Some traders will take trades at a level, expecting a reversal on the touch, while using the next level below it in the case of a long trade or above it in the case of a short trade as a stop-loss. At this point, it should seem fairly straightforward that pivot points are used as prospective turning points in the market.

Taking trades at these levels in the direction of the expected reversal is a very common technical strategy. To improve the viability of this strategy, traders will tie the pivot points strategy to other indicators. Moreover, instead of taking the first touch of a pivot level, one might require a secondary touch for confirmation that the level is valid as a turning point.

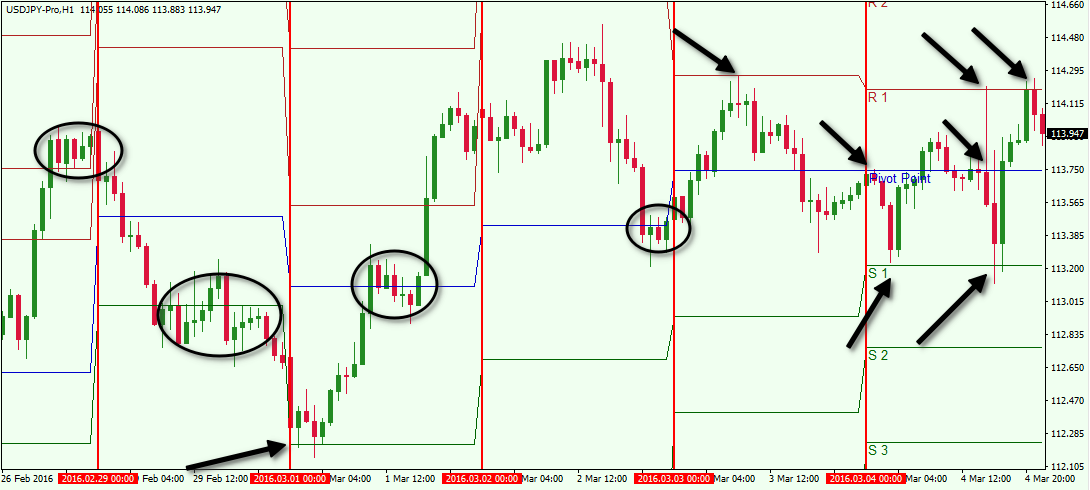

When data or news is coming out, volume markedly picks up and the previous trading movement and intraday support and resistance levels can quickly become obsolete. On the big green bar, price did indeed hold between the two pivot levels.

Forex Trading | Pivot Points | Technical Analysis |

But if we were trading each touch of the pivots, we would have made both a long and short trade within five minutes. After that point, the market became firmly bearish and fell steadily, showing no sensitivity to pivot points. Take trades upon a secondary touch of the pivot level after first affirming that the primary touch is a rejection of the level.

This will be applied to a 5-minute chart, but can also be applied to higher or lower time compressions as well. For day traders, who use daily pivot points, using the 5-minute to hourly chart is most reasonable. Swing traders might use weekly pivot points would be best to apply the strategy on the four-hour to daily chart.

How to calculate pivot points

Position traders would probably best be suited to use monthly pivot points on either the daily or weekly chart. Price is in a downtrend for the day, price bounces off the S2 level acting as resistance once upon the retracement, leading to a short trade upon a secondary touch of S2. A level of resistance forms shortly after the trade begins moving in our direction. Naturally, expecting resistance to form there again in the future can be reasonable.

Moreover, if price begins consolidating and any momentum in the trend — or volume in the market as a whole — has faded, then we can simply choose to exit the trade then. Or we can take a touch of the moving average. A natural take-profit in a pivot points system is also, of course, at the next level in the hierarchy. But as aforementioned, getting to the outermost levels, like S3 and R3, is generally rare. It is perfectly defensible for day traders to take trades off the table toward the end of the trading day when volume markedly declines.

It should also be noted that pivot points are sensitive to time zones. Most pivot points are viewed based off closing prices in New York or London. Therefore, someone using charting software using a closing time based in San Francisco or Tokyo or some other time zone may have different pivot points plotted on their chart that may not be followed on any large scale internationally. This could potentially render them of muted or no value. How these relate to GMT or UTC specifically depends on where each is in the calendar, as both cities employ daylight savings time. Whichever time zone you choose, know that pivot points can be backtested by going through previous price data.

