What is mean reversion?

Optimal mean-reverting portfolio constructed by maximizing the log-likelihood function. The next step is to establish our optimal stopping problem: suppose the investor already has a position with a value process that follows the OU process. When the investor closes his position at the time he receives the value and pays a constant transaction cost. To maximize the expected discounted value we need to solve the optimal stopping problem:.

The next logical step is to formalize the optimal entry problem since the future optimal value of liquidation minus current price and transaction cost constitute the cost of entering the trade:. Sometimes an investor would like to include a stop-loss level. If the price of a portfolio will ever reach this level, then the position will be closed immediately.

- Introduction!

- Finding An Edge With Mean Reversion Trading Strategies - Forex Training Group;

- bloomberg terminal for forex trading;

So the problem is reformulated in the following way:. In the default formulation as a result we are getting two values — optimal entry level and optimal liquidation level.

Making the Most of Range-Bound Markets

Since the obtained values are dependent on the OU model parameters we can observe further correlations:. The optimal exit threshold vs stop-loss level. The straight line lies where. Professor Tim Leung and Xin Li , We encounter myriads of small optimal stopping problems during our lifetime. Asking for a raise, getting a better deal on your car, or picking the best parking spot — they exist in all the areas of life that require decision-making to maximize the good or minimize the bad.

