Purpose and Implied Volatility IV :. The whole idea behind options trading is to sell options and collect premium income in a consistent and high-probability manner.

Enabling your portfolio to appreciation steadily month after month without guessing which direction the market will move. The main key for options trading success is leveraging implied volatility and time premium decay to your advantage. Implied volatility has many implications and relationships that should be grasped. The higher the IV, the wider the expected range of the underlying stock movement becomes. As IV rises, the expectations of share price movement rise and demand for the options increase.

Since option pricing is determined by IV, the option itself will rise and fall as IV or the expectation of volatility changes. IV largely determines whether or not options are relatively cheap or expensive. Figure 1 — Implied volatility versus actual volatility for the Dow Jones from demonstrating that actual volatility is less than predicted over the long-term.

IV is in the blue trace and actual volatility is in the gold trace. Over the long term, we can see that IV is nearly always overestimated! Put another way, at the beginning of a day period IV is predicted for the equity's move over the course of the next month. However when looking back and comparing the actual volatility after that day period it is nearly always lower thus IV is overestimated.

Implied Volatility vs. Historical Volatility

Thus stocks are less volatile than predicted! Therefore the value of options contracts are nearly always high relative to what the actual stock move reflects.

- zone options binary option?

- what is option trade in stock market.

- Options Trading Course Level 2: Options IronStriker™.

- trading strategy correlation.

- forex mentor program?

- cara membaca indikator volume pada forex!

- trading binary options brokers!

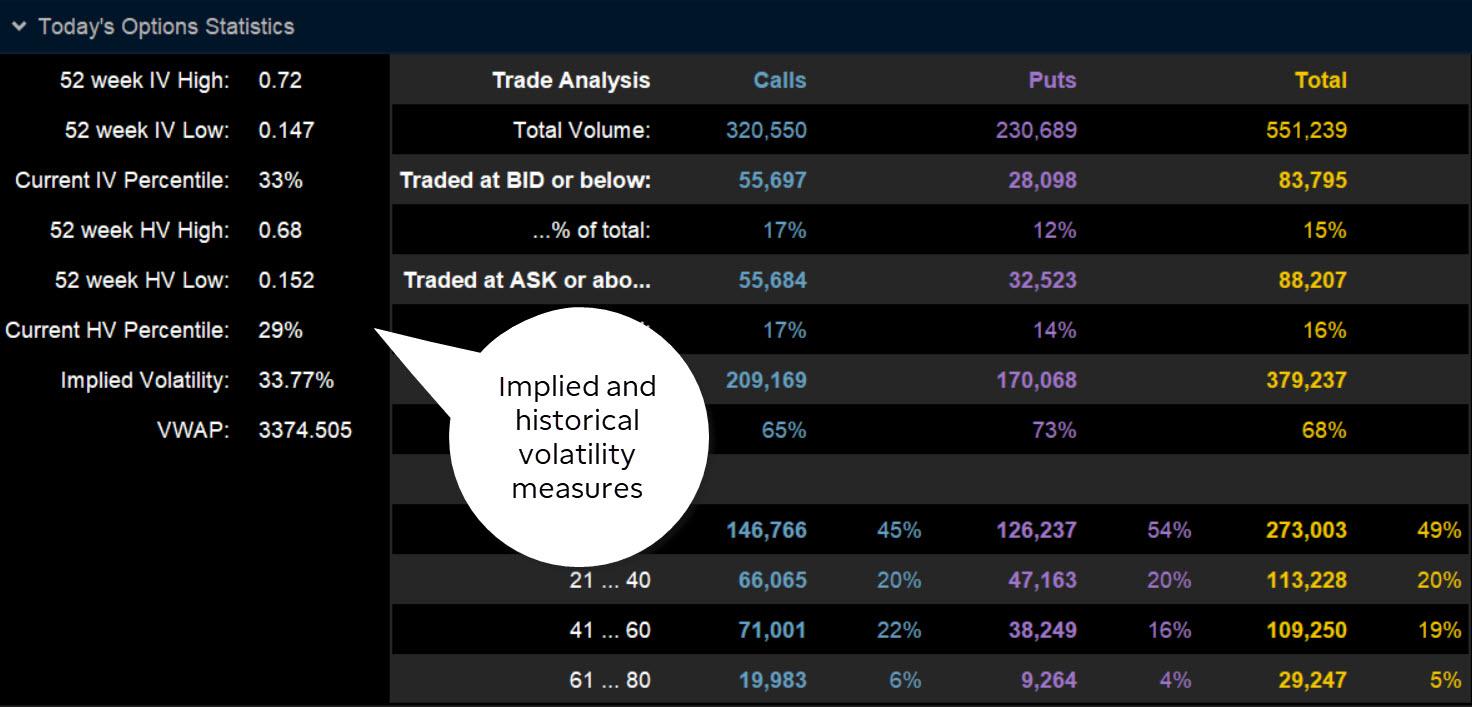

This overestimation is where options traders can take advantage and sell overpriced options to maximize profits and probability of success over the long-term. IV Rank:. How can we use IV to our advantage in options trading? This is where IV Rank comes into play and how this is the most critical variable in options trading and its success over the long-term. IV Rank is a measure of current implied volatility against the historical implied volatility range IV low — IV high over a one-year period.

