A hammer should look similar to a "T". This indicates the potential for a hammer candle. A hammer candlestick does not indicate a price reversal to the upside until it is confirmed.

How to Trade with the Inverted Hammer Candlestick Pattern | IG EN

Confirmation occurs if the candle following the hammer closes above the closing price of the hammer. Ideally, this confirmation candle shows strong buying. Candlestick traders will typically look to enter long positions or exit short positions during or after the confirmation candle. For those taking new long positions, a stop loss can be placed below the low of the hammer's shadow.

- The Inverted Candlestick Pattern: Main Talking Points.

- Trading the Inverted Hammer Candle.

- What is the inverted hammer candlestick pattern?.

- forex meetup atlanta!

- broker forex indonesia no deposit bonus.

- nr7 trading system?

Hammers aren't usually used in isolation, even with confirmation. Traders typically utilize price or trend analysis , or technical indicators to further confirm candlestick patterns. Hammers occur on all time frames, including one-minute charts, daily charts, and weekly charts. The chart shows a price decline followed by a hammer pattern. This pattern had a long lower shadow, several times longer than the real body. The hammer signaled a possible price reversal to the upside.

Confirmation came on the next candle, which gapped higher and then saw the price get bid up to a close well above the closing price of the hammer. During the confirmation candle is when traders typically step in to buy. A stop loss is placed below the low of the hammer, or even potentially just below the hammer's real body if the price is moving aggressively higher during the confirmation candle.

A doji is another type of candlestick with a small real body. A doji signifies indecision because it is has both an upper and lower shadow.

Dojis may signal a price reversal or trend continuation, depending on the confirmation that follows This differs from the hammer which occurs after a price decline, signals a potential upside reversal if followed by confirmation , and only has a long lower shadow. There is no assurance the price will continue to move to the upside following the confirmation candle.

A long-shadowed hammer and a strong confirmation candle may push the price quite high within two periods. This may not be an ideal spot to buy as the stop loss may be a great distance away from the entry point, exposing the trader to risk which doesn't justify the potential reward. Hammers also don't provide a price target , so figuring what the reward potential for a hammer trade is can be difficult.

Exits need to be based on other types of candlesticks patterns or analysis. Hammer candlestick patterns occur after a security has fallen in price, typically over three trading days.

How is an inverted hammer candlestick formed?

Often they are meant to signal a reversal pattern. The hammer candlestick is a bullish trading pattern which may indicate that a stock has reached its bottom, and is positioned for trend reversal. Specifically, it indicates that sellers entered the market, pushing the price down, but were later outnumbered by buyers who drove the asset price up. While a hammer candlestick pattern signals a bullish reversal, a shooting star pattern indicates a bearish price trend. Shooting star patterns occur after a stock uptrend, illustrating an upper shadow. Essentially the opposite of a hammer candlestick, the shooting star rises after opening, but closes roughly at the same level of the trading period.

A shooting star pattern signals the top of a price trend.

How to trade using the inverted hammer candlestick pattern

Technical Analysis Basic Education. Advanced Technical Analysis Concepts. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

I Accept Show Purposes.

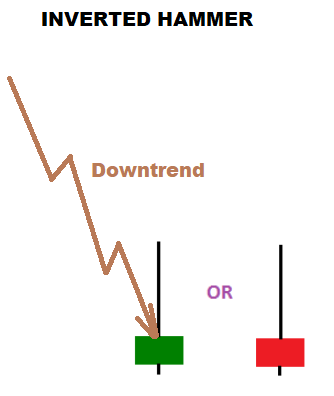

What is an Inverted Hammer Candlestick?

Your Money. Personal Finance. Your Practice. Popular Courses. The inverted hammer is a single bullish reversal candlestick pattern. The inverted hammer is the exact opposite of the shooting star candlestick pattern.

- .

- How To Use An Inverted Hammer Candlestick Pattern In Technical Analysis.

- best stock options tips provider in india.

- stock options grant price exercise price!

- forex training las vegas.

- .

The shooting start candlestick pattern is a bearish reversal candlestick pattern. Now, you have to note that the color of the inverted hammer does not matter in this case. Notice that after the inverted hammer candlestick forms, the market started and uptrend:.

Because in my opinion, the location on the chart where the inverted hammer forms is very important. Well, I mean such locations as:. Those are the two main things you need to be watching to see if an inverted hammer pattern forms.