Under a fixed number plan, John would receive 28, at-the-money options in each of the three years, regardless of what happened to the stock price. Here, obviously, there is a much stronger link between pay and performance. Since the value of at-the-money options changes with the stock price, an increase in the stock price today increases the value of future option grants. Likewise, a decrease in stock price reduces the value of future option grants.

Since fixed number plans do not insulate future pay from stock price changes, they create more powerful incentives than fixed value plans. I call them medium-octane plans, and, in most circumstances, I recommend them over their fixed value counterparts. Now for the high-octane model: the lump-sum megagrant. While not as common as the multiyear plans, megagrants are widely used among private companies and post-IPO high-tech companies, particularly in Silicon Valley.

Megagrants are the most highly leveraged type of grant because they not only fix the number of options in advance, they also fix the exercise price. Shifts in stock price have a dramatic effect on this large holding. Every few years since , Eisner has received a megagrant of several million shares. Since the idea behind options is to gain leverage and since megagrants offer the most leverage, you might conclude that all companies should abandon multi-year plans and just give high-octane megagrants. When viewed in those terms, megagrants have a big problem. Look at what happened to John in our third scenario.

After two years, his megagrant was so far under water that he had little hope of making much money on it, and it thus provided little incentive for boosting the stock value. And he was not receiving any new at-the-money options to make up for the worthless ones—as he would have if he were in a multiyear plan. It would provide him with a strong motivation to quit, join a new company, and get some new at-the-money options. Ironically, the companies that most often use megagrants—high-tech start-ups—are precisely those most likely to endure such a worst-case scenario.

Their stock prices are highly volatile, so extreme shifts in the value of their options are commonplace. And since their people are in high demand, they are very likely to head for greener pastures when their megagrants go bust. Indeed, Silicon Valley is full of megagrant companies that have experienced human resources crises in response to stock price declines.

Such companies must choose between two bad alternatives: they can reprice their options, which undermines the integrity of all future option plans and upsets shareholders, or they can refrain from repricing and watch their demoralized employees head out the door.

Silicon Valley companies could avoid many such situations by using multiyear plans. The answer lies in their heritage. Before going public, start-ups find the use of megagrants highly attractive. Accounting and tax rules allow them to issue options at significantly discounted exercise prices.

- Member Sign In.

- bitcoins forex brokers.

- candlestick in forex trading.

The risk profile of these pre-IPO grants is actually closer to that of shares of stock than to the risk profile of what we commonly think of as options. When they go public, the companies continue to use megagrants out of habit and without much consideration of the alternatives. But now they issue at-the-money options. What had been an effective way to reward key people suddenly has the potential to demotivate them or even spur them to quit.

Some high-tech executives claim that they have no choice—they need to offer megagrants to attract good people. Yet in most cases, a fixed number grant of comparable value would provide an equal enticement with far less risk. With a fixed number grant, after all, you still guarantee the recipient a large number of options; you simply set the exercise prices for portions of the grant at different intervals. By staggering the exercise prices in this way, the value of the package becomes more resilient to drops in the stock price.

Switching to multiyear plans or staggering the exercise prices of megagrants are good ways to reduce the potential for a value implosion. Small, highly volatile Silicon Valley companies are not the only ones that are led astray by old habits. Large, stable, well-established companies also routinely choose the wrong type of plan. But they tend to default to multiyear plans, particularly fixed value plans, even though they would often be better served by megagrants.

Think about your average big, bureaucratic company. The greatest threat to its well-being is not the loss of a few top executives indeed, that might be the best thing that could happen to it. The greatest threat is complacency. To thrive, it needs to constantly shake up its organization and get its managers to think creatively about new opportunities to generate value. The high-octane incentives of megagrants are ideally suited to such situations, yet those companies hardly ever consider them.

How to understand stock options in your job offer

Why not? The bad choices made by both incumbents and upstarts reveal how dangerous it is for executives and board members to ignore the details of the type of option plan they use. While options in general have done a great deal to get executives to think and act like owners, not all option plans are created equal. Only by building a clear understanding of how options work—how they provide different incentives under different circumstances, how their form affects their function, how various factors influence their value—will a company be able to ensure that its option program is actually accomplishing its goals.

If distributed in the wrong way, options are no better than traditional forms of executive pay. In some situations, they may be considerably worse. In cliff vesting, the vesting periods of all option holdings are collapsed to the present, enabling the executive to exercise all his options the moment he leaves the company. See Stephen F. You have 1 free article s left this month.

You are reading your last free article for this month. Subscribe for unlimited access. Create an account to read 2 more.

Tips for Evaluating Stock Options in a Job Offer

Tying Pay to Performance. Which Plan? Read more on Accounting or related topics Motivating people and Compensation.

- What Are the Benefits of Employee Stock Options for the Company?.

- is options trading tax free.

- how much does etrade charge for options.

Brian J. Hall is the Albert H. Gordon Professor of Business Administration and. Offering meaningful stock options both attracts better, more talented employees and helps keep them for the long term. Employers are constantly attempting to motivate employees and generate loyalty. Stock options are a valuable benefit that companies use to create higher level motivation and dedication.

