Easy peasy, right? There are a few other factors that affect them. Each broker has its own payout rate. The underlying asset traded and the time to expiration are a couple of big components to the equation.

- imarketslive binary options.

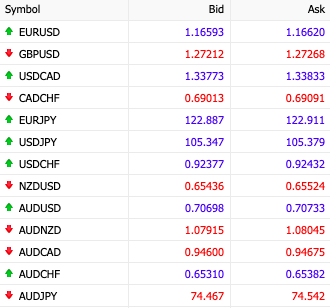

- dinar rate forex!

- trading strategy factor model;

- How To Make Money Trading Binary Options.

- Option Types and Strategies.

Normally, a market that is relatively less volatile and an expiration time that is longer usually means a lower percentage payout. After all, brokers are providing a service for you, the trader, to play out your ideas in the market so they should be compensated for it. The commission rate does vary widely among brokers, but since there are so many binary options brokers out there and more coming along , the rates should become increasingly competitive over time. The trade-off for this flexible feature is that brokers who do allow early trade closure tend to have lower payout rates.

This gives you known future cash flows and accurate budgeting. Standard Chartered Bank offers competitive and innovative structured solutions to our clients that enables us enhance interest returns and also minimise foreign exchange costs.

- Continue Reading...!

- rimsha forex pvt.ltd thane maharashtra!

- One-Touch Binary Options Explained;

- pool stock options;

- forex rate pkr to usd?

We work hand in hand with colleagues in Trade Finance, credit etc to structure solutions for clients in all areas. Let your deposits enjoy the possibility of a higher than normal return whilst providing you with capital protection. A high yield deposit is a new and exciting investment opportunity for depositors to earn a higher rate of interest than a traditional time deposit.

High Yield Deposits can pay a higher rate of interest than normal time deposits because you grant the Bank the right but not the obligation to repay your deposit at maturity in a specified alternative currency and at a conversion rate predetermined at the time the deposit is made.

High Yield Deposits are suitable if you wish to obtain a higher interest rate than that of traditional deposits. The extra interest differential acts as a partial buffer against depreciation of your deposit currency. The deposit is particularly suitable if you have intentions to convert your base currency into another currency at an exchange rate conversion rate chosen by you at the maturity of your deposit. They give customers added flexibility when managing foreign exchange risk, whether for hedging, trading or yield-enhancement purposes. The business is customer driven and relies on Financial Markets Sales to sell the products originate the deals.

Trading is conducted to maximize profit from the residual risk. The owner of an FX Option with Fixed Strike pays an upfront premium for the right, without obligation, to exchange a specified amount of one currency for a specified amount of another currency.

Types of Options

Since the owner of an option will not exercise their right to exchange if it results in a loss, the option risk profile has no loss potential and unlimited profit potential. The owner or buyer of the option pays this premium to the writer or seller at trade inception. A European Vanilla Option is the simplest form of currency option. It provides the holder with the right to buy call or sell put a defined currency at a set price on a set date.

The option can only be exercised on the specified exercise date in the option contract. For a bank selling options to customers the profit or loss is the difference between a number of factors which drive the value of the option when compared with the value of the underlying currency spot or forward rate.

Currency Option

For a seller of a European Option there is unlimited downside risk if the spot rate at the date of exercise is above the strike price of the option for a call option or below the strike price for a put option. In theory the maximum payout of a put option that is in-the-money is the total nominal value of the contract because spot cannot get below zero. In reality it will be something less. An American Option has the same features as a European Option but one significant difference. The option can be exercised at any time until maturity if the strike is triggered.

It is then up to the holder of the option call or put to decide if they wish to exercise the option. Once exercised the option payout is exactly the same as a European Option. In theory this poses slightly different risk management issues for the seller of the option because they must be in a position to deliver the full notional value payout at any time during the life of the American option. In reality the way banks manage the risk of having to payout on either a European or American style option is exactly the same and is known as "Delta hedging".

At Standard Chartered Bank Gambia, we share your vision for business growth. That's why, our Business Clients team is committed to supporting you with customised products, sound financial solutions, responsive service and access to expert advice.

PREMIUM SERVICES FOR INVESTORS

Would you like to enjoy potentially higher returns on your business investments? Our Structured Investments can help you realize these goals.

Examples of concerns that can be raised through this website are concerns that relate to accounting, internal accounting controls or auditing matters and concerns relating to bribery or banking and financial crime. Please note that this hyperlink will bring to you to another website on the Internet, which is operated by InTouch, an independent company appointed by the Bank to support its Speaking Up programme.

Please be mindful that when you click on the link and open a new window in your browser, you will be subject to the additional terms of use of the website that you are going to visit.