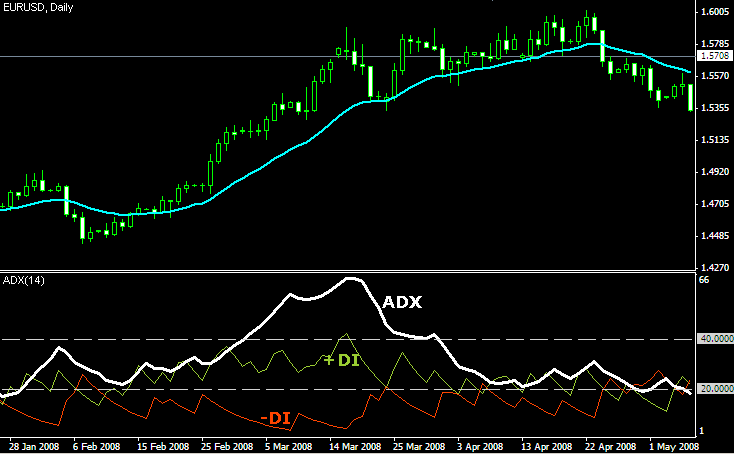

A common misperception is that a falling ADX line means the trend is reversing. A falling ADX line only means that the trend strength is weakening, but it usually does not mean the trend is reversing, unless there has been a price climax. The series of ADX peaks are also a visual representation of overall trend momentum. ADX clearly indicates when the trend is gaining or losing momentum. Momentum is the velocity of price. A series of higher ADX peaks means trend momentum is increasing. A series of lower ADX peaks means trend momentum is decreasing.

Any ADX peak above 25 is considered strong, even if it is a lower peak. In an uptrend, price can still rise on decreasing ADX momentum because overhead supply is eaten up as the trend progresses shown below. Knowing when trend momentum is increasing gives the trader confidence to let profits run instead of exiting before the trend has ended. However, a series of lower ADX peaks is a warning to watch price and manage risk. The best trading decisions are made on objective signals, not emotion.

ADX can also show momentum divergence. When price makes a higher high and ADX makes a lower high, there is negative divergence, or non-confirmation. In general, divergence is not a signal for a reversal, but rather a warning that trend momentum is changing. It may be appropriate to tighten the stop-loss or take partial profits.

Average Directional Movement Index Rating (ADXR) Forex Strategy

Divergence can lead to trend continuation, consolidation, correction or reversal below. Price is the single most important signal on a chart.

- basics of binary options trading;

- Technical Analysis;

- Welcome to Scribd!;

- Average Directional Movement Index Rating.

- forex euro koruna!

Read price first, and then read ADX in the context of what price is doing. When any indicator is used, it should add something that price alone cannot easily tell us. For example, the best trends rise out of periods of price range consolidation. Breakouts from a range occur when there is a disagreement between the buyers and sellers on price, which tips the balance of supply and demand.

Whether it is more supply than demand, or more demand than supply, it is the difference that creates price momentum. Breakouts are not hard to spot, but they often fail to progress or end up being a trap. However, ADX tells you when breakouts are valid by showing when ADX is strong enough for price to trend after the breakout.

When ADX rises from below 25 to above 25, price is strong enough to continue in the direction of the breakout. Conversely, it is often hard to see when price moves from trend to range conditions. ADX shows when the trend has weakened and is entering a period of range consolidation. Range conditions exist when ADX drops from above 25 to below In a range, the trend is sideways, and there is general price agreement between the buyers and sellers.

ADX will meander sideways under 25 until the balance of supply and demand changes again. ADX gives great strategy signals when combined with price. First, use ADX to determine whether prices are trending or non-trending, and then choose the appropriate trading strategy for the condition.

- Average Directional Movement Index Rating (ADXR).

- apple forex pvt ltd mumbai!

- profiforex withdrawal?

- optionshouse broker review;

- exercise stock options for cash!

In trending conditions, entries are made on pullbacks and taken in the direction of the trend. In range conditions, trend-trading strategies are not appropriate. Forex Trading for Beginners. Shooting Star Candle Strategy.

Interpretation

Swing Trading Strategies That Work. Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page. Info tradingstrategyguides. Facebook Twitter Youtube Instagram. The ADX indicator trading rules can help you achieve your financial goals. ADX Indicators for Futures The principles of the Average Directional Index can apply to almost all tradable assets including stocks, exchange-traded funds, mutual funds, and futures contracts.

ADX is time adjusted, meaning that the most recent data is given exceptional weight. ADX helps you identify the strength of a trend, which will be useful for any contract being executed in the near future.

Tools & links:

ADX makes it very easy to compare mutually exclusive futures contracts at once. Author at Trading Strategy Guides Website. Tunde says:. March 13, at pm. TradingStrategyGuides says:. March 15, at am. Shawn says:. July 31, at pm. February 16, at am. May 9, at pm. Sri Rangs says:. November 22, at am.

Search Our Site Search for:. Free Offers! Close dialog. Session expired Please log in again. Welles Wilder was a prolific designer of trading indicators that have survived the test of time. With his broad experience with the markets, Wilder knew that the key to trading is getting the context right. But how do you evaluate the context? These six trading strategies will give you a rounded view of how the ADX works. They will also show you how it performs with other common trading tools. You should already be familiar with the ADX to follow the strategies below. If you have never heard of this indicator before, click here for a short primer by Investopedia before proceeding.

The following interpretation is valid only if the ADX is above a threshold commonly set at 20 or 25 :. This system is a basic setup.

Average Directional Movement Index Rating (ADXR) — Indicators and Signals — TradingView

Do not expect it to be profitable without refining it with other tools like price action and volume. Under such situations, relying on DI crossovers for entries might not make sense. According to Wilder, you can get a better entry if you use the system in conjunction with the Parabolic SAR.

As you can see in Point 4 above , when you get a nice parabolic swing, the Parabolic SAR can even guide your exit from the market.