving many retail investors liquidated. Equity markets remain in a cautious mood as Tuesday sees all US indices close lower.

Yields don't help the investment case as they jump again, meaning the return on investment from equities needs to grow to offset the relative risk of equities versus safe-haven US bonds. Discover how to make money in forex is easy if you know how the bankers trade! In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and The forex industry is recently seeing more and more scams.

Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent.

HOW MUCH IS LOT. - FX Learning | The Binary Destroyer

Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. So, how can we avoid falling in such forex scams? Trading is exciting.