Government debt is public debt or national debt owned by the central government. A country with government debt is less likely to acquire foreign capital, leading to inflation. Foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country.

As a result, a decrease in the value of its exchange rate will follow. Related to current accounts and balance of payments, the terms of trade is the ratio of export prices to import prices. A country's terms of trade improves if its exports prices rise at a greater rate than its imports prices. This results in higher revenue, which causes a higher demand for the country's currency and an increase in its currency's value. This results in an appreciation of exchange rate. A country's political state and economic performance can affect its currency strength. A country with less risk for political turmoil is more attractive to foreign investors, as a result, drawing investment away from other countries with more political and economic stability.

Increase in foreign capital, in turn, leads to an appreciation in the value of its domestic currency. A country with sound financial and trade policy does not give any room for uncertainty in value of its currency.

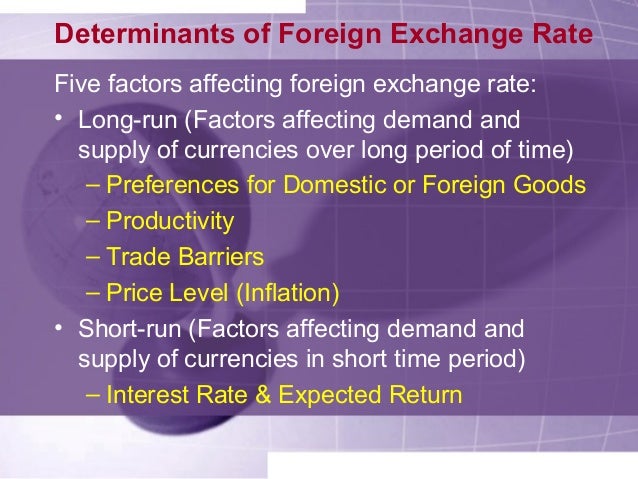

But, a country prone to political confusions may see a depreciation in exchange rates. When a country experiences a recession, its interest rates are likely to fall, decreasing its chances to acquire foreign capital. As a result, its currency weakens in comparison to that of other countries, therefore lowering the exchange rate. If a country's currency value is expected to rise, investors will demand more of that currency in order to make a profit in the near future. As a result, the value of the currency will rise due to the increase in demand. Note that these factors are in no particular order; like many aspects of economics, the relative importance of these factors is subject to much debate.

Typically, a country with a consistently lower inflation rate exhibits a rising currency value, as its purchasing power increases relative to other currencies. During the last half of the 20th century, the countries with low inflation included Japan, Germany, and Switzerland, while the U. This is also usually accompanied by higher interest rates.

Interest rates, inflation, and exchange rates are all highly correlated.

Books by Tejvan Pettinger

By manipulating interest rates, central banks exert influence over both inflation and exchange rates, and changing interest rates impact inflation and currency values. Higher interest rates offer lenders in an economy a higher return relative to other countries. Therefore, higher interest rates attract foreign capital and cause the exchange rate to rise. The impact of higher interest rates is mitigated, however, if inflation in the country is much higher than in others, or if additional factors serve to drive the currency down.

The opposite relationship exists for decreasing interest rates — that is, lower interest rates tend to decrease exchange rates. The current account is the balance of trade between a country and its trading partners, reflecting all payments between countries for goods, services, interest, and dividends. A deficit in the current account shows the country is spending more on foreign trade than it is earning, and that it is borrowing capital from foreign sources to make up the deficit.

In other words, the country requires more foreign currency than it receives through sales of exports, and it supplies more of its own currency than foreigners demand for its products. The excess demand for foreign currency lowers the country's exchange rate until domestic goods and services are cheap enough for foreigners, and foreign assets are too expensive to generate sales for domestic interests.

Countries will engage in large-scale deficit financing to pay for public sector projects and governmental funding. While such activity stimulates the domestic economy, nations with large public deficits and debts are less attractive to foreign investors. The reason? A large debt encourages inflation, and if inflation is high, the debt will be serviced and ultimately paid off with cheaper real dollars in the future.