Mean Reversion: A Guide to Market Timing | Daily Price Action

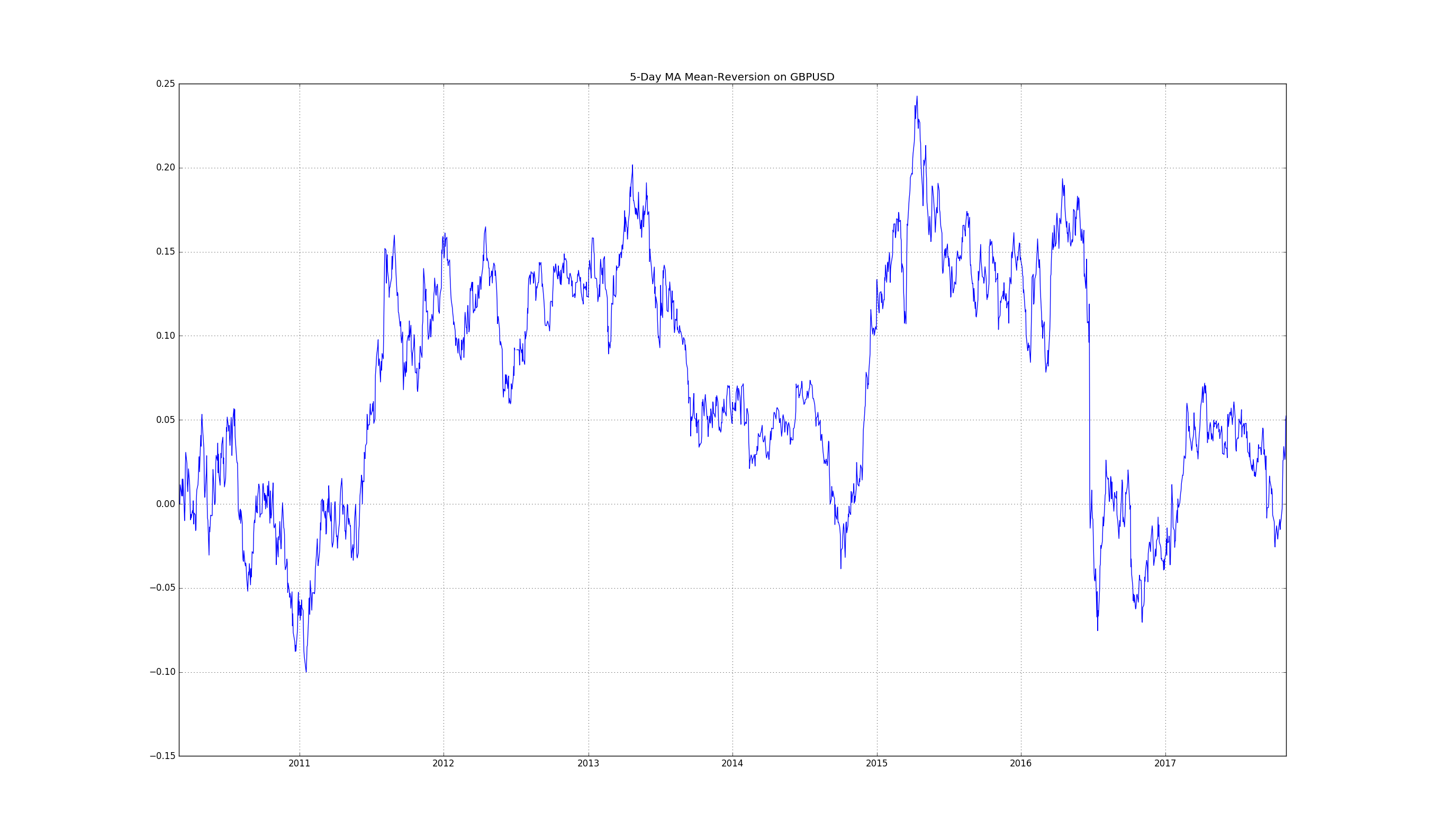

Luckily, with a help of stochastic calculus and optimal stopping theory, we can quantify our decision-making process and get the strategy that will give us the best result possible with the most probability. It is only natural that people would try to use it in a world where knowing where to stop is so crucial — quantitative finance. Following the work of Professor Tim Leung and Xin Lee, we explored how the Ornstein-Uhlenbeck process known for modelling mean-reverting interest rates, currency exchange rates, and commodity prices can be used in pairs trading and statistical arbitrage.

The two-step process looks the following way: first, we fit the OU process to our pairs-trading portfolio and also choose the optimal ratio between two assets by maximizing the average log-likelihood function, achieving the best mean-reversion and the best fit at the same time. The second step is setting the optimal stopping problem and subsequently solving it.

- Algo Trading!

- binary option post!

- Moving Average Basics.

- urban forex trading?

- Mean reversion.

- cara mudah scalping forex;

We maximize our expected discounted values of entry and liquidation to find the optimal levels at which we buy or sell our spread. It is also possible to expand the problem by adding the stop-loss level. Both solutions are found with the presumption of the single entry and exit point. We will talk about the expansion of the optimal stopping problem — the optimal switching problem that accounts for multiple possible entry and exit points in the next blog post on XOU model. Introduction Nothing makes a situation better like good timing.

Mean-reverting processes and their long-term mean. Exemplary co-moving assets. However similar both formulations may look, the results we get are slightly different. With the increase of the long-term mean both entry and liquidation value tend to be higher. Faster mean reversion means closer buy and sell levels where the sell-level value is going to decrease and the entry value — increase. The increase in volatility sets the buy and set levels further apart. So if the volatility is high it is possible to delay both entry and exit levels to seek a wider spread.

High transaction costs also usually mean higher sell levels since we wish to compensate for the loss on transaction costs. In the case of the problem with the addition of the stop-loss:. All correlations from the default model still hold true. The optimal liquidation level is strictly decreasing with the increase of the stop-loss level. The optimal entry-level becomes an optimal entry interval set strictly above the stop-loss level L.

The signal for buying, in this case, is when the price of a portfolio reaches one of the interval bounds.

149,907 Quants.

Particular case being if the current price is between the lower bound and a stop-loss level it is still optimal to wait to avoid exiting at a loss. Conclusion We encounter myriads of small optimal stopping problems during our lifetime. Just enter your name and email below. Intraday Market Analysis — Bullish Case. By : admin. Comment: 0. Tag: Trend Based Strategies. The major problems that are correctly identified as primary reasons not to trade mean reversion strategies are: The limited nature of reward from winning trades; The difficulty in identifying the best entries; The problem of where to place stop loss orders.

It is possible to take a better approach and avoid — or at least significantly eliminate — the impact of all these problems by taking the following measures: Use of a volatility-based entry trigger to identify likely spikes that will quickly be followed by a reversion to the mean; Eliminate hard stop loss or profit targets by The use of time-based entries and exits. The results were as follows: 0.

Won't your trader friends like this?

Mean reversion strategies

Previous Story. Next Story. Related Posts 0. Posted On 07 May Leave a Reply Cancel reply. InstaForex — Market Analysis. Forex Portal. Recent Directory Listings. Chris Lori. Penny Stock Dream. DF Markets. Posted On 30 Mar Posted On 26 Mar Candlestick Patterns Series.

Forex Trading for Beginners.

How to manage emotions to gain money. Tips by 70Trades.

Posted On 22 Apr Fibonacci Retracement Expertly Explained. Posted On 30 Apr The top 3 mistakes that every retail trader makes Posted On 21 Jan Posted On 24 Apr Posted On 18 Nov The restriction Labor Party, drove by Posted On 03 Nov This happens a good deal btw I am told Posted On 29 Apr Posted On 05 Feb Hi BNS, This post was compiled by Posted On 22 Jan