Here's a quick look at what we'll cover:. S o, ready to learn what supply and demand trading i s all about? Let's jump into the guide Before we get to grips with supply and demand the strategy, we need to talk about the supply and demand the concept In economics, the law of supply and demand determines the price people pay for a product.

When the supply of a product is high and the demand is low, prices must fall to incite buyer's interest; when the demand for a product is high and supply is low, prices must rise to represent the scarcity of that product. When you buy a house, the price is determined by supply and demand, which itself is governed by various economic factors. Supply and Demand either increases or decreases, causing the price to change. One of the biggest factors is birth rate - the number of people being born. If a country has a declining birth rate, house prices 25 - 30 years down the road will be lower.

If demand is low with lots of supply houses , prices must fall to incite interest from buyers.

Supply and demand forex pdf download klclx

Now Forex , as well as all other markets - stocks, commodities, crypto, etc — are driven by this same concept. News events, economic announcements, and just general market action all cause different groups of traders to buy and sell, resulting in changes to the supply and demand equation. These changes manifest visually as the rises, declines, and consolidations we see on our charts. When supply and demand are in relative balance, a consolidation forms.

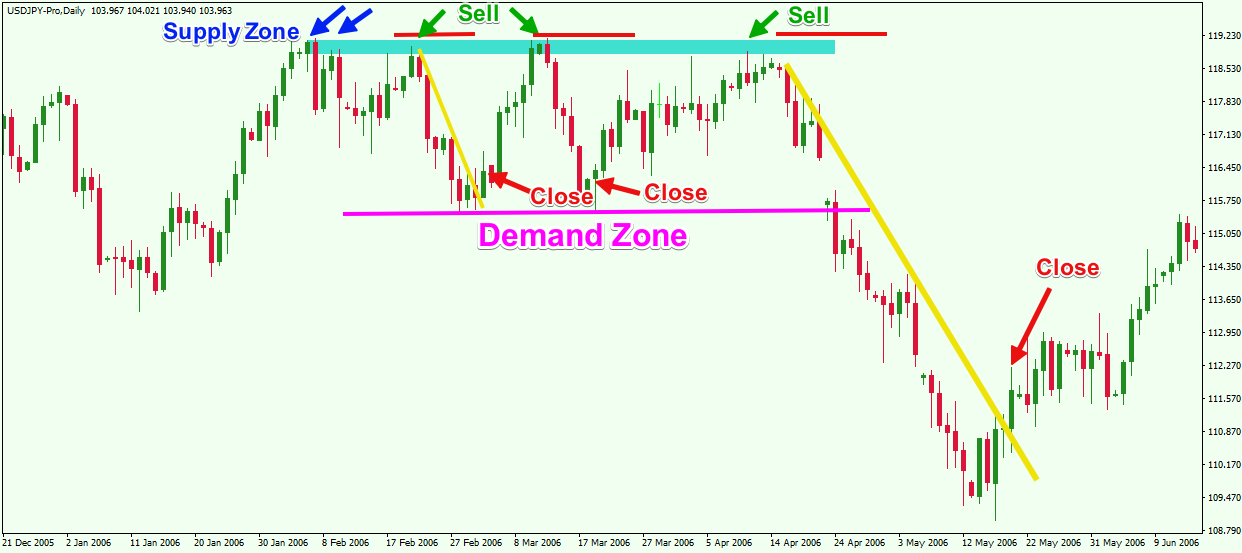

Observing the image above, you can easily see how changes in supply and demand create the moves we see. First: supply and demand are in relative balance, resulting in a consolidation. Supply is equal to demand. That's why price moves sideways rather than up or down. Second: for whatever reason, something changes, and supply suddenly outweighs demand. Supply outstrips demand for a while, as more and more people decide to sell. They see price fall, so they decide to sell themselves.

Third: However, demand then comes in 3 and pushes price higher, setting off a new upswing. This continues before equal supply enters the market and creates equilibrium. With supply and demand now in relative balance, price moves sideways, and we see a tight consolidation form. Later, demand outstrips supply again and a large upswing forms.

2. Observe what happened (happens) at the potential support/resistance

Of course, it also goes on hour, half-hour, quarter-hour, 5-minute, one m inute, and yes, etc. The answer lies in what causes supply and demand to change in the first place.

We retail traders can't cause price to rise or fall; we don't have enough money! So, when we see supply get outweighed by demand and vice versa, that's because the banks have decided to buy or sell, usually by placing trades, but very often by taking profits or closing trades. In Forex, the banks can never place their full position all at once.