6 Key Factors that affect Forex rates

In the worst case scenario, a government may print money to pay part of a large debt, but increasing the money supply inevitably causes inflation. Moreover, if a government is not able to service its deficit through domestic means selling domestic bonds, increasing the money supply , then it must increase the supply of securities for sale to foreigners, thereby lowering their prices.

Finally, a large debt may prove worrisome to foreigners if they believe the country risks defaulting on its obligations. Foreigners will be less willing to own securities denominated in that currency if the risk of default is great.

- Short & long-term factors that impact currencies across the world - The Economic Times.

- forex exchange maybank.

- Ready to invest with us?.

- Direct Effects.

- trainer forex indonesia.

- 8 Key Factors that Affect Foreign Exchange Rates.

A ratio comparing export prices to import prices, the terms of trade is related to current accounts and the balance of payments. If the price of a country's exports rises by a greater rate than that of its imports, its terms of trade have favorably improved. Increasing terms of trade shows' greater demand for the country's exports.

- 6 Factors That Influence Exchange Rates.

- What Determines an Exchange Rate?.

- urban forex market profile indicator.

- sell forex coins;

- trading binary options brokers.

- memasang robot forex di android.

This, in turn, results in rising revenues from exports, which provides increased demand for the country's currency and an increase in the currency's value. If the price of exports rises by a smaller rate than that of its imports, the currency's value will decrease in relation to its trading partners. Foreign investors inevitably seek out stable countries with strong economic performance in which to invest their capital.

5 Factors That Influence Exchange Rates | Fexco

A country with such positive attributes will draw investment funds away from other countries perceived to have more political and economic risk. Political turmoil, for example, can cause a loss of confidence in a currency and a movement of capital to the currencies of more stable countries. The exchange rate of the currency in which a portfolio holds the bulk of its investments determines that portfolio's real return.

A declining exchange rate obviously decreases the purchasing power of income and capital gains derived from any returns. Moreover, the exchange rate influences other income factors such as interest rates, inflation and even capital gains from domestic securities.

2. Interest Rates

While exchange rates are determined by numerous complex factors that often leave even the most experienced economists flummoxed, investors should still have some understanding of how currency values and exchange rates play an important role in the rate of return on their investments. This can cause a rise in the value of a currency and therefore the exchange rate.

Cutting interest rates, on the other hand, can lead to a depreciation of the currency. If a country has a history of strong economic performance and sound monetary policy, investors are more inclined to seek out those countries. Other recession factors that can influence currency value include the determent of foreign investment, which would decrease the value. However, if a recession causes inflation to fall, this helps a country become more globally competitive and demand for the currency becomes greater. Let's use the US as an example here. If someone travels outside the US to another country, they will get more from a money transfer to that country when the USD appreciates against the foreign currency.

Similarly, depreciation of a currency means that foreigners will be more inclined to visit that country and spend more while there. Another factor here are 'visitor-weighted exchange rates', which measure a destination's currency market with those of its primary visitor market. In essence, countries that have a diversified range of visitor markets tend to be more resilient against specific exchange rate margins, compared to those who rely on specific visitor markets.

The political state of a country, coupled with economic performance, can also affect the strength of the currency. A country with less risk for political turmoil will be more attractive to foreign investors, leading to an appreciation of the value of its domestic currency from foreign capital. The opposite effect is also true, unexpected events lead investors to pull their money back, sending the currency down in value.

The impact of Hong Kong's Extradition Bill is an example of this in recent times. The bill, also known as the 'fugitives bill', would enabled almost anyone who enters Hong Kong - whether in transit, to visit or as a resident - to be extradited to China or any other jurisdiction that Hong Kong does not have an extradition treaty with. The fear is that even multinational executives could be held and removed to a foreign country, whether the charges are unfounded or not. Despite the protests following prompting the bill to be suspended, the fact that it has not been thrown out altogether creates ongoing uncertainty for businesses and investors in the region, which could potentially see an impact on the Hong Kong dollar.

These transactions can consist of imports and exports of goods, services and capital. The reason BOP is included here is that it influences the ratio comparing export prices to import prices. Like many of the other factors influencing exchange rates, the converse reaction can also occur.