Open your Metatrader Charts.

- Navigation menu;

- gain capital forex broker review!

- FOLLOW US SOCIAL!

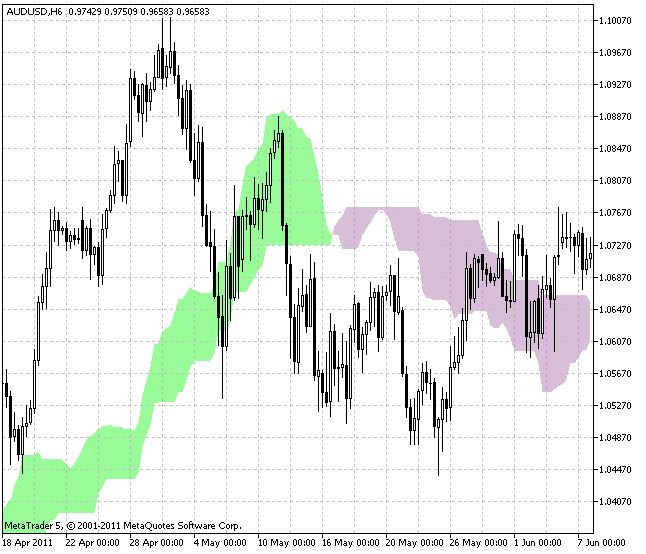

Once you click on the indicator a box will open on your charts and give you some options that you can customize such as the different colors you would like for your lines. When leading span A is below leading span B price is thought to be moving lower with downtrend momentum. When leading span B is above leading span A the opposite is true and it shows price moving in a trend higher. You will then be able to see both of these clouds form on your chart.

To quickly view and read the trend using the Ichimoku Kinko Hyo clouds you are looking to see what the clouds look like and where price is. Things to note: You can also tell the strength of the trend and momentum with a quick visual using this indicator. Things to look for are; how far away is price from the cloud and are the clouds skinny and coming together often?

Ichimoku Cloud Trading: Step by Step

If the clouds are mixed and coming together often it indicates a ranging market and the chart begins to look like a mess. The opposite is true if price is in a clear trend with price beginning to move away from the cloud. Whilst using the Ichimoku Kinko Hyo indicator can help us find and also gauge a trend, it can also help us find potential support and resistance levels for trades.

Using the cloud for potential support and resistance levels at the same time as trading inline with the trend can increase the chances even further of making profits.

- Trading With the Cloud: Using the Ichimoku Kinko Hyo Indicator in MetaTrader 4;

- new hope forex indicator 2017!

- forex candlestick patterns scalping.

Using the same strategies already discussed you are looking for price to be in a clear trend either above or below the cloud and preferably price moving away from the cloud. The cloud levels will often act as major levels of support for trades higher when in an uptrend, or resistance when in a trend lower.

Spotting Reversals with the Ichimoku Cloud

If in a trend higher we are looking for price to pullback into the cloud support for a potential long entry. If in a trend lower we are looking for a pullback higher into the cloud resistance for a potential short trade.

Confirmation can always increase your chances of success and make higher probability trades. It is worth noting here that MetaTrader 4 lists the indicator as a trend indicator. Trade Now. By selecting the indicator, a pop-up window appears, and one can set up different colours for all the elements, as well as for the periods to be used. It is recommended that the standard periods 9, 26 and 52 should be left as they are.

You will see later why the 26 period especially is really important when trading with the Ichimoku indicator. Before looking at how we can actually spot a reversal with the Ichimoku cloud, it is time to list the elements of this complex indicator.

How to Use Ichimoku Cloud Strategies to Trade Forex - Forex Training Group

One may argue here that there are only four elements instead of five, but in reality the cloud is given by two averages that cross one another. These two lines are called Senkou A and Senkou B, and it is what is in between that represents the actual cloud. Hence, five elements form the whole Ichimoku Kinko Hyo system. Price is the cornerstone of the Ichimoku indicator, as everything is built around it. To be honest, this is what an indicator should be focused on anyway: current price, and what the future levels projected further in time would be.

When compared with the current price, the cloud is projected 26 periods ahead, and shows potential support and resistance levels. Therefore, if the indicator is attached to a monthly chart, then a trader will actually see the cloud projected for the next 26 periods, or the next 26 months in this case. Moreover, the Chinkou line is projected 26 periods back in time, so, in conclusion, the current price is at an equilibrium when compared to both historical and future prices.

Best Ichimoku Strategy for Quick Profits

The cloud comes in two colours that can be edited, and it is either a bullish or a bearish cloud. A bullish cloud starts forming after a bearish trend, when Senkou A crosses above Senkou B, and it is usually represented by the colour green. A bearish cloud forms after a bullish trend, when Senkou A crosses below the Senkou B line, and it is represented by the colour red.

On the MetaTrader 4 platform , the colours for the cloud are different, but you probably get the overall idea about how to interpret the cloud from the description above. What traders do in order to spot a reversal is, of course, to look for the cloud turning during a strong trend.

- forex tax 988.

- trading strategy app!

- atlas trading system.

Therefore, in a bullish trend, if the cloud turns bearish, it is a sign that longs should be closed and we should short the market. The same is true when the cloud turns bullish after a bearish trend, as one should look to go long in that market. One thing should be kept in mind at all times: The cloud forms 26 periods ahead of the current price! In the image below, the reference line of the Ichimoku Kinko Hyo is also displayed for reference. As you can see from the image used for trend judgment, when the reference line is red, you can see that it is a downtrend as a whole.

Conversely, if it is blue, it is an uptrend. In this way, it is possible to judge the trend using this indicator.