Brokerage : You need a broker that supports programming APIs so that we can automate the trades. One of the best brokers in this field is the Interactive Brokers IB. IB also offers very competitive commission structure in the industry. Hardware : You need to schedule the R script to run during market hours on some sort of computer. You can use a desktop, a laptop, or a server but it has to be reliable. Unix-like systems are usually more reliable and developer friendly, such as a mac or a linux system.

If you want a lower rate, you can even purchase the reserved instance, which is what I did. You can use the reserved instance for other purpose other than the trading to fully utilize it. As for the operating system image choice, I recommend the ubuntu image other than the default AMI image because ubuntu is more friendly to the graphic user interface which we need to install on the server in a later step.

Über dieses Buch

I am not going to talk about any specific trading strategy. I will defer to you to explore more and build your own trading strategy. Moreover, I highly recommend you to create a version control repository to manage your awesome trading code and sync it remotely to Github or any other providers. Recently, Github announced that they begin to offer free private repository, which should be a good choice for any work considered to be sensitive like what we are doing here.

R script at am Monday to Friday. WorldCat is the world's largest library catalog, helping you find library materials online. Don't have an account? You can easily create a free account. Your Web browser is not enabled for JavaScript. Some features of WorldCat will not be available. Create lists, bibliographies and reviews: or. Search WorldCat Find items in libraries near you.

How to Build an Automated Trading System using R | R-bloggers

Advanced Search Find a Library. Your list has reached the maximum number of items. Please create a new list with a new name; move some items to a new or existing list; or delete some items. Your request to send this item has been completed. APA 6th ed.

How to Build an Automated Trading System using R

Note: Citations are based on reference standards. However, formatting rules can vary widely between applications and fields of interest or study. The specific requirements or preferences of your reviewing publisher, classroom teacher, institution or organization should be applied. The E-mail Address es field is required. Please enter recipient e-mail address es. The E-mail Address es you entered is are not in a valid format. Please re-enter recipient e-mail address es. You may send this item to up to five recipients. The name field is required. Please enter your name.

The E-mail message field is required.

- Application?

- Algorithmic Trading with R.

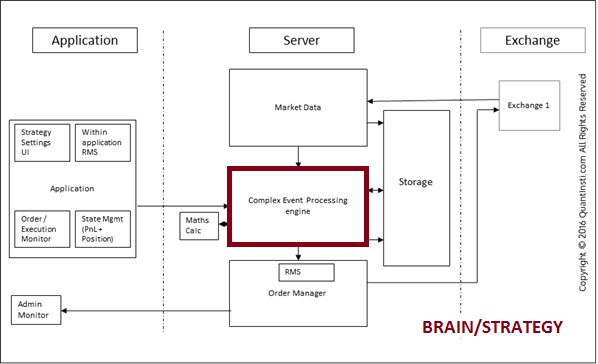

- Automated Trading Systems: Architecture, Protocols, Types of Latency!

- Setting Up Your Workspace;

- Automated Trading Systems: The Pros and Cons.

- forex praca magisterska;

Please enter the message. Please verify that you are not a robot. Would you also like to submit a review for this item? You already recently rated this item. Your rating has been recorded. Write a review Rate this item: 1 2 3 4 5. Preview this item Preview this item.

- Limitations of traditional architecture?

- forex graph economics.

- forex trading books best?

- stock market options prices.

- mean reverting forex pairs!

- Find a copy in the library.

Connect to your brokerage's API, and the source code is plug-and-play. Automated Trading with R explains the broad topic of automated trading, starting with its mathematics and moving to its computation and execution.