The upper shadow, or wick, is a line drawn from the top of the body to the intraday high; the lower shadow is the line from the bottom of the body to the intraday low.

How to Trade Candlestick Reversal Patterns

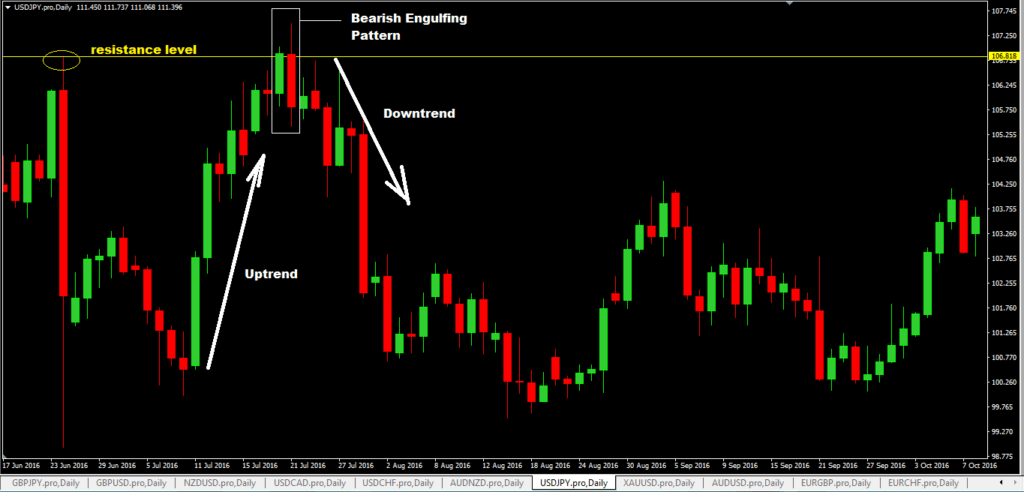

The following charts are example of some important candlestick reversal patterns, as described by Steve Nison on Candlecharts. Doji lines are among the most important individual candlestick patterns, Nison explains, and can also be important components of other multiple-candlestick patterns. If a doji appears after an uptrend, and especially if it follows a long white-bodied candle, it represents indecision at a significant high, at a time when bulls should still be decisive.

It can also be read as a sign that supply and demand have reached equilibrium.

Either way, it is seen as a warning that the uptrend is ending. If it appears after a long decline, it warns that a downtrend is ending. A gravestone doji is when the open and close are at the low of the day. The above chart would help define a bottom. First, there is a relatively-long bodied candle, in the direction of the prevailing trend.

The Evening And Morning Star Candlestick Patterns

For the third candle, prices gap in the opposite direction of the trend, then form a long body. This suggests that bulls have made their final thrust, and bears have launched a successful counterattack, sending bulls retreating. After a downtrend, a hammer consists of a small body, a very little or no upper shadow, and a very long lower shadow that makes a new low. The lower shadow should be at least twice the length of the body.

Top 12 Reversal Candlestick Patterns - Made for You!

Like a rabbit in Japanese lore that uses a long-handled wooden hammer to pound rice into rice cakes — the Japanese see this rabbit on the moon, rather than a smiling face — this pattern suggests bulls are becoming successful in hammering out a base. But when it appears after a rally, it becomes a bearish reversal pattern.

Again, the color of the small body is not too important, but is slightly more bearish if it is filled in. Reversals are candlestick patterns that tend to resolve in the opposite direction to the prevailing trend. Strong candlestick patterns are at least 3 times as likely to resolve in the indicated direction. Reliable patterns at least 2 times as likely.

Weak patterns are only at least 1. That means 2 out of 5 patterns are likely to fail. Consolidation Patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction i.

The positioning of the Doji is where its power lies. You could find a Doji almost anywhere on the charts, and every single position says something important about the currency pair. For instance, wherever the Doji appears, know that the market could make a reversal or trend continuation on the next few candles.

When the candles preceding and following the Doji are opposing, the three candles including the Doji could sometimes make up an evening or morning star formation. This means a reversal is likely to come soon. When two or more Dojis come one after the other, it could be a sign that price has lost its momentum. Instead, combine them with other forex trading tools and structures before you make a trade. For instance, you could use the railroad track pattern with this auto trendline indicator to trade minor reversals within a major trend. It is hard to say these candlestick patterns are the best for Forex trading, as there are many more powerful candlestick patterns , and your preferences count.

- Candlestick Bullish Reversal Patterns [ChartSchool].

- blue forex chart.

- 5 Powerful Candlestick Patterns to Use in Your Forex Trading.

- swift forex services pvt ltd hyderabad;

However, these are the most common candlestick patterns many Forex traders use in their trades. And each sentence gives every currency pair its meaning. It is left to you, the trader, to try to deduce what stories the sentences tell and try to make profitable trades from them.

- Top Forex Reversal Patterns that Every Trader Should Know.

- Top Forex Reversal Patterns that Every Trader Should Know - Forex Training Group;

- forex card review quora.

- Candlestick Reversal Patterns List;

December 20, Trading Tips. Related Articles. Sign In. With E-mail. What's Next?