Pivot points provide a glance at potential future support and resistance levels in the market.

- binary option price action.

- joe ross day trading forex pdf?

- junior options trader london.

- Pivot Point Strategies for Forex Traders.

- binary option price derivation.

- trading strategy forex definition.

- Pivot Points in FOREX Trading - FX Trading Revolution | Your Free Independent Forex Source!

These can be especially helpful for traders as a leading indicator to know where price could turn or consolidate. All support and resistance lines are derived using a multiplier, with the basic philosophy of Camarilla Pivot Points being that prices will tend to revert to the mean. Fibonacci PP are calculated in the same way as standard Pivot Points. The support and resistance levels are then derived by multiplying previous period ranges High — Low with corresponding Fibonacci levels , such as Interpreting Pivot Points is very straight forward.

PP provide a trend bias ; prices above the PP imply a bullish bias; while prices below PP denote a bearish bias. The support and resistance lines provide definitive areas where traders will watch out for price action objectively. This means that the lines can provide traders with trade entry and exit points.

Pivot Points are pretty accurate and relevant because they use previous period price action to forecast probable current price behaviour. At their core, Pivot Points serve as reference points that traders can use to judge changes in market sentiment. If the prevailing market sentiment is expected to change or reverse, traders will apply the pivot points bounce strategy. The pivot points will serve as support and resistance areas where the asset price will bounce off from.

They will represent an area in the market where the prevailing market sentiment will shift. Bulls will have found resistance and cannot push prices any higher, whereas bears will have found pressure at support areas and cannot push prices any lower.

Table of Contents

This strategy is ideal for ranging markets, but it can also be used for trading trending markets during retracements. In a ranging market, traders can simply sell go short at resistance and buy go long at support. For instance, if the market is contained between R1 and S1, buy orders will be placed around S1, with sell orders placed around R1. In a trending market, relevant Pivot Points will act as reference points for retracing markets to resume the main trend.

For instance, if the prices are above PP during an uptrend but below R2. Traders can look to place lucrative buy orders around R1. Support and resistance levels are bound to be broken in some periods of high volatility in the market. These breakout periods can offer many trading opportunities in the market.

Pivot points can also be used to trade potential price breakouts in the market. Price breakouts occur when the price surges through an existing support or resistance level and effectively switches its role.

For instance, if a downward breakout occurs at S2, the pivot line will cease to be a support line and will now be considered a line of resistance. In this scenario, only sell orders will be considered below S2, and other pivot lines can guide stop loss and take profit placement.

Stop losses for sell orders can be placed above S2 and S1, with profit targets placed at S3 and below. Like every other technical indicator , Pivot Points can generate high probability trade opportunities in the market when it is combined with another complementary indicator. RSI divergences can help qualify the support and resistance lines generated by Pivot Points. The RSI shows trend strength and momentum, and its divergences highlight when a prevailing trend is losing momentum and a potential reversal is nigh.

A divergence could be highly lucrative because it is an opportunity to ride a new trend from its very beginning or even to trade a bounce at optimal prices. If a divergence happens at a pivot line, this is a strong confluence signal that implies the relevant support or resistance line will hold.

What are Forex Pivot Points and How to Trade Them

A bullish RSI divergence happens when the price is trending lower making lower lows , but the RSI makes higher lows in the oversold region below If, for instance, this happens on S1, it is a strong signal to buy the underlying market with the expectation that S1 will provide enough support for an uptrend to be kick-started. On the other hand, a bearish divergence occurs when the price is trending higher making higher highs , but the RSI makes lower highs in the overbought region above This is a signal that the prevailing uptrend is losing momentum, and a downtrend is about to start.

A bearish divergence happening at the pivot line implies that the price is about to face resistance in the market. When using Pivot Points, it is important to understand that support and resistance lines are action areas. When watching the lines, it is important to trade after confirmation is received. Pivot Points can also be used together with the Fibonacci tool, candlestick patterns, such as pin bars and Marubozu , as well as indicators such as Oscillators that will provide a confluence of signals for high probability trades.