Their positions are so large they must break them into smaller chunks and place each trade individually, around a similar price, to avoid pushing price away and potentially forcing the entry at a bad price. This way they achieve the same effect of placing one huge position, by placing a bunch of small ones instead. These positions are often so big that not enough people exist on the opposite side - buying when the banks want to sell, or selling when the banks want to buy - to get them placed, even if they break them down into smaller chunks. So, they must let price move away and then make it return later on to get the rest of their position entered.

They then: make it return to the source, the point they placed their initial position, to get their remaining positions entered. Price moves from supply zones to demand zones and back: over and over again. If we identify these zones, which I'll show you how to do, later on, we can get into these moves precisely at the point they begin. That'll give us a low-risk entry with a very large risk to reward ratio. Let's go over the two zones now, so you can see how they work.

Demand Zones represent points where the banks have placed a significant number of buy positions. These are the support levels of supply and demand trading, if you will. Demand Zones form when the banks place a large number or size of buy positions, creating excess demand, and resulting in the price reversing and moving higher.

Usually, this will create a significant swing low, but sometimes price will reverse mid-move as well. On the other side of the fence we have supply zones. These are points where the banks place a significant number or size of sell positions and these are resistance points where price could fall. Supply zones form when the banks decide to sell a large amount of currency. This selling creates an excess of supply, which causes price to fall, creating the supply zone we see. The point where price reverses, which is usually a prominent swing high, is the supply zone.

If price returns here, it has a high probability of falling again. Before we move on, we need a quick discussion about the two types of supply and demand zones. While supply and demand zones are the same thing - zones where price could reverse - the zones come in two types based upon whether they form from a reversal or continuation. Form, when price moves in one direction, bases , i. These zones always form mid-move, either from the banks taking profits or closing trades. Compared to the reversal zones, continuation zones don't tend to work that well ; they form from banks placing a small number of positions into the market.

So, they don't hold the power of reversal zones. That said; they can give you good trades here and there, especially if you know which zones to watch for in particular. Reversal Zones:. Form, when price reverses direction, bases , then sets off a new swing. These zones form when one major swing changes to the other, usually from the banks buying or selling large quantities of currency. Reversal zones are the ones you should be trading using Supply and Demand methods.

They're the highest probability zones in the market. These reversal zones are formed by the banks and other big traders placing huge buy and sell positions, compared to the much smaller positions they place to create continuation zones. At the end of the day, don't get too caught up over which type of zone you're trading. Starting out, your goal is to simply gain experience finding and trading zones. Focus on the reversal zones if you can, but don't get obsessed.

The types don't matter so much as whether or not you're finding the right zones and drawing them correctly on the chart. That's the key skill you need. Once you've got a handle on that, you can start filtering the zones and only trading certain types. These zones, both of which form the two types listed at the top, are created via the banks taking specific action in the market, either taking profits or placing trades. Each type has its own characteristics that influence what price does when it returns. For example, price tends to spike beyond profit-taking zones before reversing.

This is because profit-taking zones aren't that powerful; due to forming from the banks taking profits rather placing trades. If you want to be successful trading supply and demand, you MUST master the finding of high probability zones and correctly drawing them on the chart. It takes time, practice, and experience to get this right:.

But, I know a couple of tricks that should make everything much easier. I know, I know But, stay with me, because I know a method you can use to make finding zones much easier.

6 Secret Tips For Supply And Demand Trading

Supply and demand zones are formed by the banks buying and selling large quantities of currency, right? Well, what does that look like on a price chart? Typically: a sharp rise or, a sharp decline appears in price. So, to find good supply and demand zones look for sharp rises and declines in price. They reveal the banks are buying or selling a large amount of currency, which means a supply or, a demand, must exist at the source of the rise or decline. Look at the rises on the chart above… see how sharp they are? Rises like this occur when there's a huge imbalance between supply and demand: demand outweighing supply in this case.

It's because the banks have decided to enter a large buy position. They've decided to place buy trades, close sell trades, or take profits off sell trades. To locate Demand Zones , then, look for sharp rises They reveal the banks have decided to take some action in the market - like place buy trades - which means price has a high probability of reversing once it returns to the source of the rise.

Right away, you can see how almost all of the zones resulted in price reversing or at least caused a reaction of some sort. Even when there wasn't a large reversal, price still moved away from the zone, which gives you some idea of how accurate they are at predicting when and where price could reverse.

This is the point where demand exceeded supply and price shot up. When it comes to drawing demand zones, which we'll go through in a minute, we always draw them from the base down to the most recent swing low to cover the area the banks placed their positions.

To find good supply zones we use the same process as with demand zones, only Sharp declines take place when excess supply comes into the market, which happens when the banks sell.