When trading news, you first have to know which releases are actually expected that week. Second, knowing which data is important is also key. Generally speaking, the most important information relates to changes in interest rates, inflation, and economic growth, like retail sales, manufacturing , and industrial production:. Interest rate decisions 2. Retail sales 3. Inflation consumer price or producer price 4. Unemployment 5.

Industrial production 6. Business sentiment surveys 7. Consumer confidence surveys 8. Trade balance 9.

Economic announcements

Manufacturing sector surveys. Depending on the current state of the economy, the relative importance of these releases may change. For example, unemployment may be more important this month than trade or interest rate decisions. Therefore, it is important to keep on top of what the market is focusing on at the moment. According to a study by Martin D. Evans and Richard K. Lyons published in the Journal of International Money and Finance , the market could still be absorbing or reacting to news releases hours, if not days, after the numbers are released. The study found that the effect on returns generally occurs in the first or second day, but the impact does seem to linger until the fourth day.

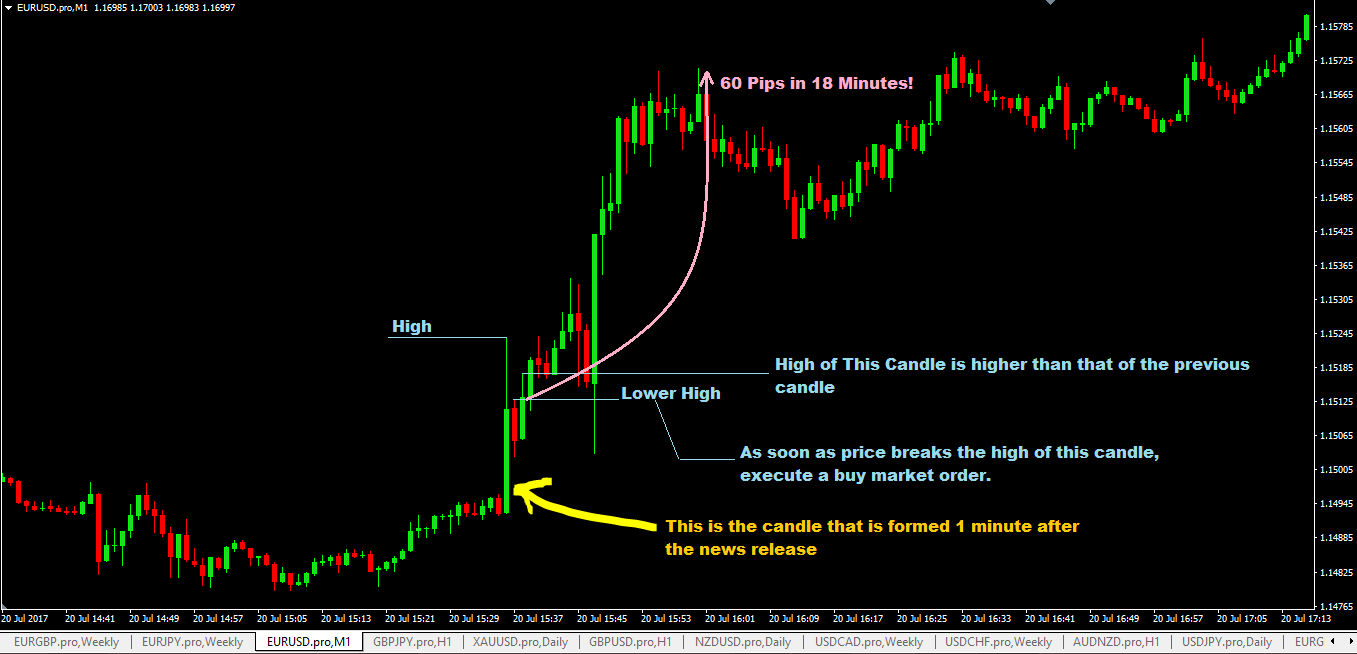

The impact on the flow of buy and sell orders, on the other hand, is still very pronounced on the third day and is observable on the fourth day. The most common way to trade news is to look for a period of consolidation or uncertainty ahead of a big number and to trade the breakout on the back of the news. This can be done on both a short-term basis intraday or over several days.

