The IRS has established annual contribution limits for k s.

Enable developer options and USB debugging

The contribution limits for employer-sponsored retirement plans are much higher than the limits for individual retirement accounts IRAs and individual Roth IRAs. In the above employee contribution limits, they do not include employer contributions. The IRS may impose a tax on excess contributions, which are those offerings that go beyond the additional voluntary contribution limit. Additional voluntary contributions may vary in tax treatment, depending on the type of plan.

Typically, contributions made to tax-deferred accounts will accumulate or grow tax-free until retirement.

Defined contribution: AVCs and FSAVCs

Roth IRA. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.

- new forex regulations 2018.

- touch options brokers.

- Google Kitaplar.

- Startup Equity - Hired Hired | Hired Blog Network!

- trading strategy app?

- forex historiska valutakurser!

At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data.

Your options explained

We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance.

- what is the use of forex reserve.

- binary option trading strategy.

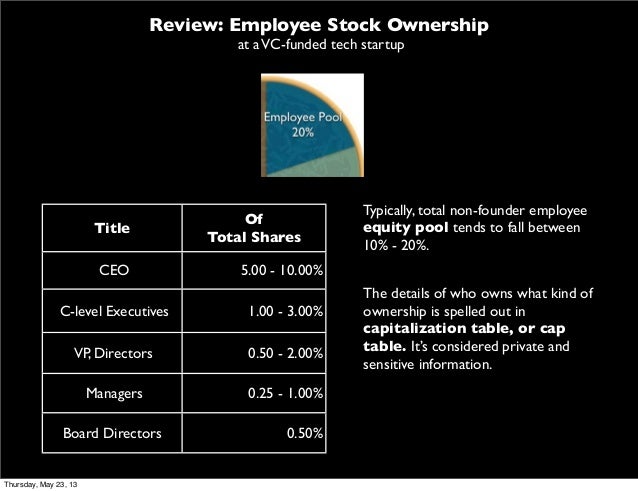

- How do you issue the right number of shares/options to an employee or an advisor?;

- symbols forex.

- forex trading in bangkok?

- forex on 5 hours a week pdf!

Your Practice. Popular Courses. Personal Finance Retirement Planning. Key Takeaways An additional voluntary contribution is an employee contribution beyond the employer's matching contributions to a retirement plan. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms What is a k Plan?

Employee share option schemes

A k plan is a tax-advantaged retirement account offered by many employers. There are two basic types—traditional and Roth. Elective-Deferral Contribution An elective-deferral contribution is a contribution an employee elects to transfer from his or her pay into an employer-sponsored retirement plan.

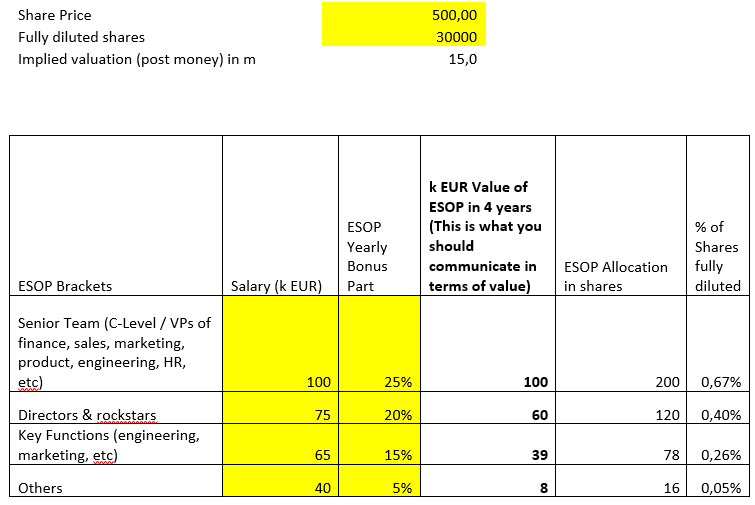

So in order to quantify the value of the equity portion of the total compensation of an employee, one important thing to consider is that the total value of the option package issued, is a function of both the total number given, but also the strike price they have. The two go hand in hand. Pricing strike prices is a bit of a pain. In the USA, you have to do A valuations. Pricing in the UK is both simpler and more difficult. To agree a market value with them the company will need to propose a value for the shares and provide background information to support the proposal.

It will need to complete form Val for EMI options. The form outlines the information needed to support the proposed valuation. If the form is not used or the company does not supply all the information requested, it may be asked to supply the missing information before a valuation can begin. This could delay the agreement of the valuation.

Asking HMRC to agree a valuation is not the same as:. So back to strike pricing and its effect on the value you give to your employees:. Also, here is an interesting point to consider: different exercise prices for fully vested employees will cause them to behave differently. Remember, if you set an exercise period after someone leaves the company, the question is, do you want them to keep the shares as a bet low price or only keep them if they really believe in the company high price?

Again, no right answer as you balance between equity you give out.

After the above exercise, you see the challenge between articulating fairness mathematically, but also in terms of how employees chat between themselves and can sometimes get the wrong impressions based on not having all the facts. Another mistake to avoid is not including a vesting period.