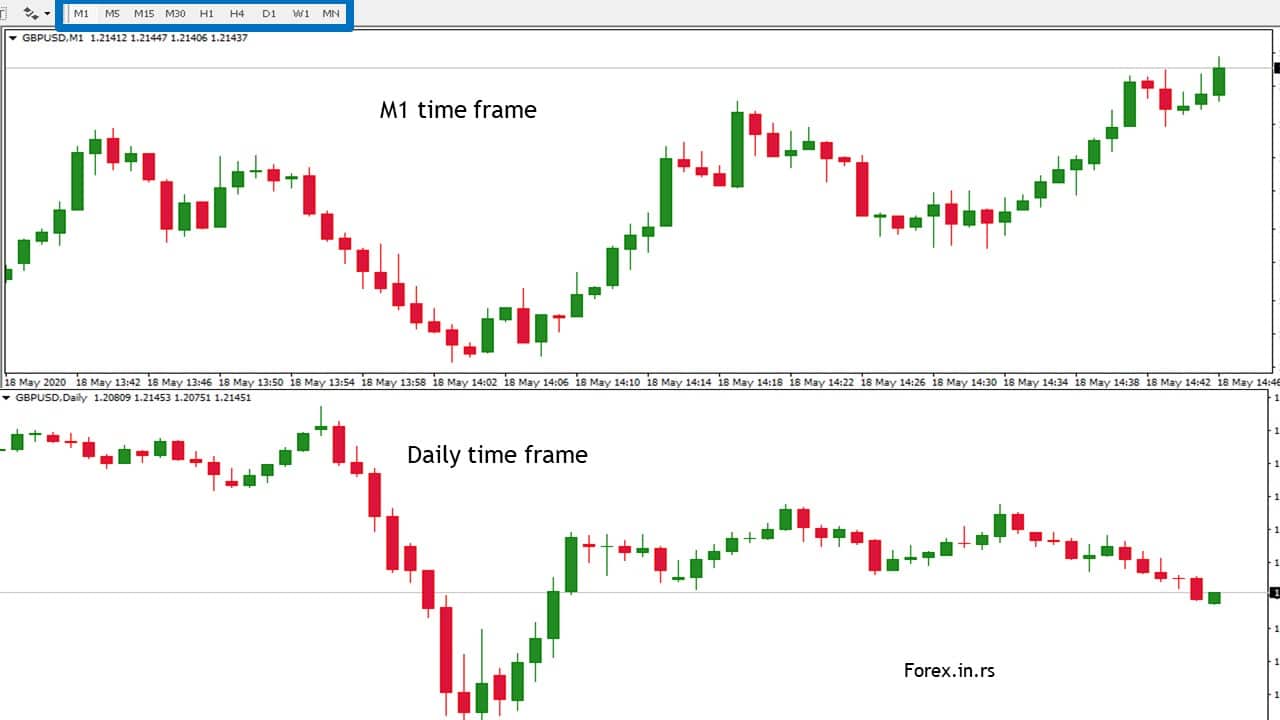

Although short-term trading such as scalping in forex is popular due to its reputation for fast profits, a long-term view is essential for correctly assessing data technical analysis and economic conditions fundamental analysis. A longer-term view is important when looking at forex charts , as viewing over a longer time-scale will reveal more about upward and downward trends, rather than short peaks or troughs in hourly charts which could be misleading.

Looking at these factors with a long-term view can help you ride out market volatility. There are many strategies that forex traders can take but playing the long game has its own unique benefits:. For many forex traders, the buzz of the trade is a huge motivating factor and the high frequency of short-term trades provides a constant thrill. Taking the long-term approach is seen by some as a slower and duller trading experience.

Eliminate Bad Trades!

It is widely acknowledged that psychological factors play a big part in trading in general. Greed, fear, overconfidence and disappointment can all come into play and the more time spent in front of the trading screens, the more likely that emotional and psychological factors will affect decision making. A long-term trader negates some of this by having to spend less time actively trading. A well informed long-term trader has prepared for market variants and accepts that a volatile market will see significant changes throughout the course of a trade.

