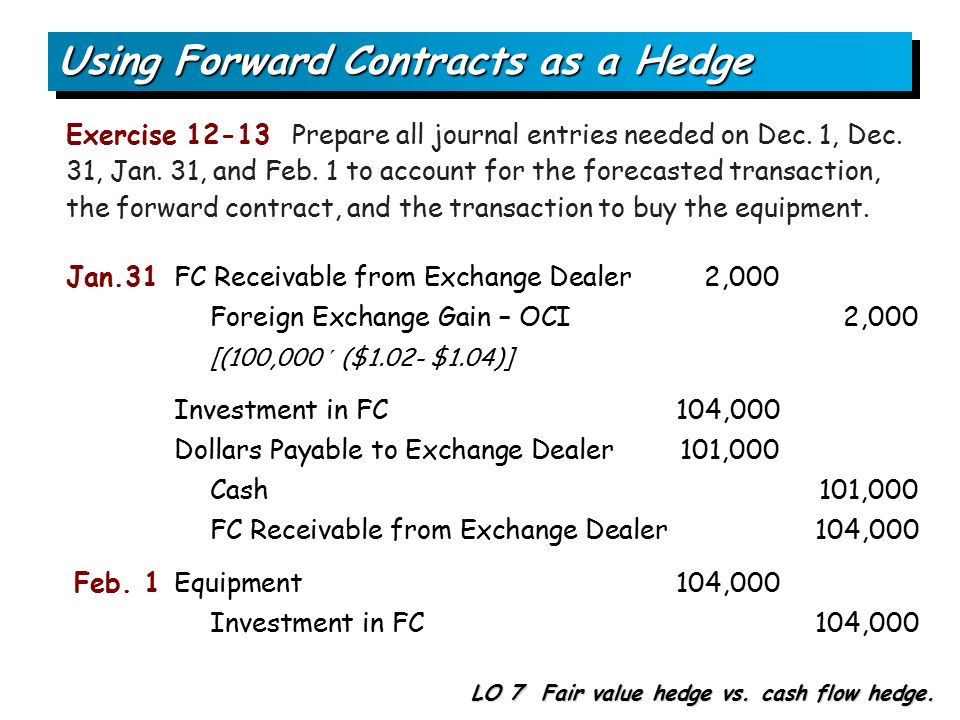

Download PDF. A short summary of this paper. The forward contract is entered to hedge a firm commitment and hence AS 11 will not apply.

On 31st March Forward Rate as at 31st March Hence no accounting entries are required as at 31st March in terms of announcement of ICAI that gains should not be recognized. Disclosure of the amount of Hedge is to be made in Notes to accounts with a mention that gain as on March 31st, is not recognized. Hence no accounting entries are required as at 31st March.

Data about the Forward Rate on 1st Jan with reference to 31st March is required.

What is a Forward Exchange Contract?

If this is achieved by way, of closure of existing contract and entering into new contract. Then the bank may debit or credit the exchange difference on closure.

This requires to be recognized. The new contract will also be in the nature of a contract to hedge firm commitment, since the contract is entered into prior to the actual occurrence of the transaction. Then the scheme of entries mentioned in Case A under Scenario 1 will be applicable. On 15th March The rate of exchange that will be considered by the Bank on 15th March, will have to be considered for ascertaining the profit or loss on cancellation. If the Bank considers the rate as Since, the maturity date and cancellation date is the same, the gain of Rs.

This will be accounted as under: Bank Dr. Securities transactions initiated in year 1 with the spot settlement date of the transaction in year 2. No special treatment required as transactions and consequences are already booked at trade date.

How to Account for Forward Contracts: 13 Steps (with Pictures)

Realised gains and losses are recognised in year 1 at the period end, i. Daily booking of accrued interest, including premiums or discounts. Interest, premium or discount accrued related to financial instruments denominated in foreign currency is calculated and booked on a daily basis, independently of real cash flow. This means that the foreign currency position is affected when this accrued interest is booked, as opposed to only when the interest is received or paid 2.

