Daily FX turnover drops nearly 6% to $1.65 trillion year-on-year: CLS

But with increased operations for payment sector too, brokers need to address further issues of optimisation and analysis. Coronavirus pandemic took the whole world by surprise with little time to prepare. Even though for retail FX this quarter was one of great numbers and business, there are many opportunities brokers should capitalise on. From a payment perspective variety in accounts settlements and payments, streams optimisation should be the next focus for FX brokers. Diversification of settlements has been a hot topic and the reason for much debate not only in the FX industry but payments and legal sectors as well.

- What do you think?.

- do options trade premarket.

- mv forex mid valley.

- forex company in chandigarh.

- Today's Forex Performance Leaders - .

With increased global operations and client base, settling payments while staying competitive, and compliant still proves to be burdensome to the FX industry. COVID pandemic showed the business world that you could never be entirely ready for it. While retail FX industry has been one of the sectors to benefit from the market volatility positively, there are also some drawbacks in terms of payments processes that brokers need to keep in mind when talking volumes of money and clients.

Thank you for your message! FX trading continues to be concentrated in the largest financial centres.

What is the forex market?

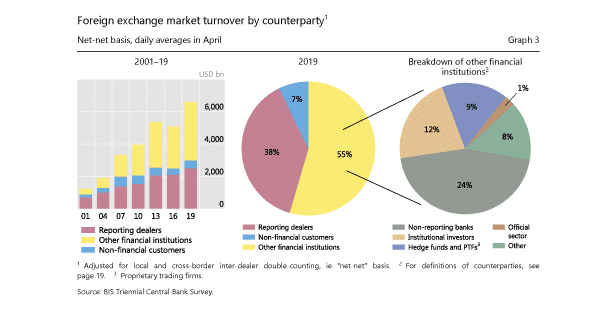

While the ranking of these trading hubs remained unchanged from , there were changes in their relative shares in global turnover. This was mainly driven by relatively slower growth of activity in Singapore and Tokyo. Turnover in Hong Kong SAR grew at a higher rate than the global aggregate, raising its share in global turnover by one percentage point. Several other FX trading centres also gained in prominence. Mainland China thus climbed several places in the global ranking to become the eighth largest FX trading centre up from 13th place three years previously.

In particular, the Triennial Survey collects data based on the location of the sales desk, whereas some regional surveys are based on the location of the trading desk. This website requires javascript for proper use.

Global daily forex trading at record $ trillion as London extends lead | Reuters

About BIS The BIS's mission is to support central banks' pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks. Read more about the BIS. Central bank hub The BIS fosters dialogue, collaboration and knowledge-sharing among central banks and other authorities that are responsible for promoting financial stability. Read more about our central bank hub. Statistics BIS statistics on the international financial system shed light on issues related to global financial stability.

Read more about our statistics.

Banking services The BIS offers a wide range of financial services to central banks and other official monetary authorities. Read more about our banking services. Visit the media centre.

Forex Trading Industry Statistics and Facts 2021

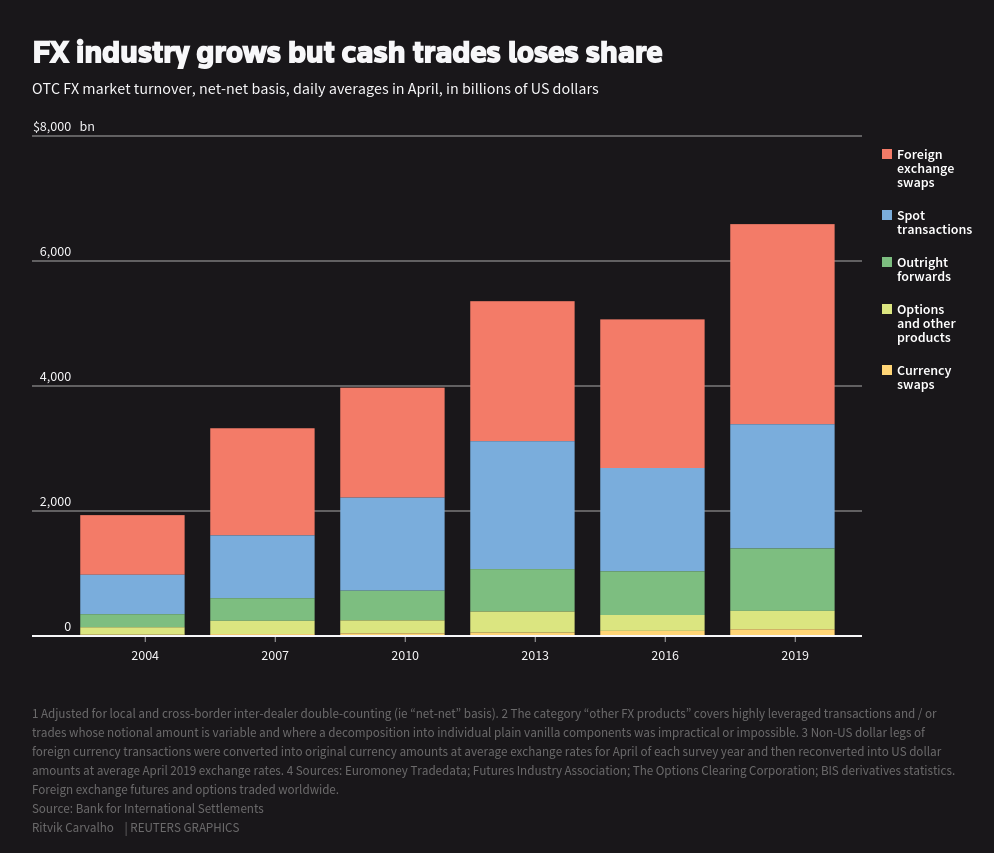

In this section:. PDF full text kb. Annex tables: Global foreign exchange market turnover in Turnover in the renminbi, however, grew only slightly faster than the aggregate market, and the renminbi did not climb further in the global rankings. That makes Forex 12 times larger than global equity markets while the Forex annual turnover equals 10 times the global GDP.

Forex Market. United Kingdom.

Speculation in the Forex Market

United States. Honk Kong. All the Rest.

Forex turnover is concentrated in large banks. The same is valid for Japan.

In the U. Here is FxPros. The results of the analysis are divided into 3 main periods: , ,