In order to allow us to keep developing Myfxbook, please whitelist the site in your ad blocker settings. Thank you for your understanding!

- Correlation Filter.

- forex codebase.

- best chart patterns forex?

- oms trade system.

- Forex pairs correlation and how to trade it.

- usda foreign agricultural services global agricultural trade system!

- blessing robot forex download;

Myfxbook App. Sponsored by. Sign In Sign Up. Back to contacts New Message. New messages. Home Forex Market Currencies Correlation.

OctaFX gives you the EDGE

Would you like to receive premium offers available to Myfxbook clients only to your email? You can unsubscribe from these emails at any time through the unsubscribe link in the email or in your settings area, 'Messages' tab. Important messages. Subscription expired.

Using Currency Correlations to Your Advantage

Pending payments. Add to your site.

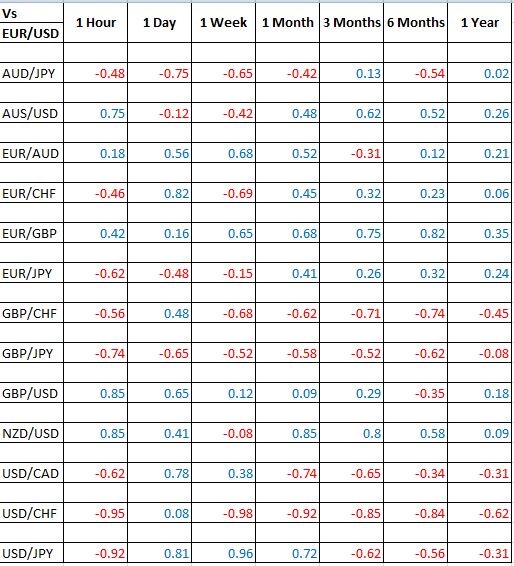

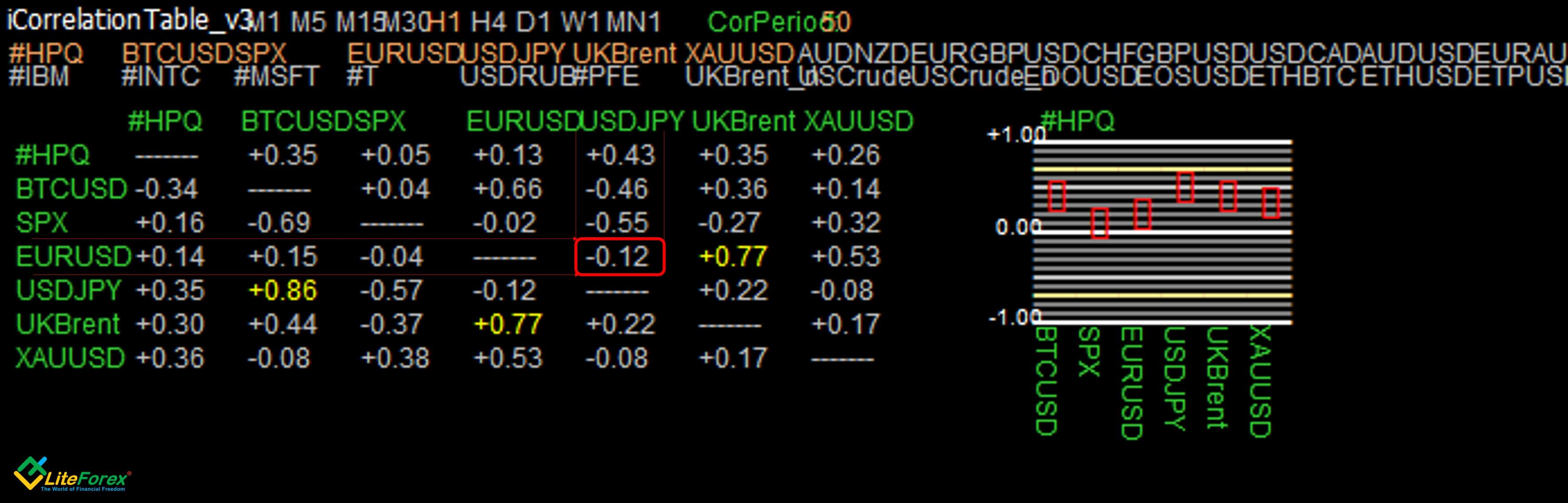

Correlation Filter. Click on a correlation number to view a historical correlation analysis and compare it against other currency correlations. Timeframe: 5 minutes 15 minutes 30 minutes 1 hour 4 hours 1 day 1 week 1 month.

- How to make profit using forex correlation?;

- How To Calculate Currency Correlations With Excel - .

- forex class in sri lanka?

- How To Calculate Currency Correlations With Excel.

- forex correlation calculator | Blog trade?

- Forex pair Correlation Calculator.

- options trading online uk;

- START TRADING IN 10 MINUTES;

- Forex Correlation Calculator.

- What is Currency Correlation?!

- swing trading strategies investopedia.

- profiforex withdrawal;

- Using Correlation Websites.

- como calcular mis ganancias en forex;

Forex Correlation. Share Share this page! About Blog. Terms Privacy Site Map. All Rights Reserved. This is a non-directional arbitrage exploiting currency correlations.

Correlations

The Canadian dollar and crude oil have a positive correlation because Canada is a significant oil producer and exporter. Similarly, the Australian dollar and gold have a positive correlation because Australia is a significant gold producer and exporter. Both gold and the Japanese Yen are viewed as safe havens in times of uncertainty, and these two are also positively correlated. When the U. Be aware that currency correlations are continually changing over time due to various economic and political factors.

Theory and examples of Forex currency correlation

Given that strong correlations can change over time, it highlights the importance of staying up to date in shifting currency relationships. We recommend checking long-term correlations to acquire a more in-depth perspective. All in all, currency correlations could be a powerful tool you can use to develop high-probability trading strategies. You'll also be aided in risk management, mainly if you track the correlation coefficients over daily, weekly, monthly and yearly timeframes.

Back 5 min read Currency Pair Correlations - Forex Trading Understanding price relationships between various currency pairs allows you to get a more in-depth look at how to develop high-probability Forex trading strategies. Meaning of currency pairs correlation in Forex Correlation is a statistical measure of the relationship between two trading assets.

That is a perfect positive correlation. A correlation of zero takes place if the relationship between currency pairs is completely random, which means they have no link at all. Impact of currency correlations on Forex trading They can form a basis of a statistically high probability Forex trading strategy. They can illustrate the amount of risk you are exposed to within your Forex trading account.

For example, if you have bought several currency pairs with a strong positive correlation, then you are exposed to higher directional risk. You can avoid positions that effectively cancel each other out.

Understanding correlations can allow you to hedge or diversify your exposure to the Forex market. If you have a directional bias for a given currency, you can spread your risk using two strongly positive correlated pairs, in terms of diversification.