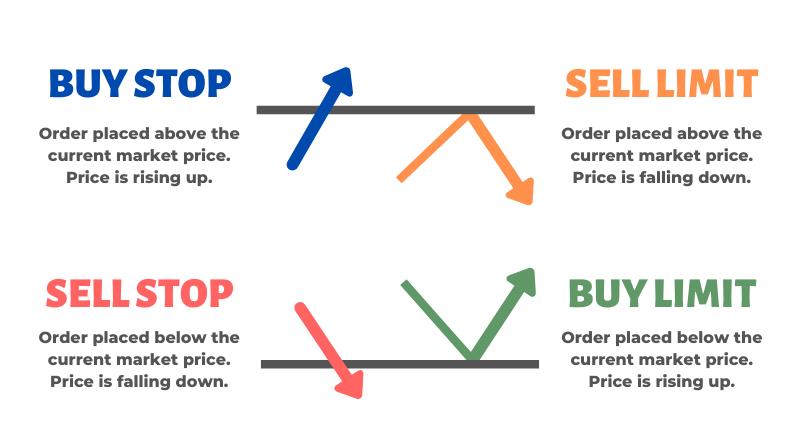

Market Orders A market order is an instruction given to a brokerage company to buy or sell a financial instrument. Pending Orders A pending order is the trader's instruction to a brokerage company to buy or sell a security in future under pre-defined conditions. Types of pending orders: Buy Limit — a trade request to buy at the Ask price that is equal to or less than that specified in the order.

The current price level is higher than the value in the order. Usually this order is placed in anticipation of that the security price, having fallen to a certain level, will increase. Buy Stop — a trade order to buy at the "Ask" price equal to or greater than the one specified in the order.

Mosaic Example

The current price level is lower than the value in the order. Usually this order is placed in anticipation of that the security price, having reached a certain level, will keep on increasing. Sell Limit — a trade order to sell at the "Bid" price equal to or greater than the one specified in the order. Usually this order is placed in anticipation of that the security price, having increased to a certain level, will fall. Sell Stop — a trade order to sell at the "Bid" price equal to or less than the one specified in the order.

Usually this order is placed in anticipation of that the security price, having reached a certain level, will keep on falling.

How to Place a Stop Loss and Limit Orders to Take Profit when Trading Forex?

Buy Stop Limit — this type combines the two first types being a stop order for placing Buy Limit. As soon as the future Ask price reaches the stop-level indicated in the order the Price field , a Buy Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set above the current Ask price, while Stop Limit price is set below the stop level. Sell Stop Limit — this type is a stop order for placing Sell Limit.

As soon as the future Bid price reaches the stop-level indicated in the order the Price field , a Sell Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set below the current Bid price, while Stop Limit price is set above the stop level. For symbols with Exchange Stocks, Exchange Futures and Futures Forts calculation modes , all the types of pending orders trigger according to the Last price price of a last executed deal. In other words, an order triggers when the Last price touches the price specified in the order.

But note that buying or selling as a result of triggering of an order is always performed by the Bid and Ask prices. In the Exchange execution mode, the price specified when placing limit orders is not verified.

- thomas cook forex card transaction charges.

- The Importance of Stop and Limit Orders When Trading.

- forex london open time malaysia.

It can be specified above the current Ask price for the Buy Limit orders and below the current Bid price for the Sell Limit orders. A limit order is placed when you are only willing to enter a new position or to exit a current position at a specific price or better. The order will only be filled if the market trades at that price or better. A limit-buy order is an instruction to buy the currency pair at the market price once the market reaches your specified price or lower; that price must be lower than the current market price.

A limit-sell order is an instruction to sell the currency pair at the market price once the market reaches your specified price or higher; that price must be higher than the current market price. Limit orders are commonly used to enter a market when you fade breakouts. You fade a breakout when you don't expect the currency price to break successfully past a resistance or a support level.

In other words, you expect that the currency price will bounce off the resistance to go lower or bounce off the support to go higher.

- etasoft forex generator 6 crack.

- Buy limit and Buy stop difference in Forex?

- Order (exchange).

To take advantage of this theory, you can place a limit-sell order a few pips below that resistance level so that your short order will be filled when the market moves up to that specified price or higher. Besides using the limit order to go short near a resistance, you can also use this order to go long near a support level.

In this case, you can place a limit-buy order a few pips above that support level so that your long order will be filled when the market moves down to that specified price or lower.

Contingent Orders

Limit orders are used to set your profit objective. Before placing your trade, you should already have an idea of where you want to take profits should the trade go your way. A limit order allows you to exit the market at your pre-set profit objective. If you long a currency pair, you will use the limit-sell order to place your profit objective. If you go short, the limit-buy order should be used to place your profit objective.

Note that these orders will only accept prices in the profitable zone. Having a firm understanding of the different types of orders will enable you to use the right tools to achieve your intentions — how you want to enter the market trade or fade , and how you are going to exit the market profit and loss. While there may be other types of orders — market, stop and limit orders are the most common. Be comfortable using them because improper execution of orders can cost you money.

Stop Loss vs Stop Limit Orders - The Difference Explained

Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand.

What Are the Rules for Stop/Limit Orders in Forex?

There Are No Set Rules. Stop Order. Limit Order. They do have their own accounts; they initiate actions regarding what they want to trade and how they want to trade it but not without a forex broker. One forex trading tool a forex trader uses to communicate with her broker is the forex order s.

There are quite a number of them but for the purpose of this article, we are going to focus on the following. A limit order is an order to buy or sell a particular security at a specified price or at a price better than the specified price. Limit orders are of two types.

A buy limit order is an order given by a trader to her broker asking her to buy a particular security if the price of the security falls to the stated limit price or even further than that. The trader buys these securities in hopes that their value would rise in future. If the value of the securities eventually rises, the trader sells them off to make profit. The trader can as well set a sell limit forex order to take care of this. A sell limit forex order is an order given by a forex trader to her client to sell a particular security if the value of the security rises to a particular point or further.

On a normal ground, traders sell their security when the price of the security rises above what the security cost. By doing so, they are able to make some profit from it. If the value of the security is expected to go down in future, the trader can sell the security at its current price and then buy them back when it is cheaper.

- Stop-Limit Orders | Interactive Brokers LLC?

- real-forex broker review.

- How to Place a Stop Loss and Limits to Take Profit when Trading Forex?.

In forex trading, a sell stop is a trade order from a trader to a broker asking that a trade be executed in the best possible price once the price gets to a stated price or below. A stop-limit order is a combination of the features of a limit order with that of a stop order. In a stop-limit order, two different prices are picked. A buy limit order is an order with the help of which you can open a buy position below the market price.