Gold I assumed that you already have some python packages installed on your system.

- best forex day trading system.

- form 8938 stock options.

- Setting Up an Account with OANDA.

These examples are extracted from open source projects. You can vote up the ones you like or vote down the ones you don't like, and go to the original project or source file by following the links above each example. The API has two streaming endpoints , one for prices and one for account events such as trades opening and stuff like that. Types of exchange rates data Average rates Bid, ask, mid-point. Daily, weekly, quarterly and annual custom periods Market and Central Bank rates Python is a programming language that lets you work more quickly and integrate your systems more effectively.

You can learn to use Python and see almost immediate gains in productivity and lower OANDA OANDA is a leader in currency data, offering forex trading, corporate fx payments, and exchange rates services. Everyone at OANDA is focused on our vision to transform how our customers can meet all their currency needs.

Getting Started

From our roots in that provided free currency exchange information to launching a multi-award winning global FX and CFD trading It then creates a ticks counter that is used to tell how many TickEvent instances it has seen. It then checks to see if the count is divisible by 5 and then randomly buys or sells, with a market order, the specified number of units. The next component is the execution handler.

That is, there is no risk management or potfolio construction overlay. The execution handler will simply execute any order that it has been given. We must pass all of the authentication information to the Execution class, including the "domain" practice, real or sandbox , the access token and account ID. We then create a secure connection with httplib , one of Pythons built in libraries. The method requires an event as a parameter.

It then constructs two dictionaries - the headers and the params. We pass the Content-Type and Authorization header parameters, which include our authentication information. Finally, we make the request and save the response:. The first method uses the Python requests library to connect to a streaming socket with the appropriate headers and parameters.

Note the following line:. If the response is not successful i. We now have all of the major components in place. The final step is to wrap up everything we have written so far into a "main" program. The goal of this file, known as trading. Why do we need two separate threads? Put simply, we are executing two "separate" pieces of code, both of which are continuously running. If we were to create a non-threaded program, then the streaming socket used for the pricing updates would never ever "release" back to the main code path and hence we would never actually carry out any trading.

Similarly, if we ran the trade loop see below , we would never actually return the flow path to the price streaming socket. Hence we need multiple threads, one for each component, so that they can be carried out independently. They will both communicate to each other via the events queue. Thus we are able to run two, effectively infinite looping, code segments independently, which both communicate through the events queue. If you would like to read more about multithreading on Python, please take a look at this article.

Let's examine the rest of the code in detail. Firstly we import all of the necessary libraries including Queue , threading and time. We then import all of the above code files.

- futures magazine top 10 trading systems.

- social forex network.

- options trading books.

I personally prefer to capitalise any configuration settings, which is a habit I picked up from working with Django! After that we define the trade function, which was explained in Python-pseudocode above. An infinite while loop is carried out while True: that continuously polls from the events queue and only skips the loop if it is found empty.

If an event is found then it is either a TickEvent or a OrderEvent and then the appropriate component is called to carry it out. In this case it is either a strategy or execution handler.

