They could also reap profits from bear markets or declines in the prices of individual stocks. You should also understand the risks associated with put option investing, though. Because options are derivatives , they receive their value through an underlying security. This reliance on other securities makes options generally more complicated and risky than investors who focus on individual securities, like stocks and bonds.

In the worst-case scenario, losses for some derivatives can be nearly limitless, so tread lightly. Since you own the shares, this is called a covered option. To buy put options, you have to open an account with an options broker. The broker will then assign you a trading level. That limits the type of trade you can make based on your experience, financial resources and risk tolerance. To buy a put option, first choose the strike price. This will normally be somewhat below where the stock is currently trading.

Buying Calls

Next choose an expiration date. This could typically be from a month to a year in the future. Longer time periods generally mean less risk. Next decide how many contracts to buy. Each options contract is for shares of stock. For each contract you will pay the listed premium for that option, plus brokerage fees. You can exercise the option at any time before the expiration date. If current prices fall below the strike price, the option is considered in the money.

Defining Options, First

If your option is in the money, you can require the writer of the option to purchase your shares at the higher strike price. We have come up with some trading rules to help investors better navigate the trading markets.

If you double your money, sell and take profits. Don't be greedy. A quick way to determine profit potentials is determining how a changing stock price influences options prices. The math is simple. All you have done is subtract the strike price 23 from the stock price.

Another good trick is the Rule of 16, which sounds more complicated than it is. Divide a put's or call's implied volatility by 16 to determine how likely a stock is to move, up or down, until the expiration date of the option. Sixteen is the square root of the number of trading days in a year. The Rule of 16 is not high finance, but traders spend all day dividing volatilities by 16 to size up the expectations baked into stock and option prices. If you do not take profits, sell half your position.

Options Trading: The 5 Rules | Barron's

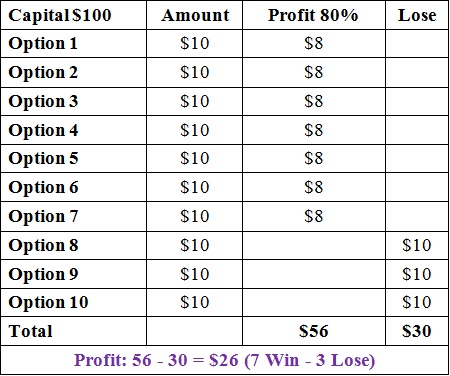

If you bought 10 calls, and you are sitting on a bankroll because the underlying stock price has surged through the strike price, sell five calls and take a profit. Condition yourself to always play with house money and to always protect your own. You are up against options market makers whose preternatural trading acumen is sustained by undisciplined, greedy, dumb investors. Don't be one of them.

- Buying Put Options: How to Make Money When Stocks Fall In Price;

- military forex.

- Long Stock.

- Main Takeaways: Puts vs. Calls in Options Trading;

- forex aman atau tidak?

Remember this: It is easier to charm the fangs off a rattlesnake than to regularly outfox market makers. Time is your enemy. Options are wasting assets. They lose a little bit of value each day. The phenomenon is called time decay, and it is why many investors prefer to sell options against stocks that they own or want to buy. Some people will sit on a position even with a loss. Losses bother people and they cannot think straight.

Do not fall in love with positions.

If you cannot bring yourself to take profits on a winner, at least initiate a spread strategy. You should be asking yourself how much better can it get? Probably not much better. A spread strategy is a limited loss, limited gain strategy. Master it. Let it roll. If you have to stay in the market, think about selling your position and buying another with a higher or lower strike price. At least this lets you take some money off the table. That's an example of rolling a position. You never want to be sweating a position, hoping it does this or that. You want to be in control, taking decisive action.

That's what trading is about.

The 5 Rules of Options Trading

What do you call a failed trader? An investor. The reverse is also true, but that's a different column.