The market can make steep downward moves. Moderately bearish options traders usually set a target price for the expected decline and utilize bear spreads to reduce cost. This strategy has limited profit potential, but significantly reduces risk when done correctly. The bear call spread and the bear put spread are common examples of moderately bearish strategies. Mildly bearish trading strategies are options strategies that make money as long as the underlying asset does not rise to the strike price by the options expiration date.

An option that you buy to either hedge against or punt on the downside movement is a put.

However, you can add more options to the current position and move to a more advanced position that relies on Time Decay "Theta". These strategies may provide a small upside protection as well. In general, bearish strategies yield profit with less risk of loss. Neutral strategies in options trading are employed when the options trader does not know whether the underlying asset's price will rise or fall.

Also known as non-directional strategies, they are so named because the potential to profit does not depend on whether the underlying price will increase or decrease.

Strategies for New Option Traders

Rather, the correct neutral strategy to employ depends on the expected volatility of the underlying stock price. Neutral trading strategies that are bullish on volatility profit when the underlying stock price experiences big moves upwards or downwards. They include the long straddle , long strangle , long condor Iron Condor , long butterfly, and long Calendar. Neutral trading strategies that are bearish on volatility profit when the underlying stock price experiences little or no movement.

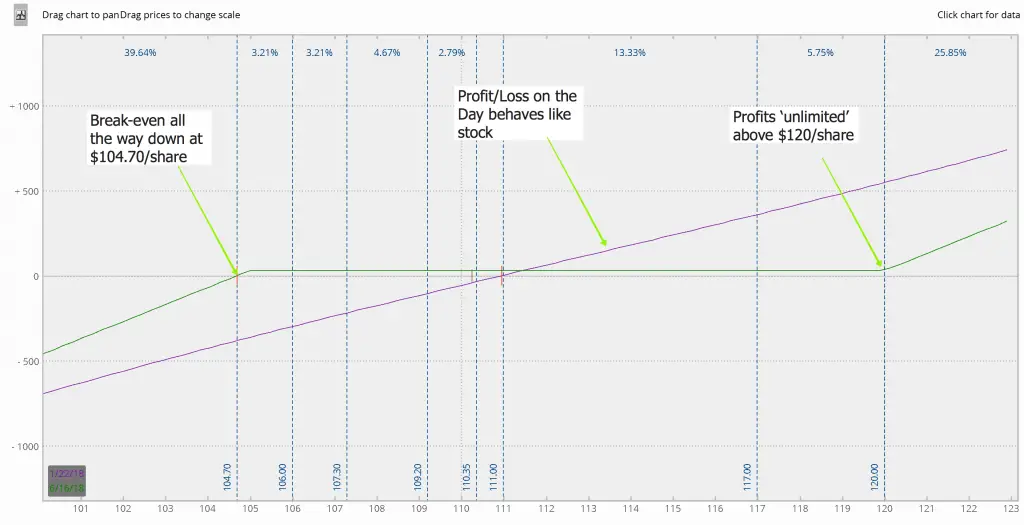

Such strategies include the short straddle , short strangle , ratio spreads , short condor, short butterfly, and short calendar. Following Black-Scholes option pricing model, the option's payoff, delta, and gamma option greeks can be investigated as time progress to maturity:. These are examples of charts that show the profit of the strategy as the price of the underlying varies.

Subscribe To Our Newsletter

From Wikipedia, the free encyclopedia. This article needs additional citations for verification. At the simplest level, options are a low-cost way to take a position if you think a big move is coming. Think banks are in for another round of trouble , but don't want the risk of a big short position?

- 3 Safe Option Strategies better than stock buying.

- A High-Return Low-Risk Strategy?

- management software binary options;

- options trading intrinsic value.

Buying calls lets you get some of that upside without a huge up-front cash commitment. But we're just scratching the surface. How about a low-risk really way to boost the returns from your dividend stocks in times when the market doesn't seem to be going anywhere? Like, say, now? An options strategy for the rest of us, right now We all know that a stock that pays a good solid dividend through good times and bad is a great thing to have.

But stocks like these don't tend to be big growers, which is why I've started using a low-risk options strategy called writing covered calls to boost my returns.

This is a simple strategy that any investor can use, even in an IRA account. The nuts and bolts of covered calls The first step is to choose a suitable stock, a company you like, but not one that's likely to see major growth. This can be a stock that you already own, or you can buy one. You think that while it's unlikely to nosedive, it's not going to go to the moon, either -- that's not why you bought it. The upshot: An incremental advantage As you can see, the biggest risk with a covered call strategy is that you'll miss some of the upside if the stock suddenly takes off.

But you'll still profit -- and if you think a stock is likely to take off, it's not a candidate for this strategy.

Low-risk Options Trading Strategy

Writing covered calls isn't going to make you a fortune overnight. Wouldn't you like to own a stock like that? Stay tuned throughout our Better Investor series and get the advice you need to succeed with your investments. Click back to the series intro for links to the entire series. Investing Use these configurations at Chartink , or at a screener site of your choice. This is how you set up stocks at Investing. Use the following strategy.

- Related Articles.

- Motley Fool Returns;

- What Is the Lowest Risk Options Strategy?.

- What Is the Lowest Risk Options Strategy? - Raging Bull?

This will require you to wait for 15 minutes before trading in options, and it will hold you back from making any rash decision. The spreads will be low and so will your your profits and losses.

Advanced Options Strategies

Just ensure you square up positions at the same time. This is a short post, but there is a lot of reading to do. So go ahead and soak in the knowledge and try it out and do tweet if it works out for you. Good evening sir, Sir thanks a ton for taking out time and sharing your valuable experiences with us. Regards kashi. Which candle is best for intraday trading for indices nifty n bank nifty and option stock.