Coupon accruals and amortisation of premium or discount are calculated and booked from the settlement date of the purchase of the security until the settlement date of sale, or until the contractual maturity date. The table below outlines the impact of the daily booking of accruals on the foreign exchange holding, e. Daily booking of accrued interest as part of the economic approach.

Related information

Accruals for foreign exchange denominated instruments are calculated and booked daily at the exchange rate of the recording day. Impact on the foreign exchange holding. Accruals affect the foreign currency position at the time they are booked, not being reversed later on. The accrual is cleared when the actual cash is received or paid.

At settlement date there is thus no effect on the foreign currency position, since the accrual is included in the position being revalued at the periodic revaluation. There is no preference regarding the choice of approach. However, if the last day of the year is not a business day it needs to be included in the calculation of accruals in either approach. Balance sheet item 2. Scope of application 3. Physical gold, i.

Non-physical gold, such as balances in gold sight accounts unallocated accounts , term deposits and claims to receive gold arising from the following transactions: a upgrading or downgrading transactions; and b gold location or purity swaps where there is a difference of more than one business day between release and receipt. Claims on non-euro area residents denominated in foreign currency.

Claims on counterparties resident outside the euro area including international and supranational institutions and central banks outside the euro area denominated in foreign currency. National quota minus balances in euro at the disposal of the IMF. General arrangements to borrow, loans under special borrowing arrangements, deposits made to trusts under the management of the IMF.

Balances with banks and security investments, external loans and other external assets. Current accounts, fixed-term deposits, day-to-day money, reverse repo transactions. Notes and bonds, bills, zero bonds, money market paper, equity instruments held as part of the foreign reserves, all issued by non-euro area residents. Marketable debt securities other than held-to-maturity.

Switch to Cloud with ClearTDS!

Marketable debt securities classified as held-to-maturity. Non-marketable debt securities. Marketable equity instruments. Claims on euro area residents denominated in foreign currency. Notes and bonds, bills, zero bonds, money market paper, equity instruments held as part of the foreign reserves, all issued by euro area residents.

Deposits and other lending at nominal value, translated at the foreign exchange market rate. Claims on non-euro area residents denominated in euro. Balances with banks, security investments and loans. Current accounts, fixed-term deposits, day-to-day money. Reverse repo transactions in connection with the management of securities denominated in euro.

Equity instruments, notes and bonds, bills, zero bonds, money market paper, all issued by non-euro area residents.

Securities issued by supranational or international organisations, e. Lending to euro area credit institutions related to monetary policy operations denominated in euro. Items 5. Regular liquidity-providing reverse transactions with a weekly frequency and normally a maturity of one week. Longer-term refinancing operations. Regular liquidity-providing reverse transactions normally with a monthly frequency, with a maturity longer than that of the main refinancing operations.

Fine-tuning reverse operations. Overnight liquidity facility at a pre-specified interest rate against eligible assets standing facility. Credits related to margin calls. Additional credit to credit institutions, arising from value increases of underlying assets regarding other credit to these credit institutions. Other claims on euro area credit institutions denominated in euro. Correspondent accounts with non-domestic euro area credit institutions. Other claims and operations unrelated to monetary policy operations of the Eurosystem including Emergency Liquidity Assistance.

Securities of euro area residents denominated in euro. Securities held for monetary policy purposes. Securities held for monetary policy purposes including securities purchased for monetary policy purposes that are issued by supranational or international organisations, or multilateral development banks, irrespective of their geographical location.

Market price. Securities other than those under asset item 7. Equity instruments. General government debt denominated in euro. For the NCBs: net claim related to the application of the banknote allocation key i. Only relevant for the period between booking of monetary income as part of the year-end procedures, and its settlement on the last working day in January each year.

Items in the course of settlement. Settlement account balances claims , including the float of cheques in collection. Tangible and intangible fixed assets. Land and buildings, furniture and equipment including computer equipment, software. Securities, including equities, and other financial instruments and balances, e. Reverse repo transactions with credit institutions in connection with the management of securities portfolios under this item.