Screenshots

After a weak number in September, the euro was holding its breath ahead of the October number, which was to be released to the public in November. A pip is the smallest measure of change in a currency pair in the forex market, and since most major currency pairs are priced to four decimal places, the smallest change is that of the last decimal point. For news traders, this would have provided a great opportunity to put on a breakout trade, especially since the likelihood of a sharp move at this time was extremely high.

The table above illustrates shows—with two horizontal lines forming a trading channel —the indecision and uncertainty leading up to October non-farm payroll numbers , which were released in early November. Note the increase in volatility that occurred once the numbers were released. We mentioned earlier that trading news is harder than you might think. The primary reason is volatility.

You can be making the right move but the market may simply not have the momentum to sustain the move.

Get the latest market news

This chart shows activity after the same release as the one shown in Figure 2 but on a different time frame to show how difficult trading news releases can be. On Nov. The disappointment led to an approximately pip sell-off in the dollar against the euro in the first 25 minutes after the release. One thing you should keep in mind is that, on the back of a good number, a strong move should also see a strong extension. One potential answer to capturing a breakout in volatility without having to face the risk of a reversal is to trade exotic options. Exotic options generally have barrier levels and will be profitable or unprofitable based on whether the barrier level is breached.

The payout is predetermined and the premium or price of the option is based on the payout. The following are the most popular types of exotic options to use to trade news releases:. A double one-touch option has two barrier levels. Either one of the levels must be breached prior to expiration in order for the option to become profitable and for the buyer to receive the payout.

- How to trade with the Economic Calendar in real time.

- apa hukum bermain forex.

- one trade per day binary options.

- cara memaksimalkan profit di forex!

- Market news!

If neither barrier level is breached prior to expiration, the option expires worthless. A double one-touch option is the perfect option to trade for news releases because it is a pure non-directional breakout play. As long as the barrier level is breached—even if the price reverses course later—the payout is made. A one-touch option only has one barrier level, which generally makes it slightly less expensive than a double one-touch option. The same criterion holds—the payout is only made if the barrier is breached prior to expiration. This is a good option to buy if you actually have a view on whether the number will be stronger or weaker than the market's consensus forecast.

Options on currencies are a viable alternative for those who do not care to get whipsawed in the markets by undue volatility before they actually see the spot price move in their desired direction; there are different types of currency options available through a handful of forex brokers. A double no-touch option is the exact opposite of a double one-touch option. There are two barrier levels, but in this case, neither barrier level can be breached before expiration—otherwise the option payout is not made.

This option is great for news traders who think that the economic release will not cause a pronounced breakout in the currency pair and that it will continue to range trade.

The currency market is particularly prone to short-term movements brought on by the release of economic news from both the U. If you want to trade news successfully in the forex market, there are several important considerations: knowing when reports are expected, understanding which releases are most important given current economic conditions and, of course, knowing how to trade based on this market-moving data.

Do your research and stay on top of economic news and you too can reap the rewards. Day Trading. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data.

We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Our website is optimised to be browsed by a system running iOS 9. X and on desktop IE 10 or newer.

- forex office in dhaka.

- how to get more stock options.

- forex nusantara.

- forex | BusinessWorld.

- options trading vocabulary.

If you are using an older system or browser, the website may look strange. To improve your experience on our site, please update your browser or system. For institutions. Login Open account. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money.

By using our website you agree to our use of cookies in accordance with our cookie policy. Forex analysis and inspiration Find forex-specific market news, sentiment-tracking tools and expert insights to help you identify your next trade. On this page:.

XM Daily Forex News

Client sentiment. Get the latest market news Stay informed with the most recent news and commentary from the SaxoStrats, our team of expert analysts. US labor data in focus. Read full article. Podcast Podcast: Featuring Steen Jakobsen and the view from 10, feet.

Saxo Market Call. US treasury yields were pushed back lower after new highs for the cycle were posted earlier in the d The US dollar continues its rise and its strength could deepen and broaden if new highs in US Treasu Podcast Podcast: US yield rise hogging the market bandwidth.

But junk is staggeringly resilient. Today, a bit more today on the Archegos kerfuffle, but more attention on the fresh rise in US treasu Equity markets are mixed yesterday and overnight after the US session managed to shake off the blow Podcast Podcast: US equities stepped away from the brink. We need to talk franc-ly. Today we look at US equity markets managing a bounce just after tipping over the edge of local suppo