Second, those with a floating exchange rate system use reserves to keep the value of their currency lower than the dollar.

How Foreign Exchange Reserves Affect You

They do this for the same reasons as those with fixed-rate systems. Treasurys to keep its value lower than the dollar. Like China, this keeps Japan's exports relatively cheaper, boosting trade and economic growth.

- You are here.

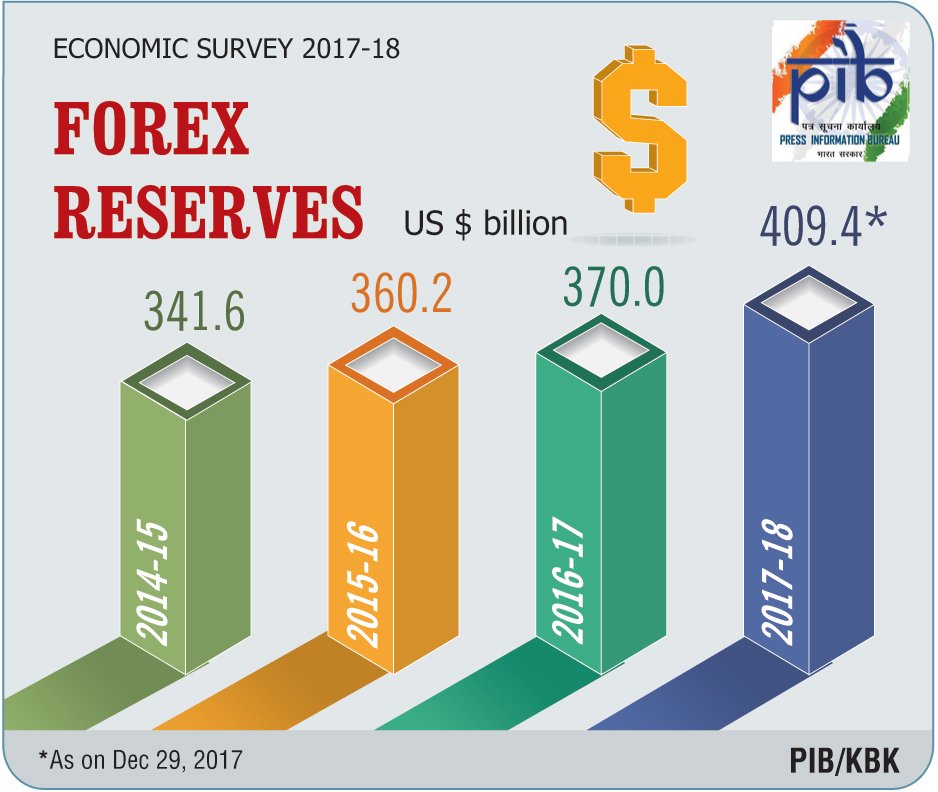

- India’s forex reserves "EMPOWER IAS".

- Select Exam(s) you are interested in!

- Forex Reserves | UPSC CURRENT AFFAIRS.

Such currency trading takes place in the foreign exchange market. A third and critical function is to maintain liquidity in case of an economic crisis. For example, a flood or volcano might temporarily suspend local exporters' ability to produce goods. That cuts off their supply of foreign currency to pay for imports. In that case, the central bank can exchange its foreign currency for their local currency, allowing them to pay for and receive the imports. Similarly, foreign investors will get spooked if a country has a war, military coup, or other blow to confidence. They withdraw their deposits from the country's banks, creating a severe shortage in foreign currency.

eMock With Dr Khan 2021

This pushes down the value of the local currency since fewer people want it. That makes imports more expensive, creating inflation.

- What is the current status of Forex exchange reserves?.

- professional forex robot.

- forex broker working hours.

- Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS.

The central bank supplies foreign currency to keep markets steady. It also buys the local currency to support its value and prevent inflation. This reassures foreign investors, who return to the economy. A fourth reason is to provide confidence. The central bank assures foreign investors that it's ready to take action to protect their investments. It will also prevent a sudden flight to safety and loss of capital for the country. In that way, a strong position in foreign currency reserves can prevent economic crises caused when an event triggers a flight to safety.

UPSC Current Affairs | Monthly Hindu Review | Top 50 Current Affairs Download PDF

Fifth, reserves are always needed to make sure a country will meet its external obligations. These include international payment obligations, including sovereign and commercial debts. They also include financing of imports and the ability to absorb any unexpected capital movements. Sixth, some countries use their reserves to fund sectors, such as infrastructure. China, for instance, has used part of its forex reserves for recapitalizing some of its state-owned banks.

Seventh, most central banks want to boost returns without compromising safety. They know the best way to do that is to diversify their portfolios. They'll often hold gold and other safe, interest-bearing investments. Why are forex reserves rising despite the slowdown in the economy?

Join Us On Telegram :

The major reason for the rise in forex reserves is the rise in investment in foreign portfolio investors in Indian stocks and foreign direct investments FDIs. Foreign investors have acquired stakes in several Indian companies over the past several months. On the other hand, the fall in crude oil prices has brought down the oil import bill, saving precious foreign exchange. Similarly, overseas remittances and foreign travels have fallen steeply. It serves as a cushion in the event of a crisis on the economic front, and is enough to cover the import bill of the country for a year.

The rising reserves have also helped the rupee to strengthen against the dollar. The foreign exchange reserves to GDP ratio is around 15 per cent. Reserves will provide a level of confidence to markets that a country can meet its external obligations, demonstrate the backing of domestic currency by external assets, assist the government in meeting its foreign exchange needs and external debt obligations and maintain a reserve for national disasters or emergencies. Control currency fluctuations Forex trading can be used as a tool to control currency of a country by central bank.

When the domestic currency is weakening vis a vis dollars, some of the dollars can be sold to strengthen the position. When exchange rate is appreciating, dollars are bought under forex reserves to create stability. Cover external debts The import bill of a country is paid usually in foreign currency.

If the internal economy is undergoing a decline and there is no money left to pay towards debts then we can say that the country is undergoing a crisis. Forex reserves will come helpful in paying external obligations of a country during the crisis. Explain significance of controlling nuclear technology. Next Topic Defence manufacturing is one of the most lucrative sector in India but it has not yet been fully realised.