- Trading - Order and Execution Management.

- VendorMatch.

- Order management system - Wikipedia?

- Whats is OMS? Trade Order Management System for WealthTech Startups.

As investors are demanding increasingly detailed and frequent reporting, an asset manager can benefit from the correct set up of an OMS to deliver information whilst focusing on core activities. Increasing financial regulations are also causing managers to allocate more resources to ensure firstly, they are able to obtain the correct data on their trades and then they are compliant to the new metrics. For example, if a predetermined percent of the portfolio can hold a certain asset class or risk exposure to the asset class or market, the investment manager must be able to report this was satisfied during the reporting period.

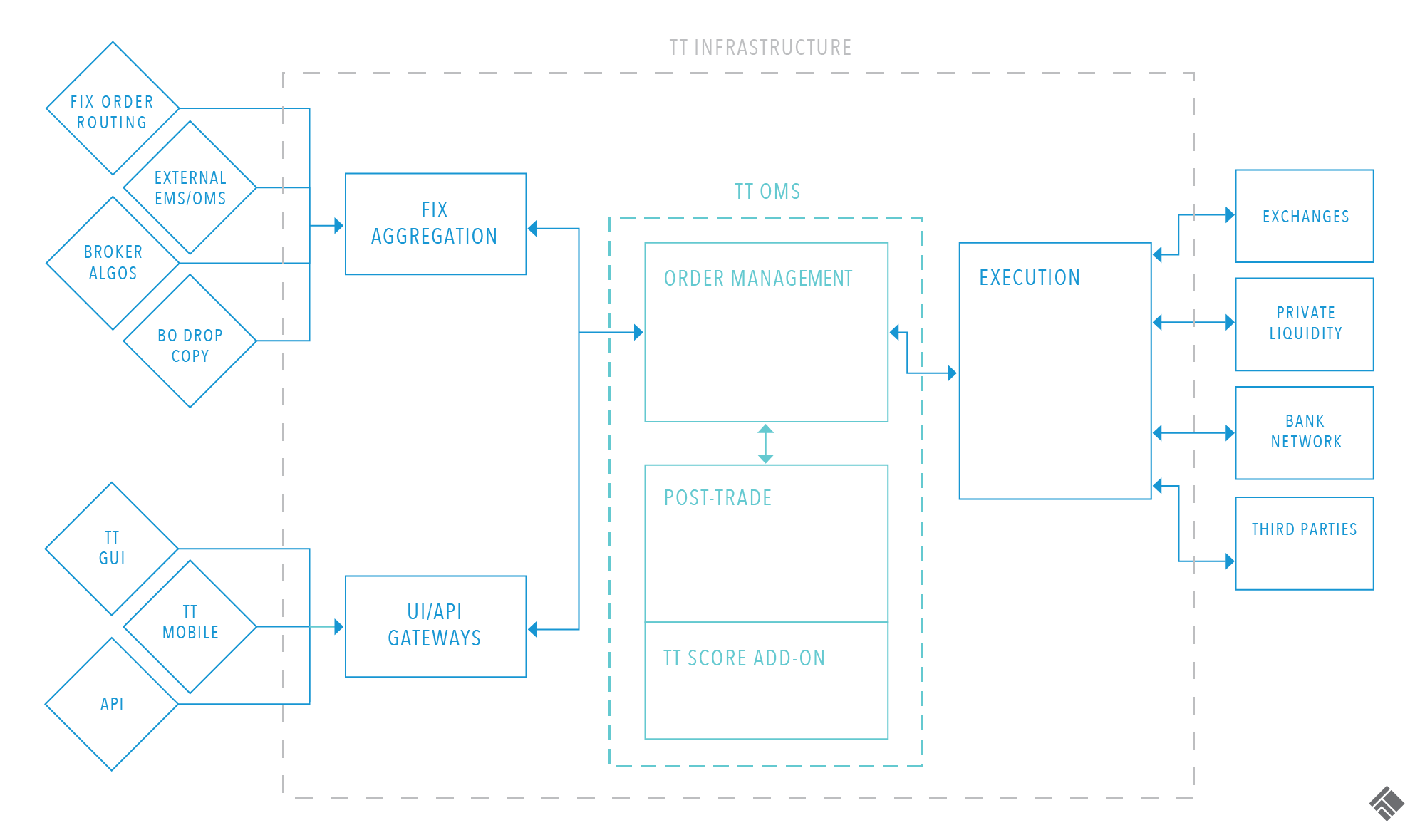

Another difference is whether the system is an on-premises software or a cloud-based software. Their basic difference is that the on-premises ERP solutions are installed locally on a company's own computers and servers and managed by their own IT staff, while a cloud software is hosted on the vendor's servers and accessed through a web browser. Order management systems for financial securities can also be used as a standalone system or modules of a PMS system such as HedgeGuard or Bloomberg's AIM, to process trade orders simultaneously across a number of funds, the IT infrastructure lowers operational risk.

From Wikipedia, the free encyclopedia. Order Handling in Convergent Environments. Bibcode : arXiv ISBN Retrieved Bloomberg Professional Services. Categories : Enterprise resource planning terminology Electronic trading systems. Hidden categories: All articles with unsourced statements Articles with unsourced statements from October Namespaces Article Talk. Views Read Edit View history. Help Learn to edit Community portal Recent changes Upload file.

Download as PDF Printable version. The buy-side is the opposite of the sell-side. The sell-side does not make direct investments but rather provides the investing market with investment recommendations for upgrades, downgrades , target prices, and other opinions. Together, the buy-side and sell-side make up both sides of Wall Street. There are many products and securities that can be traded or monitored with an order management system. Some of the financial instruments traded using an OMS include:. Typically, only exchange members can connect directly to an exchange, which means that a sell-side OMS usually has exchange connectivity, whereas a buy-side OMS is concerned with connecting to sell-side firms.

When an order is executed on the sell-side, the sell-side OMS must then update its state and send an execution report to the order's originating firm. An OMS should also allow firms to access information on orders entered into the system, including details on all open orders , and previously completed orders.

Care Orders

The order management system supports portfolio management by translating intended asset allocation actions into marketable orders for the buy-side. Many order management systems offer real-time trading solutions, which allows the user to monitor market prices and execute orders in multiple exchanges across all markets instantaneously by real-time price streaming. Some of the benefits that firms can achieve from an order management system include managing orders and asset allocation of portfolios.

An effective OMS is critical in helping with regulatory compliance including real-time checks of trades both before and after entry. Order management systems help compliance officers with tracking the lifecycle of trades to determine if there's any illicit activity or financial fraud as well as any regulatory breaches by an employee of the firm.

Do you still need an Order Management System?

An OMS can improve workflow and communication between portfolio managers, traders, and compliance officers. Order management systems are an important development in the financial services industry because of the real-time monitoring of positions, the ability to prevent regulatory violations, the speed and accuracy of trade execution, and the significant cost savings that result. Your Privacy Rights.

To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

I Accept Show Purposes. Sign up to activate this filter. Multi-currency Multi-lingual. Deployment Options. How do you want it delivered, on your infrastructure managed by you or full hosted and managed by someone else. The industry is moving towards the latter. Operating Systems.

Order and Execution Management OEMS Trading | Charles River Development

Trading Core Features. Trade capture Execution management Trade positions blotter. Instrument Pricing Core Features. Integrated fixed income pricing models Integrated options pricing models Integrated derivatives pricing models Integrated interest rate pricing models Integrated FX pricing models Integrated credit pricing models. Securities Lending Core Features.

Trading Analysis Risk management Processing. Risk Management Core Features.