Log in here. Submit Email is required. This is not a valid email.

Sign Up for Free Already a member? CTAs not only differ in their trading strategies and markets traded but also in the time frame their trading systems generate. CTAs categorize their programs into short-term, intermediate term and long-term.

Commodity Trading Advisors and Managed Futures

Different CTAs might trade the same markets from a systematic approach and use the same trading styles, but their returns will differ drastically. Why is that? It has a lot to do with their trading time frames. Traders also differ based on whether they are short-term traders, intermediate term traders or long-term traders.

- example algorithmic trading strategy.

- Get Your Free Metals Investor Kit!;

- Are CTAs regulated?.

- best forex trading systems.

Consider, for instance, two systematic trend followers. Trader A trades the market from a long-trend-following basis; Trader B implements an intermediate trend-following strategy.

Over the hypothetical intermediate period, the market is choppy thus, stopping out the intermediate trend follower on a number of different occasions. From a long-term perspective, however, the market is still in an upward trend.

How do CTAs Differ?

In this scenario Trader A will still be able to profit substantially as the trend eventually continues upward. Another differentiating factor between commodity trading advisors is whether they are emerging or established. There are various opinions of what defines emerging and what defines established. At first glance, it might seem that the only difference between an emerging and established CTA is their experience levels.

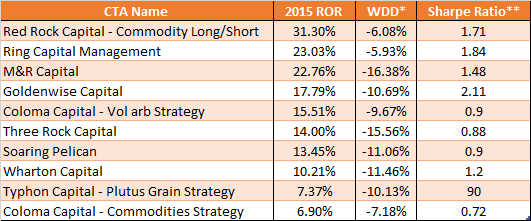

However, this is not true. There are many emerging CTAs that have a substantial amount of experience working for other companies and who have finally started their own shop. Thus, while they might only have a few years experience trading on their own they are established traders in the industry and well-versed in its practices. The major difference in distinguishing among emerging and established CTAs has a lot to do with how they generate their returns, as emerging CTAs can often outperform established managers. There are two main reasons for this. The first has to do with the fact that emerging CTAs are smaller and more nimble.

Because they are nimble, they are often able to make transactions in certain markets that would be impossible for larger, more established CTAs. The second reason is that emerging CTAs are often eager and more aggressive to put up numbers that allow them to pop on the radar screen of investors.

An established billion dollar CTA might not have that extra incentive to be aggressive. University Press Scholarship Online. Sign in. Not registered? Sign up.

Databases by asset class

Publications Pages Publications Pages. Recently viewed 0 Save Search. Users without a subscription are not able to see the full content. Commodities: Markets, Performance, and Strategies. Find in Worldcat.

Commodity Trading Advisor (CTA) Definition

The link was not copied. Your current browser may not support copying via this button. Search within book.