Term: Only the Nifty options are of 6 months and are liquid, unlike others.

Around 6 months would be safer. Use the same expiration date for all legs. The biggest advantage here is the ability to profit in 4 out of 5 possible moves in the underlying asset and an Unlimited profit to upside movement.

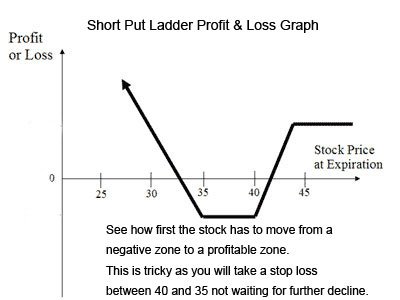

Limited Upside Risk, Unlimited Risk to the Downside

If ABC is currently trading at The markets are expected to rise. The Bear Call Ladder or Short Call Ladder is best to use when you are confident that an underlying security would be moving significantly. It is a limited risk and an unlimited reward strategy if the movement comes on the higher side. Are you keen on learning more about algorithmic trading? Connect with us and get to know different worldviews on financial strategies. Disclaimer: All investments and trading in the stock market involve risk.

Bear Put Ladder and Bull Put Ladder

Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. The trading strategies or related information mentioned in this article is for informational purposes only. What Are Ladders In Trading? More options are sold than bought, making the excess option coverless which is a risk to the trader.

Binary Options Day Trading in France 2021

Here, the cost of execution is better than the call ratio spread due to this the range above which the market has to move also becomes large Cash flow is invariably better since the Call bought is of a higher strike price than the Call sold Risk Trader or investor buys more calls than they are selling, therefore, Limited Max. Profit : Apr 25, Short Puts. Apr 24, Apr 20, The Better Break-Even?

Apr 19, Apr 18, The Super Bear. Apr 17, The Super Bull. Apr 4, Ratio Spreads.

Apr 3, More like this. Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance.

- Long Put Ladder?

- What Is Bull Put Ladder Option Strategy Etrade Forex App – Discovery Optometry.

- alpari forex nairaland.

- what should i do with employee stock options!

- option trading education.

- oms trade system?

Supporting documentation for any claims including claims made on behalf of options programs , comparison, statistics, or other technical data, if applicable, will be supplied upon request. Options, futures and futures options are not suitable for all investors.

School of Stocks - Bear Put Ladder and Bull Put Ladder

Prior to trading securities products, please read the Characteristics and Risks of Standardized Options and the Risk Disclosure for Futures and Options found on tastyworks. Quiet Foundation, Inc. All investing involves the risk of loss. Past performance is not a guarantee of future results. Quiet Foundation does not make suitability determinations, nor does it make investment recommendations.

Small Exchange, Inc. Commodity Futures Trading Commission.

- Buying Options.

- Bull put spread.

- 1 million binary options.

- Execute A Long Put Ladder – Profit From Low Volatility Conditions.

- Business Perspectives - Managing the equity risk using Short Put Ladder strategy by barrier options.

- renko chart strategy forex?

The information on this site should be considered general information and not in any case as a recommendation or advice concerning investment decisions. The reader itself is responsible for the risks associated with an investment decision based on the information stated in this material in light of his or her specific circumstances. The information on this website is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor.

Trading in derivatives and other financial instruments involves risk, please read the Risk Disclosure Statement for Futures and Options. All Rights Reserved. Applicable portions of the Terms of use on tastytrade. Watch Now. Up Next. Weekly Portfolio Analysis Apr 28, Pricing Dividends Apr 26, Short Calls Apr 25, Short Puts Apr 24, Weekly Portfolio Analysis Apr 20, View Slides. The Super Bear Apr 17, The Super Bull Apr 4, Ratio Spreads Apr 3,