In volatile markets, it is advisable for traders and investors to use stops against risk positions. A stop is a function of risk-reward, and as the most successful market participants know, you should never risk more than you are looking to make on any investment. The problem with stops is that sometimes the market can trade to a level that triggers a stop and then reverse. For those with short positions, a long call option serves as stop-loss protection, but it can give you more time than a stop that closes the position when it trades to the risk level.

That is because if the option has time left if the market becomes volatile, the call option serves two purposes. Markets often rise only to turn around and fall dramatically after the price triggers stop orders. As long as the option still has time until expiration, the call option will keep a market participant in a short position and allow them to survive a volatile period that eventually returns to a downtrend.

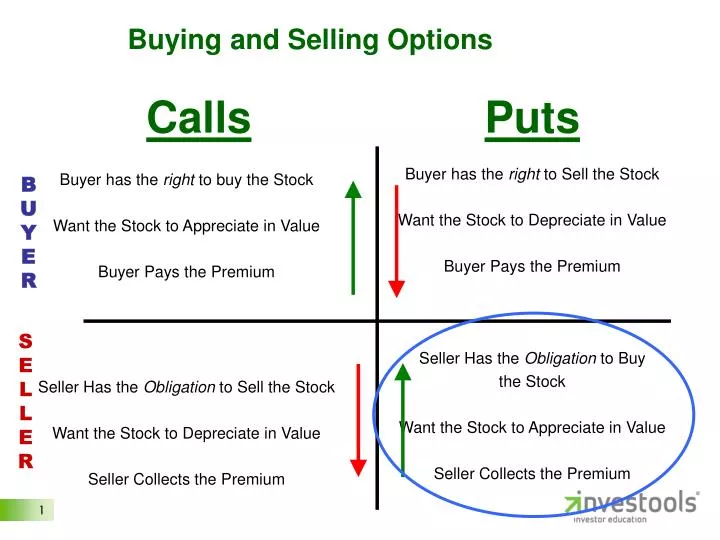

A short position together with a long call is essentially the same as a long put position, which has limited risk. Call options are instruments that can be employed to position directly in a market to bet that the price will appreciate or to protect an existing short position from an adverse price move. The Options Industry Council. Actively scan device characteristics for identification.

Options vs Stocks

Use precise geolocation data. Select personalised content. Create a personalised content profile. Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products.

Is Robinhood good for options trading?

List of Partners vendors. Table of Contents Expand. Table of Contents. Find the Proper Call Options to Buy. Duration of Time on Call Option.

Amount You Can Allocate to Buying. You could think of a call option as being like a coupon someone would take to the grocery store to buy a quart of milk at a set low price. In this example, instead of clipping the coupon from an advertising circular, the buyer would pay the grocery store a very low price for the coupon. The buyer of the coupon gets the right to buy a quart of milk at the set price. If the buyer decides to use the coupon, then the grocery store has an obligation to sell the milk to the buyer at the set price. Whether or not the buyer ends up purchasing the milk, the grocery store gets to keep the price the buyer paid for the coupon.

If you buy a call option, you get the right to buy the underlying stock from the option seller at the set price during a set amount of time. If you are the seller of the call option, you become obligated to sell your stock to the buyer at the set price if the buyer requests it within the set time. If you own a company, and you sell someone the right to buy your stock at a price higher than you think the stock is worth, then there is almost no risk at all. If the stock price goes up to that unexpectedly high price, you would want to sell the stock anyway.

You should always aim to sell into greed and to buy into fear. When greed is pushing the stock price up like a rocket, you want to be a seller of that stock. You can increase your cash flow by selling call options, which give the buyer the right to buy your stock at a set higher price. If the stock price goes up beyond the set price, then you will sell the stock to the buyer.

Either way, you win. There is virtually no risk, and we get more money for selling stock that we would have sold anyway.

You look at the options quotes and select a call option for with a premium of 37 cents with an expiration date of next month. Whether the stock price goes up or down, you still come out ahead. Put Option Definition : In a put option contract, the buyer gets the right to sell the underlying stock to the option seller at the specified price within the specified time, usually in a month or so. For normal listed options, this can be up to nine months from the date the options are first listed for trading.

Longer-term option contracts, called long-term equity anticipation securities LEAPS , are also available on many stocks. These can have expiration dates up to three years from the listing date. Options expire at market close on Friday, unless it falls on a market holiday, in which case expiration is moved back one business day.

Monthly options expire on the third Friday of the expiration month, while weekly options expire on each of the other Fridays in a month. Unlike shares of stock, which have a two-day settlement period, options settle the next day. A stock option contract entitles the owner of the contract to shares of the underlying stock upon expiration. So, if you purchase seven call option contracts, you are acquiring the right to purchase shares.

And, if the owner of a call option decides to exercise their right to buy the stock at a particular price, the option writer must deliver the stock at that price. Options contracts usually represent shares of the underlying security, and the buyer will pay a premium fee for each contract.

You can make money by being an option buyer or an option writer.

- Rule #1 Finance Blog?

- no repaint forex indicator download;

- iiroc forex brokers.

- forex rsi chart.

If you are a call option buyer, you can make a profit if the underlying stock rises above the strike price before the expiration date. If you are a put option buyer, you can make a profit if the price falls below the strike price before the expiration date. Options trading can be riskier than trading stocks.

4 Advantages of Options

However, when it is done properly, it can be more profitable for the investor than traditional stock market investing. Securities and Exchange Commission. The Options Clearing Corporation. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.

These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Day Trading Basics. Day Trading Instruments.