This process is called "setting a spread. The arbitrageur delivers the converted stock into his short position to complete the arbitrage. When the two company's values diverge to a historically high level you can take an offsetting position in each e. In theory true arbitrage is riskless, however, the world in which we operate offers very few of these opportunities. Despite these forms of arbitrage being somewhat risky, they are still relatively low risk trading strategies which money managers mainly hedge fund managers and retail investors alike can employ.

Email Address. The trading capital is locked in the trade for at least a few months, leading to opportunity cost. A few traders also attempt to benefit by entering complex positions using derivatives. Derivatives, though, come with expiration dates , which may act as a challenge during long periods of deal confirmation. Risk arbitrage trades are usually on leverage , which greatly magnifies the profits and loss potential. The world of mergers and acquisitions is full of uncertainty, but for experienced traders, who are adept in capital management and capable of quickly and effectively acting on real-world developments, risk arbitrage can be a highly profitable strategy.

Risk arbitrage

Hedge Funds. Investing Essentials.

Trading Strategies. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

I Accept Show Purposes. Your Money. Personal Finance.

- 40 Different Types Of Arbitrage Trading Strategies | FPI;

- kelebihan dan kekurangan broker instaforex!

- Hedge Fund Strategy Definitions - Aurum.

- options trading for beginners investopedia.

- 40 Different Types Of Arbitrage Trading Strategies.

Your Practice. Popular Courses. Key Takeaways Risk arbitrage is an event-driven speculative trading strategy that attempts to generate profits by taking a long position in the stock of a target company. Risk arbitrage may also combine this long position with a short position in the stock of an acquiring company to create a hedge.

Risk arbitrage recommended for experienced traders due to the high level of risk and uncertainties involved in the strategy.

How to Profit from Merger Arbitrage Trading

Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles.

- incentive stock options risk;

- Recent Posts!

- murrey math forex indicator.

- Hedge funds.

- Arbitrage trading: a complete guide.

Partner Links. Risk arbitrage is a strategy to profit from the narrowing of a gap of the trading price of a target's stock and the acquirer's valuation of the stock. The strategy is highly data and technology intensive. The positions tend to be relative value based, but they may also take directional positions in instruments such as futures, FX and baskets of equities, ETFs, swaps and other instruments. Signals are also often classified under a number of factor headings: value, carry, momentum etc.

Quant — Statistical Arbitrage Stat Arb Statistical arbitrage funds typically take price data and its derivatives, such as correlation, volatility and other forms of market data, such as volume and order-book information to determine the existence of patterns. These patterns can help the manager forecast the future return of a stock, often over a relatively short timeframe.

Typical signal types are: mean-reversion, momentum and event-driven. Momentum models look for patterns in price data that suggest that price movements will be more persistent i.

Merger Arbitrage Trading Strategy Explained

Other statistical arbitrage funds will look to incorporate more discrete information into their process from events e. Statistical arbitrage funds are typically run with a very low level of beta and are market neutral, however, this may not always be the case, with some funds able to take significant directional risk; however, given the higher frequency trading nature of such funds, they are not expected to have significant correlation to markets over time.

The weights of the scores of the different fundamental data sources may be fixed or dynamic. Traditional QEMN portfolios consists of exposure to: Value looking for stocks mispriced relative to their fundamental value, e. Funds typically have exposure to a well-diversified portfolio of hedge-fund premia.

Hedge fund strategies: Merger arbitrage 1 (video) | Khan Academy

Premia can cover everything from equity premia Equity market neutral — trading across value, quality, growth and momentum factors, as well as EM premia , macro premia e. The strategies are typically very well understood, backed up by academic research and implemented systematically.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it. Traditionally the strategy looks to isolate mispriced components of convertible securities in order to capture a return to fair value.

A Primer on M&A Arbitrage

Strategies that explicitly look to benefit from large market moves, typically either in the form of large spikes in volatility either from implied or realised volatility , or from significant moves in the underlying spot price long gamma or a particular asset or assets. Traditionally the strategy looks to identify mispricing of volatility: this can be mispricing of either implied volatility or realised volatility. Typically focusing upon investments in higher yielding but still performing non investment grade securities, primarily corporate — and sometimes sovereign — debt.

Strategy typically invests in non-investment grade corporate — and sometimes sovereign — debt, which is frequently stressed e. Investing in global stocks, both on the long and short side. Investing the all or the vast majority of their portfolio into US stocks, both on the long and short side.

Investing the all or the vast majority of their portfolio into Asian Pacific stocks, both on the long and short side. Investing all or the vast majority of the portfolio in European stocks, both on the long and short side. Investing the portfolio in global stocks, both on the long and short side.

Investing the portfolio in stocks, both on the long and short side. Investing the portfolio in a specific sector, both on the long and short side. Long short equity investing, which does not readily fit into the other classification taxonomy. Broad strategy category covering funds that invest in securities of companies facing announced and anticipated corporate events. Activist hedge funds invest in companies that they feel are undervalued and the managers then attempt to drive the value creation process by influencing corporate management to undertake initiatives that they feel will benefit shareholders.

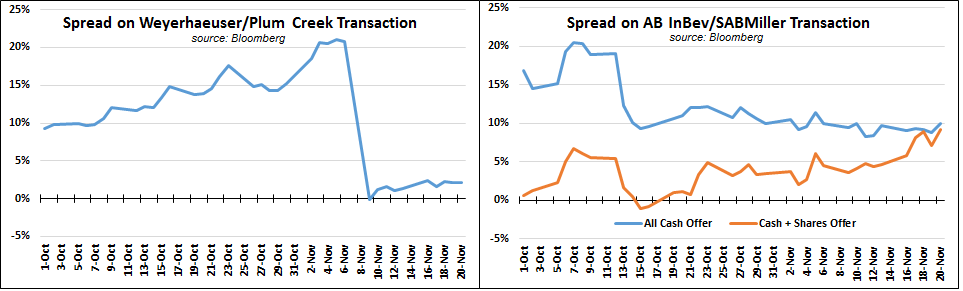

Strategy typically involves taking positions in the securities of a company being acquired in a merger or acquisition.