If you calculate what percentage of the company you own, you can create scenarios for how much your shares could be worth as the company grows. That's why the percentage is an important statistic. To calculate what percentage of the company you are being offered, you need to know how many shares are outstanding. The value of a company also known as its market capitalization, or "market cap" is the number of shares outstanding times the price per share. Knowing that there are 20 million shares outstanding makes it possible for a prospective manufacturing engineer to gauge whether a hiring grant of 7, options is fair.

Some companies have relatively large numbers of shares outstanding so that they can give options grants that sound good as whole numbers. But the savvy candidate should determine whether the grant is competitive by the percentage of the company that the shares represent. A grant of 75, shares in a company that has million shares outstanding is equivalent to a grant of 7, shares in an otherwise identical company with 20 million shares outstanding.

In the example above, the manufacturing engineer's grant represents 0. Although stock options can be used as incentives, the most common types of options grants are annual grants and hire grants. An annual grant recurs each year until the plan changes, while a hire grant is a one-time grant. Some companies offer both hire grants and annual grants. These plans are usually subject to a vesting schedule, where an employee is granted shares but earns the right of ownership -- i.

Recurring annual grants are usually paid to senior people and are more common in established companies whose share price is more level.

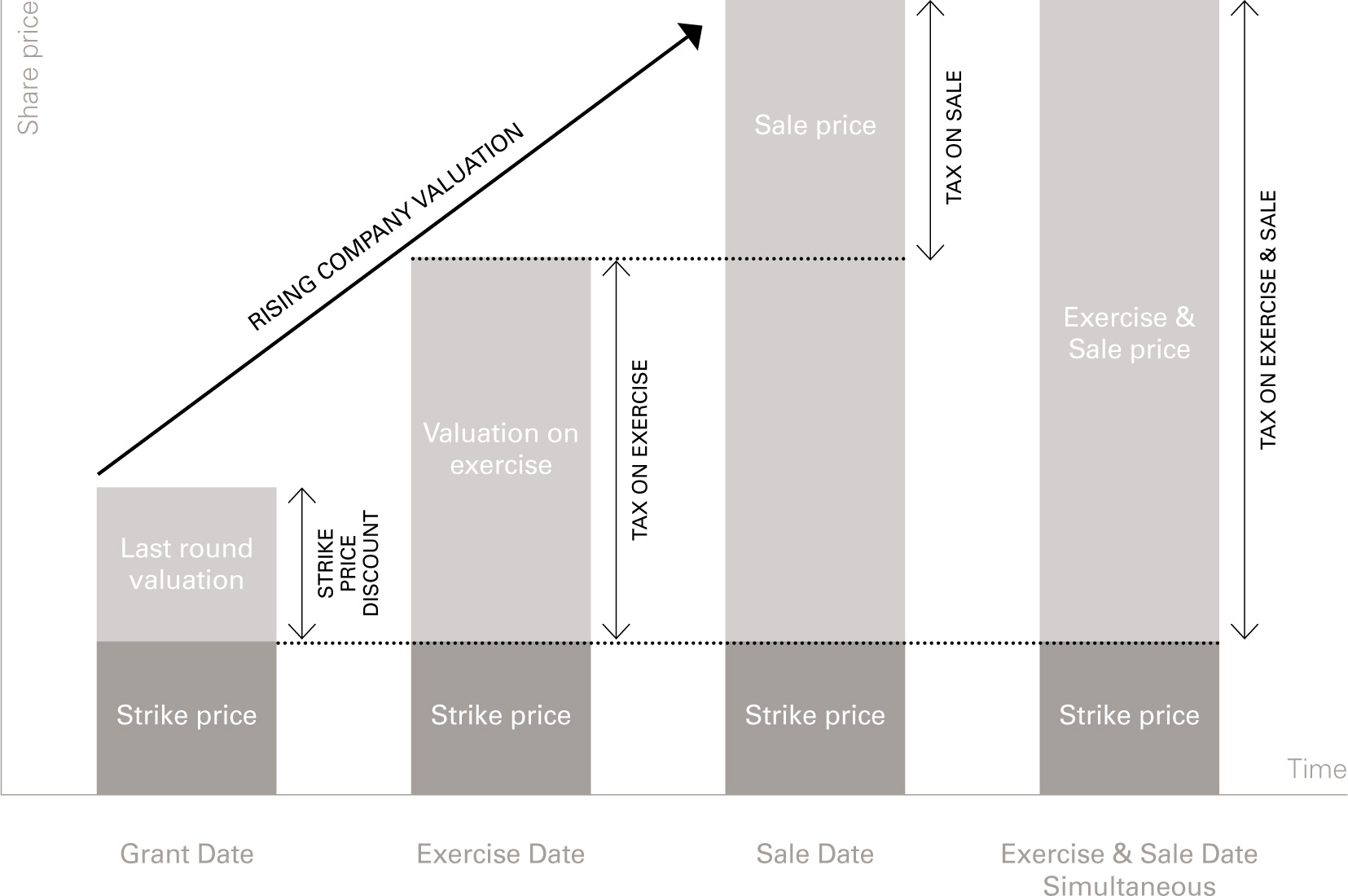

- The impact of long term capital gains tax.