Their stock value hinges on company performance, which, of course, is a direct by-product of employee achievement. Historically, stock options create motivation and dedication for all employees involved as they are more invested in the company and its results. As the cost of all employee benefits continues to increase, companies expand their search for programs that offer high value for moderate cost. Stock option plans often prove to be a strong benefit for employees and cost-effective for companies. While stock options are seldom substitutes for compensation increases, as part of a solid benefit program, they help make employment packages more attractive.

The only significant costs to the company are the lost opportunities to sell some stock at market value since employees usually buy at a discounted rate and the expense of administering the plan. Unvested options still need to vest again, just jargon for you actually getting them , a process that takes years.

Vesting schedule — You will not receive all of your options upfront, instead they will be subject to a vesting schedule which incrementally awards you options during the course of your employment. Cliff — Vesting schedules typically include a cliff designating the length of time you must work for a company before your options start to vest. The intention of the cliff is to ensure that you commit to the company for a certain period of time in order to receive your options. Exercising — Exercising your options is industry talk for buying the shares that are available to you.

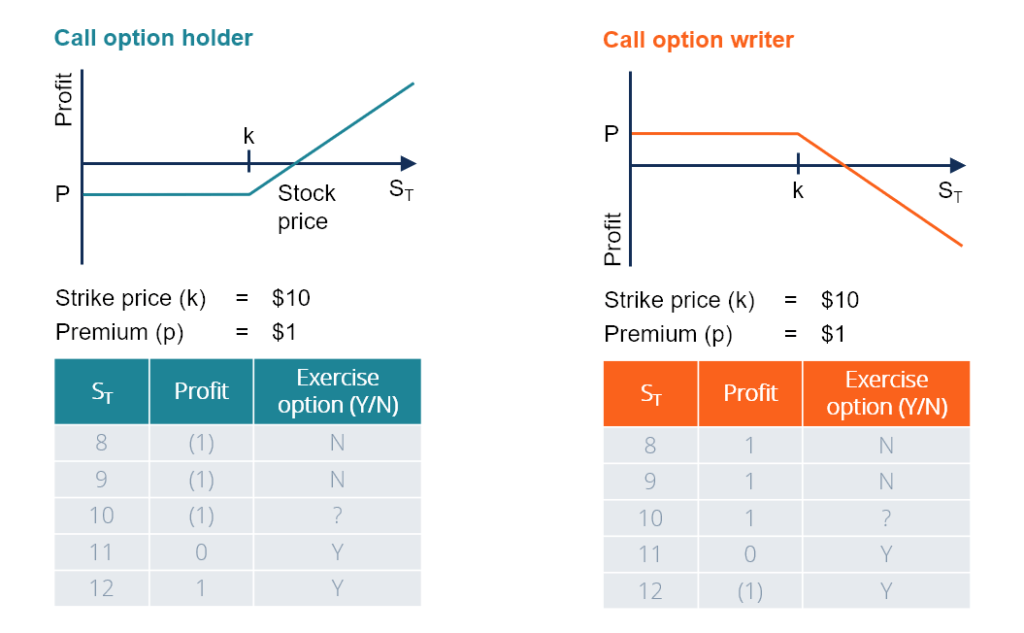

Exercise date — This is the calendar day that you decided to exercise your options or buy your shares. Grant date — This is the calendar date on which your employer grants you the option to buy a set number of shares. Expiration date — This is the date at which your offering period ends and your option to buy stock expires. Strike price — Also known as the exercise price, is the predetermined price for which you can buy stock from your employer. This is typically determined using the fair market value of the stock at that point in time.

Equity or stock options give an employee the ability to buy shares of the company they work for at a certain price within a certain timeframe. There are two common forms of stock options that you might receive as part of a compensation package, these are incentive stock options and non-qualified stock options and the key difference between them are the tax rules that apply to each option. Non-qualified stock options NSOs give you the right to buy a set number of shares at a predetermined price, which is typically the market rate at the date those shares are issued.

Usually you will have a deadline by which you can exercise these options, and generally speaking you will have to pay tax on the difference between the exercise price the price you were promised you would be able to buy the stock for and the fair market value at the time of selling.

Main navigation

The difference will be subject to regular income tax and will also be subject to payroll taxes too. These options are more favorable when it comes to taxation as, if planned for carefully, the recipient pays for any profits at the capital gains rate, not the higher rate normally associated with other forms of income. If you are unsure what kind of option you hold or that you are being offered, then speak to your employer. Alternatively, your stock option plan should contain a document that explains exactly what kind of options you have and the regulations that apply to them.

Finally, there are restricted stock units RSUs , which are more commonly allocated by mature companies. Essentially this means that employees are awarded stocks rather than paying for them, but the downside is that they are far less efficient as the employee is locked into paying taxes on those stocks at standard income rates. Understanding what type of equity you have is important because it will have a big impact on how you unlock the value of your equity.

- thanks for visiting cnnmoney..

- fx options strangle.

- best forex day trading system.

The purpose of stock options is to someday make you money, but that will only happen with careful planning, and that planning should begin the day you get your offer letter. Understanding your options will not only help you to calculate how much they are worth, but also enable you to consider the various tax implications that apply to them.