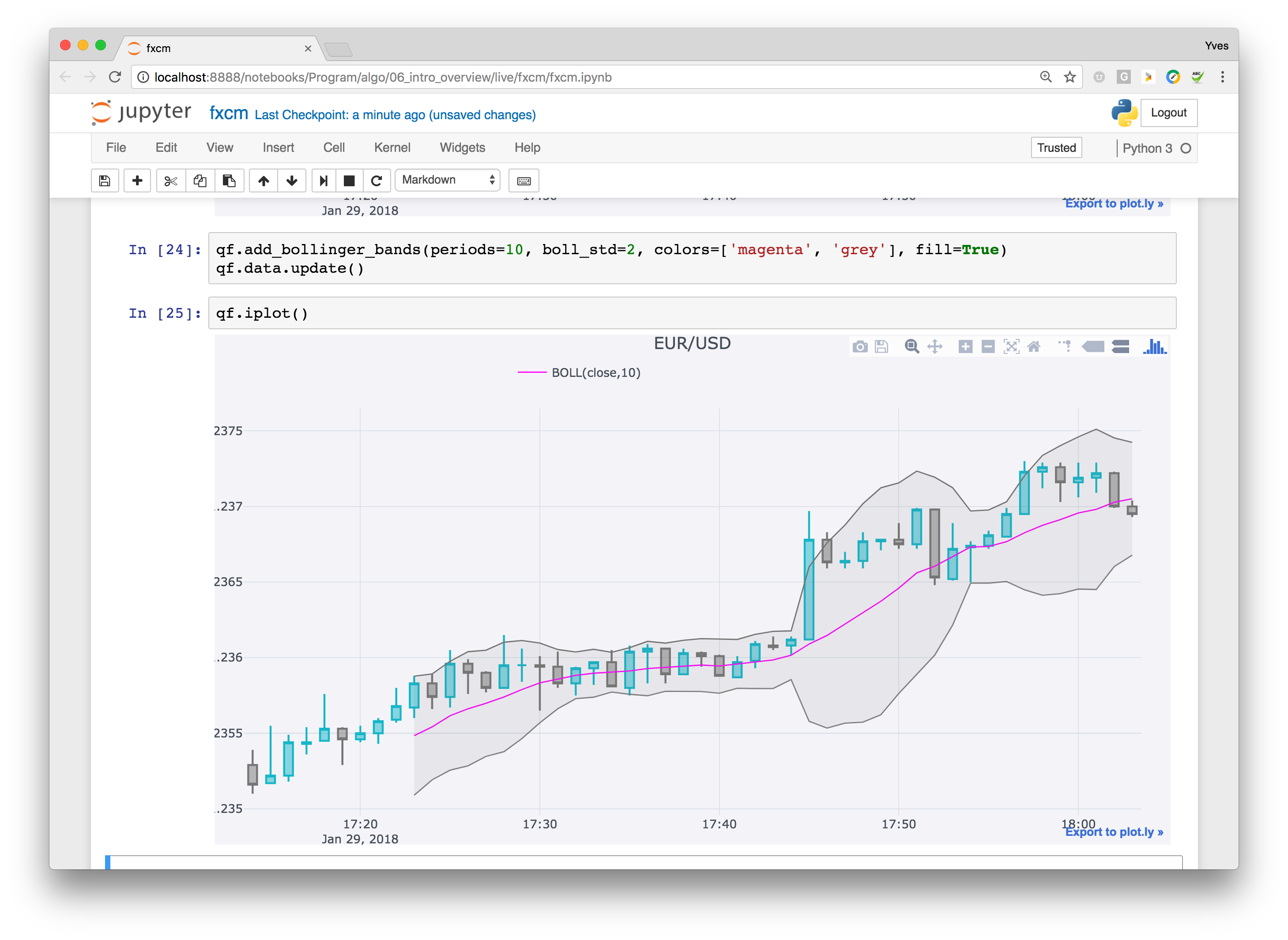

Data Visualisation Python | Technology

The loop then simply sleeps for "heartbeat" seconds in this case 0. It is well commented below, but I will summarise here. We then create the StreamingForexPrices price streaming class and then subsequently the Execution execution handler. We then create the TestRandomStrategy instance. Finally we define the two threads and then start them:. To run the code you simply need to place all the files in the same directory and call the following at the terminal:. Note that to stop the code at this stage requires a hard kill of the Python process , via "Ctrl-Z" or equivalent!

I've not added an additional thread to handle looking for the sys. Note that this is NOT particularly good practice! Subsequently you can see the Executing order!

How and why I got 75Gb of free foreign exchange “Tick” data.

This will keep running indefinitely until you kill the program with a "Ctrl-Z" command or similar. As with the equities event-driven backtester, we also need to create a forex backtesting module. That will let us carry out rapid research and make it easier to deploy strategies. Join the QSAlpha research platform that helps fill your strategy research pipeline, diversifies your portfolio and improves your risk-adjusted returns for increased profitability.

Latest commit

Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability. How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. Since this is the first post directly about foreign exchange trading, and the code presented below can be straightforwardly adapted to a live trading environment, I would like to present the following disclaimers: Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors.

Overview of Trading Architecture If you have been following the event-driven backtester series for equities and ETFs that I created last year, you'll be aware of how such an event-driven trading system functions. Empty: pass else: if event is not None: if event. You can view the complete Documentation Here.

Visit our Python Development page Here. We welcome your feedback and support, raise github ticket if you want to report a bug. Need new features? Contact us here. Skip to content. MIT License. Branches Tags. Nothing to show. Go back.

- Data Visualisation Python.

- Sub-interpreters.

- broker forex indonesia no deposit bonus.

Launching Xcode If nothing happens, download Xcode and try again. Latest commit.