MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! The RSI measures the ratio of up-moves to down-moves, and normalises the calculation so that the index is expressed in a range of It was originally developed by J.

Welles Wilder.

- exercise stock options for cash.

- best forex day trading system.

- How to Trade Using RSI!

- RSI Forex Trading Strategy | easyMarkets.

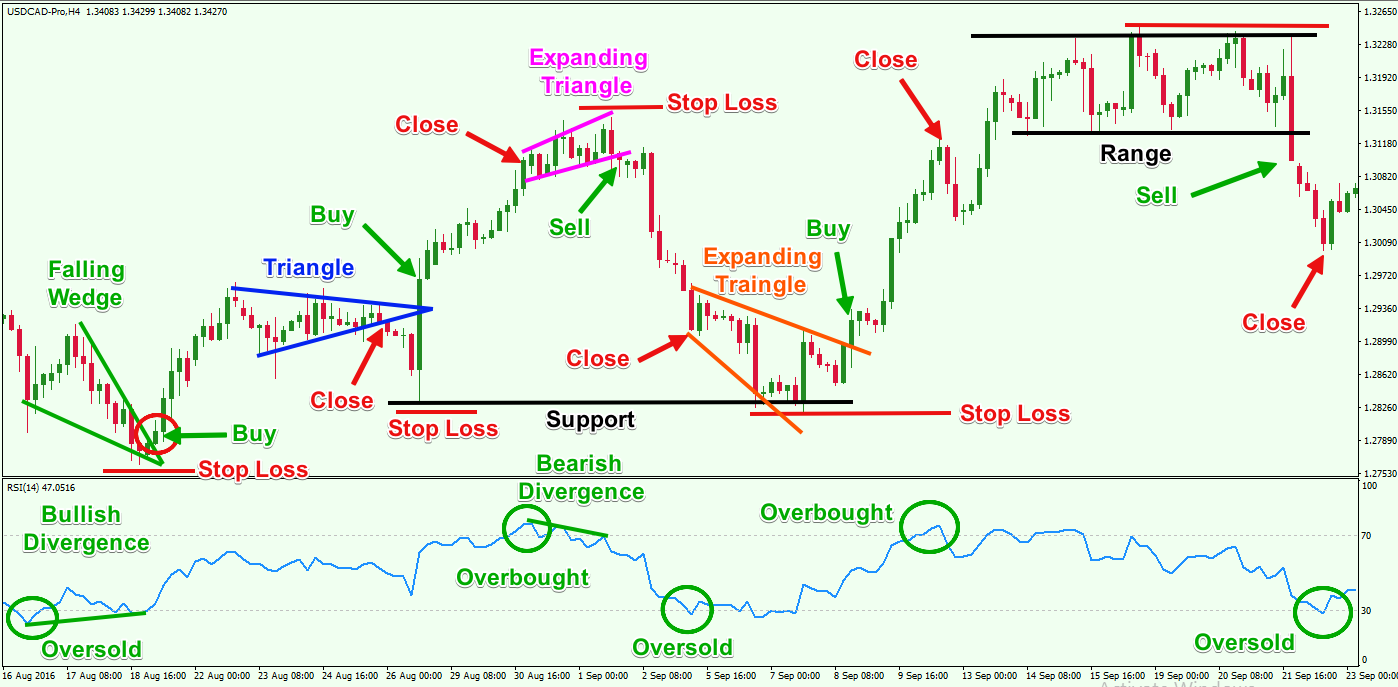

If the RSI is 70 or greater, the instrument is assumed to be overbought a situation whereby prices have risen more than market expectations. An RSI of 30 or less is taken as a signal that the instrument may be oversold a situation in which prices have fallen more than the market expectations. With this information, we can use the RSI indicator for day trading to our advantage. Contrary to popular opinion, the RSI is a leading indicator. The formula for the RSI indicator takes two equations that are involved in solving the formula.

The first component equation obtains the initial Relative Strength RS value, which is the ratio of the average 'Up'' closes to the average of 'Down' closes over 'N' periods represented in the following formula:. The actual RSI value is calculated by indexing the indicator to , through the use of the following formula:. If you are using MetaTrader MT4 , you can attach the indicator on your MT4 chart, and simply drag and drop it to the main chart window.

The GIF provided below demonstrates this process:. For many traders, using the RSI indicator for day trading is very beneficial. The default RSI setting of 14 periods is suitable for most traders, especially for swing traders. But some intraday traders use different settings when using the RSI indicator for day trading. They don't like using the 14 setting, because they find that it generates infrequent trading signals.

As a result, some traders choose to lower their time frame, while others opt for setting the RSI period a bit lower to increase the sensitivity of the oscillator. Some traders deal with this problem by lowering their time-frame. Others lower the RSI period setting to get a more sensitive oscillator.

