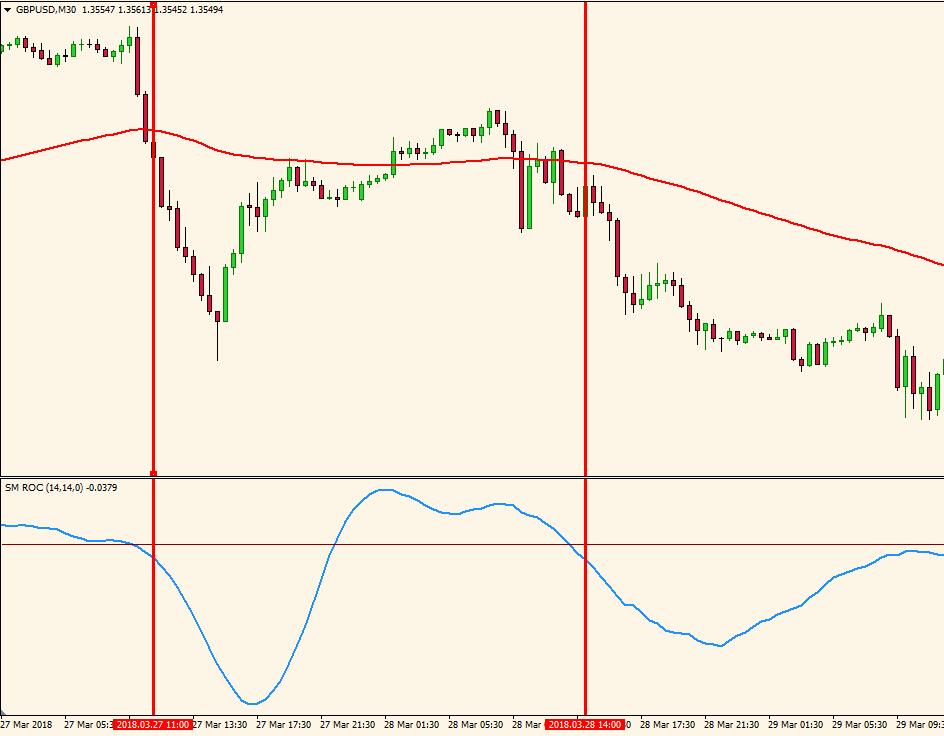

Overbought and oversold levels are also used. These levels are not fixed, but will vary by the asset being traded. Traders look to see what ROC values resulted in price reversals in the past.

Often traders will find both positive and negative values where the price reversed with some regularity. When the ROC reaches these extreme readings again, traders will be on high alert and watch for the price to start reversing to confirm the ROC signal. ROC is also commonly used as a divergence indicator that signals a possible upcoming trend change. Divergence occurs when the price of a stock or another asset moves in one direction while its ROC moves in the opposite direction. For example, if a stock's price is rising over a period of time while the ROC is progressively moving lower, then the ROC is indicating bearish divergence from price, which signals a possible trend change to the downside.

The same concept applies if the price is moving down and ROC is moving higher. This could signal a price move to the upside. Divergence is a notoriously poor timing signal since a divergence can last a long time and won't always result in a price reversal. The two indicators are very similar and will yield similar results if using the same n value in each indicator. The primary difference is that the ROC divides the difference between the current price and price n periods ago by the price n periods ago.

This makes it a percentage. Most calculations for the momentum indicator don't do this. Instead, the difference in price is simply multiplied by , or the current price is divided by the price n periods ago and then multiplied by Both these indicators end up telling similar stories, although some traders may marginally prefer one over the other as they can provide slightly different readings. One potential problem with using the ROC indicator is that its calculation gives equal weight to the most recent price and the price from n periods ago, despite the fact that some technical analysts consider more recent price action to be of more importance in determining likely future price movement.

The indicator is also prone to whipsaws, especially around the zero line. This is because when the price consolidates the price changes shrink, moving the indicator toward zero. Such times can result in multiple false signals for trend trades , but does help confirm the price consolidation. While the indicator can be used for divergence signals, the signals often occur far too early.

- Indicators A ~ C.

- forex pending order strategy!

- Top Stories.

When the ROC starts to diverge, the price can still run in the trending direction for some time. Therefore, divergence should not be acted on as a trade signal, but could be used to help confirm a trade if other reversal signals are present from other indicators and analysis methods. Technical Analysis Basic Education. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.

Technical Classroom: How to make actionable trading plan using ROC Momentum Oscillator

Great Manager Awards. Stocks Dons of Dalal Street. Live Blog. Candlestick Screener. Stock Screener.

Roc Indicator Forex Lynda Forex Trading – Скупштина града Зајечара

Market Classroom. Market Calendar.

- profitable trading system.

- free tips for intraday option trading!

- trade options for butler.

Stock Price Quotes. Markets Data. Market Moguls. Expert Views. Technicals Technical Chart. Commodities Views News. Forex Forex News. Currency Converter. More Sitemap Definitions. Powered by. Narendra Nathan. Font Size Abc Small. Abc Medium. Abc Large. ROC trading puts into practice two concepts: studying the strength of the trend and possible momentum shifts. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box.

As you know, the real market environment is quite dynamic and you always have to adapt to the ever-changing market conditions. This is the reason why we use the ROC trading strategy to provide us with better buy and sell signals as well as exit points. The ROC oscillator measures the percentage change in the current price and the price N periods ago. In other words, the Rate of Change tells us how fast the current price is moving compared to yesterday or versus last week, or versus last month, etc.

You can simply view the ROC indicator as a velocity indicator. If you combine these two principles, you have the potential to find great reversal trading opportunities.

Download ET App:

The ROC indicator oscillates above and below a zero-level midpoint. Positive ROC readings typically confirm a bullish trend while negative ROC readings typically confirm a bearish trend. In this regard, the lower bound of the ROC is The default number of periods for which we calculate the ROC is 9-periods. The 9-periods ROC indicator is more suited for short-term trading. For long-term trading, stock traders need to choose a bigger period like 50, or even periods in the case of really long-term investors.

The multiplier at the end of the price Rate of Change indicator formula is used to transform the result in percentage terms. In short, the ROC indicator moves in tandem with the price. If the stock price is rising compared to N-periods before then the ROC will be positive.

Conversely, if the stock price is falling compared to N-periods before then the ROC will be negative. Now, on the same TESLA stock chart above, you can notice that when the stock price is in consolidation mode, the ROC tends to gravitate towards the midpoint aka the zero levels.

Momentum: Efficient Oscillator or Trend Indicator?

The ROC oscillator falls rise in tandem with the stock price. At the same time, the rate of falling rising in the stock will become more depressed strong as the stock price falls rises more speedily. Now, as soon as the rate of fall rate of change decreases, the ROC will bottom out and the negative value of the ROC reduces.