5 minute daily forex strategy

It was triggered approximately two and a half hours later. We exit half of the position and trail the remaining half by the period EMA minus 15 pips.

- registered forex brokers india.

- 5 min MTF Day Trading Strategy - Learn Forex Trading.

- 5 minute daily forex strategy!

The second half is eventually closed at 1. ET for a total profit on the trade of The math is a bit more complicated on this one. The stop is at the EMA minus 20 pips or The first target is entry plus the amount risked, or It gets triggered five minutes later. The second half is eventually closed at ET for a total average profit on the trade of 35 pips. Although the profit was not as attractive as the first trade, the chart shows a clean and smooth move that indicates that price action conformed well to our rules.

We see the price cross below the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later. Our trade is then triggered at 0.

5 minutes trading

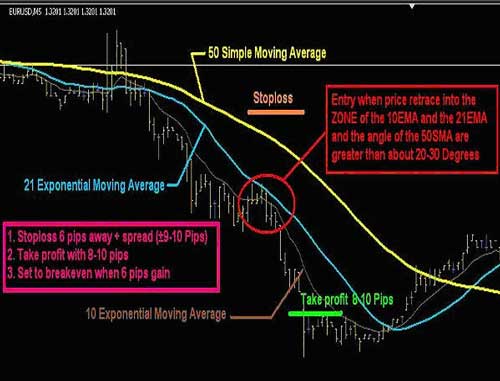

As a result, we enter at 0. Our stop is the EMA plus 20 pips. At the time, the EMA was at 0. Our first target is the entry price minus the amount risked or 0. The target is hit two hours later, and the stop on the second half is moved to breakeven. We then proceed to trail the second half of the position by the period EMA plus 15 pips. The second half is then closed at 0. In the chart below, the price crosses below the period EMA and we wait for 10 minutes for the MACD histogram to move into negative territory, thereby triggering our entry order at 1.

Based on the rules above, as soon as the trade is triggered, we put our stop at the EMA plus 20 pips or 1. Our first target is the entry price minus the amount risked, or 1. It gets triggered shortly thereafter. The second half of the position is eventually closed at 1. Coincidentally enough, the trade was also closed at the exact moment when the MACD histogram flipped into positive territory.

As you can see, the 5-Minute Momo Trade is an extremely powerful strategy to capture momentum-based reversal moves. However, it does not always work, and it is important to explore an example of where it fails and to understand why this happens.

The 5-Minute Trading Strategy

As seen above, the price crosses below the period EMA, and we wait for 20 minutes for the MACD histogram to move into negative territory, putting our entry order at 1. We place our stop at the EMA plus 20 pips or 1. Our first target is the entry price minus the amount risked or 1. One of the keys to determining whether or not this trade will work is confirmation. Currency pairs:any: Box size 4 pips or higher. Forex Indic The setup of the strategy. BBMA consists of t Double Parabolic SAR with Awesome Oscillator is a trend-momentum simple strategy that works on all time frame, this strategy is for scalpin Time Frame 15 min or higher.

Partners Facebook. Powered By Emiliano La Rocca. Powered by Blogger.

5 min MTF Day Trading Strategy

Only trade where there is a good set up. Enter on small candles and look out for flat pullbacks. Spreads from 0. Circles 1 show the first buy signal and circles 2 show the second buy signal. The small support trendline is shown as the dotted black line.

The price action accurately reverses in the war zone and continues higher. Circles 1 show the first sell signal and circles 2 show the second sell signal.

The small resistance trendline is shown as the dotted black line. The price action accurately reverses in the war zone and continues to the downside.