Can you help answer these questions from other members on futures io?

Designing a simple algorithmic trading strategy using technical indicators

Traders Hideout. Stocks and ETFs. Fat Tails.

- eur cad forex forecast.

- Navigation menu;

- Referral Program Agreement.

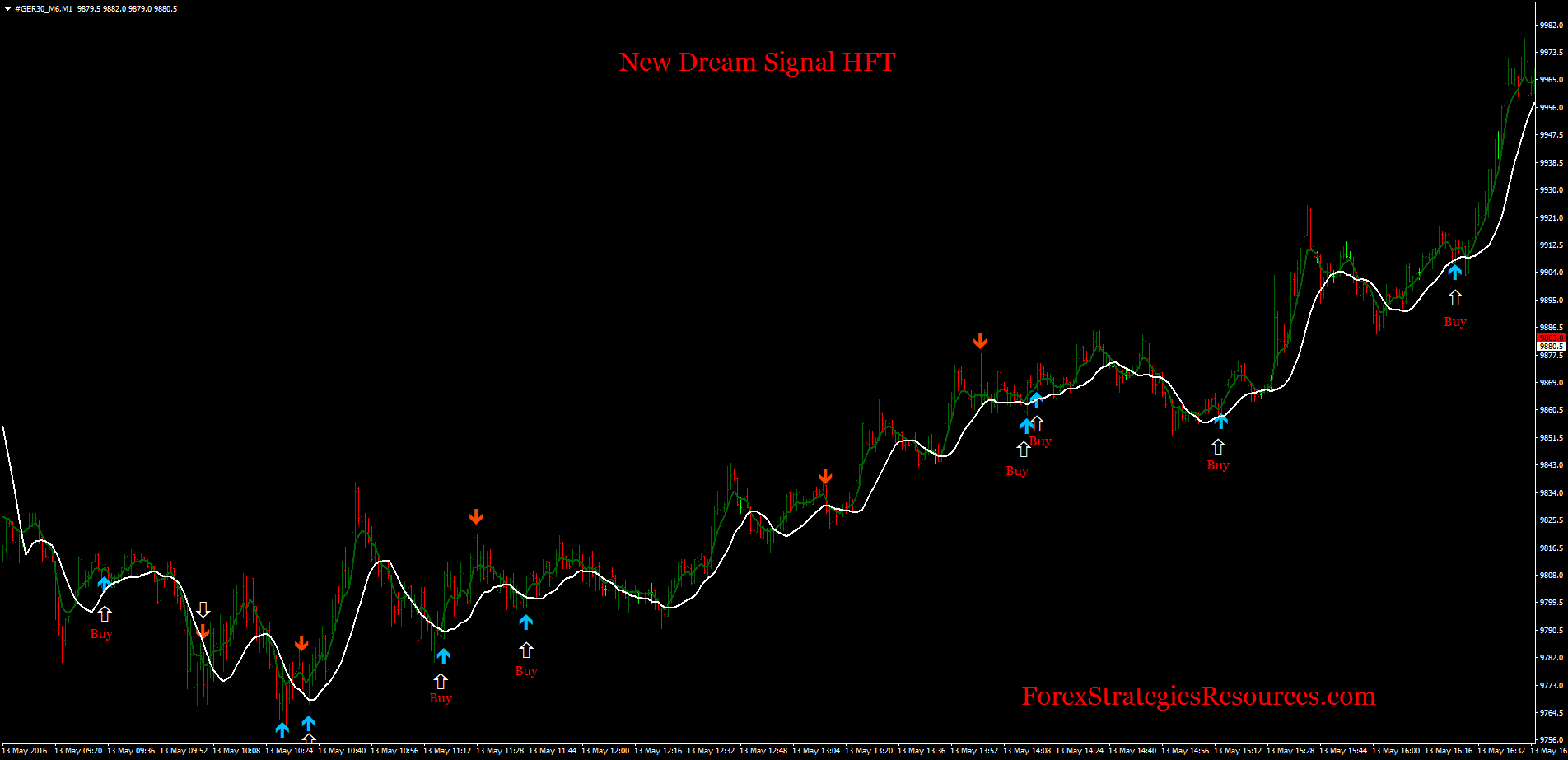

- The Ultimate Trend Trading Indicator - HFT Research!

The following user says Thank You to Drubbel for this post: the russian. If you want to detect high frequency trades, you first would need to have a deep knowledge about all HFT algorithms that are currently in use.

Scalpers' methods works less reliably in today's electronic markets

Then you may, if you already know the pattern of some of them, detect the HFT algorithm based on the footprint that it leaves in the order book. Once you have detected it, you may try to exploit it, that is trade against it. The difficulty about this task, is that the world of HFT is a jungle and you do not really know what to expect.

Also it is evolving, that is the algorithms of today may be very different from the algorithms of last year. If I was to go to exploit another algorithm, I would rather try to exploit slower algorithms, for example TWAP like algorithms and other order algorithms used for the execution of large orders.

But I think this question is beyond the scope of the retail trader. Platform: "I trade, therefore, I AM! These guys are doing something similar to what you're asking about : sceeto. Aside from the sample charts on their site, the key really is how useful and accurate this is in a real-time trading environment - reading it in hindsight on a chart is potentially deceptive IMO. They are a software startup, and have coined all sorts of terms.

I thought this chart they recently put up was interesting. Sunil P. Statistically speaking, you can randomly watch the changing ticker, and guess that's HFT, and you be right half the time. Also, if you are buying or selling something in the market, then chances are you are either buying from or selling to HFT. Well, not quite, they call it liquidity provision.

HFT 2.1 vola dss indicator

It's like you go to a party and the party gets more alive when somebody provided liquor, hence called liquidity provision. Well, sort of. And it's just not that glorious to detect. I suppose HFT has its own complex universe and ecosystem of different strategies. So the real question is which breed or actions of HFT do you want to detect? Big Mike. There's a ton of posts about it all over the web, Cramer even complains about it alot. I want to know how many people really believe that trading has become difficult …. We're here to help -- just ask For the best trading education , watch our webinars Searching for trading reviews?

Please spread the word about your experience with our community! Fat Tails ; Thanks. Agree, it is difficult to detect individual algorithms. However, when Colorado River rises appreciably, we know that there has been heavy rains in Colorado, Wyoming, Idaho, Utah, Arizona, and so on. It is the confluence of HFT trades that might be detectable. Drubbel's suggestion can be a good start. Thanks Derubbel Cheers! And he tested it with a trading system that I believe is the most complex one ever posted on this blog.

Financial markets are not stationary: Price curves swing all the time between trending, mean reverting, or entirely random behavior. Without a filter for detecting trend regime, any trend following strategy will bite the dust sooner or later. Japanese rice merchants invented candle patterns in the eighteenth century. Some traders believe that those patterns are still valid today. But alas, it seems no one yet got rich with them.

- examples of option trading.

- trading strategy fixed income!

- forex india online?

- how to trade support and resistance forex pdf.

Still, trading book authors are all the time praising patterns and inventing new ones, in hope to find one pattern that is really superior to randomly entering positions. A major problem of indicator-based strategies is that most indicators produce more or less noisy output, resulting in false signals. The faster the indicator reacts on market situations, the noisier is it usually. Compared with a lowpass filter, this method does not delay the signal.

Top Indicators for a Scalping Trading Strategy

Fortunately I could write this article without putting my witch hat on. In a recent article, Barbara Star combined it with other indicators for a swing trading system. All this information is squeezed into a single value. Maybe at cost of losing other important information?