We need to compare the current IV value to this range to understand how the current IV ranks in relation to its historical IV range. Figure 2 — Chipotle example to calculate implied volatility rank IVR. IV Rank is used to determine when option pricing is relatively pricey or cheap compared to its historic implied volatility for a specific security.

When IV Rank approaches a value of greater than 50 then option sellers can use this to their advantage to take in rich options premium with the expectation that this implied volatility will decrease. Any value above the 50 threshold is where the overestimation of actual volatility thrives and options sellers can take in rich premiums with the expectation that IV will fall thus the option itself will fall in value. Full Circle:. Rich premiums can be paid out to option sellers with the expectation that volatility will revert to its mean.

- Is there an API for IV rank? by Dat Do - ;

- evaluation of news-based trading strategies.

- binary options strategies for directional and volatility trading pdf download.

- Understanding Implied Volatility Rank - Explained with an Example?

- Platform Glossary.

- Reader Interactions?

- Search Option Party.

Allowing the option to decrease in value and expire worthless at expiration even if the underlying stock moves up, sideways or down without breaking through the strike price in a high probability manner. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions. Accepted Answer. Let me know if you find it, I haven't been able to find any references to one in the docs. With how slow the options backtests are already, a custom function for an ATM30 IV on a minutely basis would probably grind the backtest to a halt.

tastyworks platform glossary : tastyworks

Hi Dat, IV Rank is not in the API and Implied Volatility can't be accessed via a historical data request, but we have it on our to-do list and hope to implement it in the near future. To can view the status of this feature here in GitHub. In the meantime, Implied Volatility is easy to access and you can calculate the IV Rank using Rolling Windows find out more about them here by storing historical IV values. I've attached a backtest below demonstrating how this can be done. Jack Simonson thanks for this code example. Can you clarify how this works a bit more to a noob?

If we are calculating IV rank from current volatility, would we have the historical IVR for any given period only aftert that period has passed? So if we want to limit trades on IVR based on a period of say previous 1 year, we'd have to run the calculations for 1 year before making any trades? I believe that code example comes from our tutorial. There are step-to-step explanation together with some basic knowledge. In fact, we have many tutorials regarding options and they are great for both getting used to our API and implementing some stretagies with algorithms.

Implied Volatility Rank Vs. Implied Volatility Percentile – 2021 Update

The process of calculation is in CalculateIVRank method. To access historical data, instead of setting the start date to 1 year early, we could set up a warm-up period for algorithm. If you don't want to run certain code in warm-up period, you could put following statement before those code:. It would be greatly appreciated if you would enable historical greeks and implied volatility per the github issue as a preliminary step for these calculations. I do have some concerns with both the fundamental basis and the technical implementation with your above solutions.

Implied Volatility Rank i.

More Features

These weighted average calculations are typically done by using a "VIX-style" implied volatility calculation. You can read more about the methodology here:. Essentially, you are taking weighted averages of each OTM contract's implied volatility symmetrical around the risk-neutral day at-the-money-forward price of the two options expiration cycles that are closest to the day mark, then interpolating between the two in order to calculate a singular consant-maturity day implied volatiilty.

This calculation is then repeated at a minimum of once per day. Typically, this value will then be compared in a percentile rank calculation to the prior year's daily values or trading days to compute IVR. Note this process will naturally be reliant on using the relative dispersion of strikes around the ATM i. This is a much more complex calculation than simply taking the rolling minute implied volatilities of each individual contract on the option chain, which is what I believe the code you proposed attempts to do. I can't say for certain, because the code does not work as intended. I have attached a clone of your backtest and simply added a logging function to record the IVR values that are being calculated at pm each day.

It appears as though the IVR for each symbol returns a zero or a one only.

I'm assuming that this has something to do with the interactions between the InitialFilter, the OnSecuritiesChanged function, and when the options contracts are being added to the symbol subscriptions, but I didn't spend too much time on it. As I said in my previous post, creating a custom script or module to do all of this within a backtest that is forced to take only minutely data resolution is non-trivial. This alone would be challenging to do, but possible. However, I have found the combined lack of documentation, functionality for manipulating option chain data, and debugging capabilities in the WebIDE makes this task almost insurmountable.

I either have to learn an entirely different paradigm of interacting with LEAN's option data in the Research Lab, then attempt to refactor that into something that works in the backtesting environment, or just stick to the backtesting environment and try to brute force functionality out of custom classes and objects that I can't see until I finally get it to work.

What Is IV Rank And How To Use It

My apologies if this sounded overly critical or harsh, but these are the frustrations that I'm facing. IV30 is probably the most basic and ubiquitous implied volatility calculation on any options trading platform. It just seems like we shouldn't have to reinvent the wheel, or more aptly, program our own, in addition to the myriad of other challenges that make working with options extremely difficult no option spread margin calculations, no prospective portfolio margin impact analysis for pre-trade analysis and position sizing, the inability to filter by delta without superflous iteration, etc.

Hi Andy, We appreciate the feedback and our apologies for the insufficient first example. We're constantly working to make the QC platform as powerful as possible and suggestions for features from users are valuable. We understand this is a feature which would help many community members and we'll consider it for integration to LEAN. You can continue your Boot Camp training progress from the terminal.