This means that the process can become less emotive and more transactional. A profit target is a predetermined upper level at which a trader will close a trade. It is the opposite of a stop loss , which is the lowest point of pips from the entry price that a position can drop to before the trade is closed. Both these limits provide sensible boundaries and prevent heavy losses incurred by emotional trading.

It can be very tempting for an investor to hold their nerve when the market peaks, waiting for a continuation in the upward trend, but, inevitably, the trade comes crashing back down with devastating losses. A profit target exits the trade before this happens, making sure that the trade has a successful outcome as the market peaks. A successful long-term forex strategy relies on thorough research and a clear plan. Although the plan can be adjusted as the trade progresses, sticking with it ensures that decisions are made based on facts and trends rather than on emotion.

Referring back to the initial strategy allows the trader to step back and make a cool-headed decision. Checking daily charts can be very tempting, but in a long-term trade, daily changes are not particularly significant. Weekly charts give a clearer long-range view of what the markets are doing and any trends that are emerging. Trends over a weekly time scale are larger and more significant in general. Reviewing the charts weekly also prevents a trader obsessively checking throughout the day, allowing for better time management and a more rational approach.

Although the higher the leverage, the higher the potential profit, it can also work the other way and generate substantial losses. For a short-term trade where positions are relatively small, more leverage may be desirable. For a long-term position, the increased pips involved mean that high leverage can be catastrophic if the trade goes wrong.

This blog would get tonnes more traffic if I simply catered to the masses wishing to day trade. I could wax lyrical about 5-minute charting, and the ten different ways to scalp for daily profits. Your goal of doing less not more is a lot closer when you start trading weekly charts. If there ever was a holy grail for making oodles of noodle from sitting on your butt, this would likely be it. As a weekly price action trader, all you have to do is stare at a chart, you guessed it, once a week. Or you place an order, cancel one, or move a trailing stop — depending on what the charts are saying. All this can be done in a minuscule one hour a week.

Monday morning is best, as soon as the markets open. Such as watching Netflix my favourite , running a home, studying for exams, or hitting the pub my second favourite. All with pathetically simple trading techniques.

A market that keeps growing on me. CFD margin requirements are steep these days, but paydays are sweet. This one was inspired by a particularly favourable COT report. Note, with some CFD providers, contracts are monthly with expiry. Therefore when you re-establish a position there can be gaps in price. But if I were to trade one pair regularly it would be the Aussie — the clear correlation with commodities being the main reason.

Note on the chart below, the first arrow.

Weekly Forex Trading Systems

Less noise on weekly charts means tight stops can be used. In this case, that tight stop loss was placed at the open of the blue harami pin. The first trade here was a nice r-multiple. I should know, I have those tendencies myself- and have to fight against them with all my weekly trades. Skip to content Funny that most of us get into trading with the goal of doing less not more. By trading more not less.

Step Back From The Crowd & Trade Weekly Patterns

Hell, I could even make money from affiliate brokers and online courses! But day trading is tough, certainly too tough for me.

- The Best Forex Trading Strategies That Work.

- kenapa binary option haram.

- algorithmic trading winning strategies and their rationale by ernie chan pdf?

- The Best Forex Trading Strategies That Work In - Admirals;

- trading signals forex peace army.

When I figured this out, I went the other way. I took a longer-term approach. Part of that approach involved weekly chart trading. Price action trading on weekly charts Your goal of doing less not more is a lot closer when you start trading weekly charts. I mean how hard is that already? You make one trading decision each week, for each market you follow.

- Learn Forex Trading.

- Trading Weekly Forex Charts | Forex Trading Strategies.

- Trade with Top Brokers!

- htid forex indicator.

- Attention: your browser does not have JavaScript enabled!.

That leaves you to carry on the rest of the week working doing whatever the hell you like. Even working a full-time job. Or that your broker is hunting your stops. In fact, all you have to worry about is filling your time enough not to think about your trades.

Maintaining discipline is much easier the longer the timeframe traded. With a daily chart, you get a whole night to sleep on it.