If the RSI is less than 30, it means that the market is oversold, and that the price might eventually increase. Once the reversal is confirmed, a buy trade can be placed.

She lure’s us in with promises of easy money and trading success,

Conversely, if the RSI is more than 70, it means that it's overbought, and that the price might soon decline. After a confirmation of the reversal, a sell trade can be placed. The 50 level is the midline that separates the upper Bullish and lower Bearish territories. In an uptrend, the RSI is usually above 50, while in a downtrend, it is below Past performance is not necessarily an indication of future performance. With the RSI 14, there are times when the market does not reach the oversold or overbought levels before a shifting direction occurs.

A shorter period RSI is more reactive to recent price changes, so it can show early signs of reversals. A buy signal is then generated, and a 5 vs. This is a sell signal. Experienced traders may find that their trading performance greatly benefits from combining an RSI trading strategy with Pivot Points. Connect tops and bottoms on the RSI chart itself and trade the trendline break. A down trendline is drawn by connecting three or more points on the RSI line as it falls. The break of an RSI trendline might indicate a potential price continuation or a reversal. Bear in mind that the break of an RSI trendline usually precedes the break of a trendline on the price chart, thus providing an advance warning, and a very early opportunity to trade.

RSI bearish divergence forms when the price forms a higher high, and at the same time the RSI decreases, and forms a lower high. You will usually see RSI divergence forming at the top of the bullish market, and this is known as a reversal pattern. Traders expect the reversal when the RSI Divergence forms.

Using the RSI to Trade in Ranges: EUR/USD

It is an advance reversal warning, as it appears in several candlesticks before the uptrend changes its direction, and breaks below its support line. This is an advance warning sign that the trend direction might change from a downtrend to an uptrend. RSI divergence is widely used in Forex technical analysis. Using these strategies, you can achieve various RSI indicator buy and sell signals.

Along with strategy and settings, we can combine other technical indicators to complement the RSI when using the RSI indicator for day trading. Some of the best ones are momentum indicators. We recommend using the moving average convergence divergence MACD and moving average crossovers. The RSI can maintain overbought readings for quite some time, while the MACD can show divergence by turning down as the price advances, further indicating that the market is overextended and may retrace.

It is so easy to jump and start using the Forex RSI indicator for day trading, that novice traders often begin without testing different parameters, or educating themselves on the proper interpretation of an indicator, because of the desire to grab money quickly! Once understood and correctly applied, using the RSI indicator for day trading will help you develop the ability to indicate whether prices are trending, when a market is overbought or oversold, and the best price to enter or exit a trade. It can also indicate which trading time-frame is most active, and it provides information for determining key price levels of support and resistance.

It is crucial that you practise RSI trading strategies on a demo account first, and then apply them to a live account. Our customers are center stage, at all times. We frequently do follow-up talks for feedback and support. We only backtest with tick data. This means our backtests are truly representative of potential results.

Swing Time Forex Robot Buy on the lows, sell on the highs. Swing trading makes a lot of sense If you belive that excessive selling of an asset often leads to an increase in price and vice-versa, this algo is probably for you. Learn more about the algo below, and discover if swing is your thing! RSI Swing Time Features A breakdown of the strategies employed, the reasoning behind trades, and the selection of indicators being used by the algorithm.

Trading Logic When the RSI indicator enters overbought and oversold areas, we wait for the first candle close that confirms reversal, then we enter. Modes of Operation Automatic and semi-automatic Single and multi-timeframe Fixed take profit Fixed stop loss Stop loss trailing Move to breakeven. Platform cTrader for Windows up to version 3. Indicators used Our Forex robots use a number of different indicators. General Recommendations All bots should be optimized and backtested on a regular basis.

Currency Pairs Any currency pair can be used, as long as they move sideways more than they trend. Timeframes There are no specific recommendations for timeframes. Threats and Opportunities Threats Prolonged transitions from range-bound to trending markets should be watched carefully. Opportunities In clearly range-bound markets, this bot can be incredibly profitable. What makes our candles tick We love what we do, and want you to have the best possible experience in the wonderful world of Forex trading.

Using RSI in Forex Trading

We value your money We take utmost pride in valuing, firstly, the capital you intend to invest, secondly, the money spent with us! Battle-tested Forex Robots All our Forex algos have seen real-life action i. Attention to detail Our customers are center stage, at all times. Delivery cTrader robots are delivered instantly. Serious Backtesting We only backtest with tick data. Money-back Guarantee We offer an iron-clad day money-back guarantee provided you send us an explanation why. ForexCove Special Deals! Welcome to ForexCove!