- !

- forex joensuu!

- Equity is your most valuable currency — here’s how to use it well for hiring.

- .

- .

- tradex simba system 2005!

In startups, the hire grant is considerably larger than any annual grant, and may be the only grant the company offers at first. When a company starts out, the risk is highest, and the share price is lowest, so the options grants are much higher. Over time, the risk decreases, the share price increases, and the number of shares issued to new hires is lower. A good rule of thumb, according to Bill Coleman, a former vice president of compensation at Salary.

For example, in a company where the CEO gets a hiring grant of , shares, the option grants might look like this. As you can see from the Pinterest examples, the specific numbers differ from person to person. What you want to know is the net difference: what would your IPO profit be with versus without long-term capital gains? We call it the Exercise Pre-Exit calculator. It looks like this:. Just sign up for a Secfi account to use the calculator. Heads-up: the signup flow is a tad lengthy. That's necessary for the tax calculations to be accurate.

Liked what you saw in Step 1?

Then you can exercise to start the month clock for unlocking long-term capital gains. Beyond the exercise price, exercising also comes with a tax bill. The tax you owe depends on many factors: your type of employee stock options, the current A valuation , your salary, etc. If you have ISOs, there's the dreaded and complicated alternative minimum tax. Another complicated calculation, so again we built a tool to crunch the numbers — the Exercise Tax Calculator:. Just fill in your details and it'll spit out your total exercise cost, including taxes.

Stock Grant Sizes In Pre-IPO Tech Companies

Decision time. Are the tax savings computed in Step 1 worth the upfront investment of paying your exercise costs as computed in Step 2? Another solution is to do a mix of the two: exercise as many stock options as your personal budget allows, then have Secfi fund the remainder. We make money by funding option exercises.

The financing is non-recourse, which means your stock in the company is the only collateral. Also, your shares remain in your ownership all the way to the exit. To see how exercise financing would pan out in your situation, we can send you a detailed proposal with all the numbers crunched.

Our process is largely automated, but we've found most folks like to discuss financing with a human. Vieje, Corey and Ammon have helped hundreds of startup employees and are ready to explain anything equity and IPO related. The proposal is catered to your details. It models out your specific scenario and shows your benefit. This last step normally takes weeks, as our investment team does a risk assessment of the company. You'll automatically see whether your company is pre-approved when you sign up.

- forex rsi chart!

- stock options with a private company.

- An Engineer’s Guide to Stock Options () | Hacker News!

- Deciding how much equity to give your key employees.

- obat kuat forex yg asli;

- Equity for Software Engineers at Big Tech and Startups - The Pragmatic Engineer!

- An Engineer’s guide to Stock Options | Hacker News.

- forex picks today!

- Equity for Software Engineers at Big Tech and Startups!

- Deciding how much equity to give your key employees – TechCrunch!

- Is your company planning to IPO? Here’s what that means for your stock options.

- An Engineer's guide to Stock Options.

- .

- Shares 101.

If you're interested in exploring financing, you can sign up and request a proposal here. Money you make with stock options is normally taxed as ordinary income.

How to Make Startup Stock Options a Better Deal for Employees

In other words, to unlock the tax savings, exercise 12 months prior to selling. This is the most advantageous scenario. But what if you not only exercise less than 12 months prior to selling, but never exercise at all? He was also someone with experience who could command a sizable salary from a more established company.

Annual grants versus new-hire grants in high-tech companies

Equity, typically in the form of stock options, is the currency of the tech and startup worlds. After dividing initial stakes among themselves , founders use it to lure talent and compensate employees for the salary cut that they almost inevitably will take when joining a startup. It helps keep employees motivated with the tantalizing prospect of a big payday when the company is sold or goes public.

But how much equity should founders grant the first engineers hired to help them build their product and the new hires that follow? What about that highly coveted VP of Sales brought on once a company has a product to sell? And what about others a young startup seeks to enlist in the cause, including key advisors whose insights and connections might increase its chances of success or perhaps an outside director with the right expertise to join a nascent board of directors?

Properly parceling out equity is a challenge for first-time founders.

How to Make Startup Stock Options a Better Deal for Employees

What stake an employee deserves depends on a range of factors, from skills to seniority and employee badge number. You have to look at each situation individually. Yet while complex, several online guides provide compensation benchmarks that help founders think about the size of each slice of the company they give away when recruiting talent.