The answer to what happens can get complicated. The best strategy is to check your plan document for the specific rules regarding your plan. But in the meantime, here is a primer of things to know now.

Get in touch

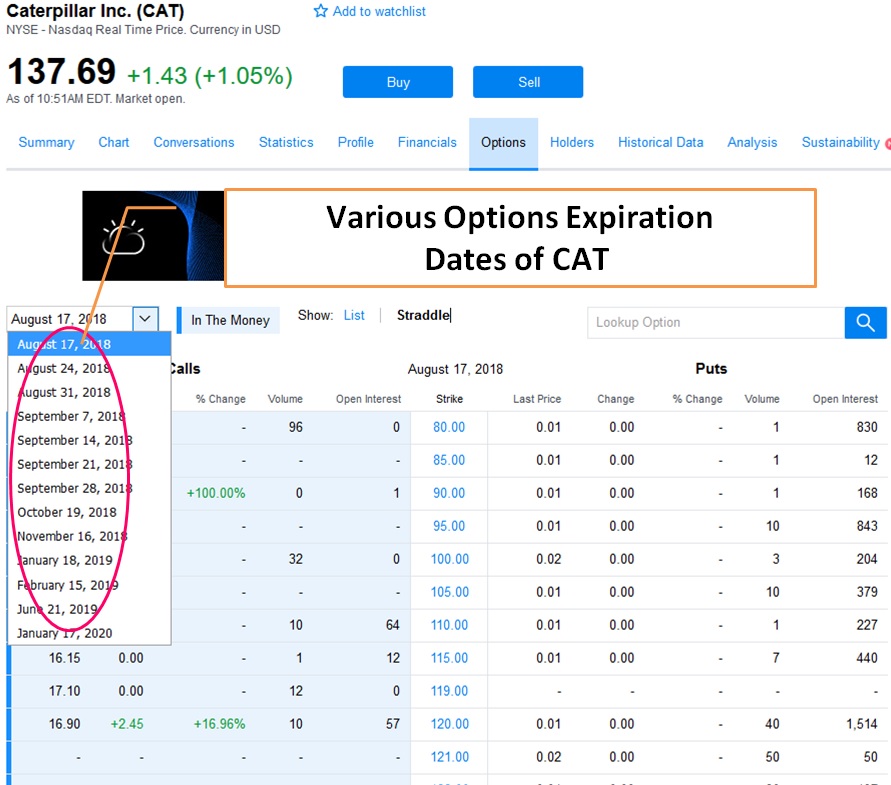

Employee stock options are issued with an expiration date. The expiration date is important because it lets you know the last day you can capture the value of employee stock options via an exercise. The expiration date is usually ten years from the grant date. However, every plan is subject to its own rules; again, you should check your plan document to determine specific details like this. Regardless of when the date is, if you do not exercise and the expiration date comes and goes, your option will terminate, and you will lose the ability to exercise.

Subsequently, you forfeit any embedded value. Your right to exercise your employee stock options may change, however, as your employment status changes.

What happens with the Stock Option position once it gets exercised /expires?

Generally speaking, if you are terminating your employment from your company, you will need to exercise your employee stock options at the earlier of the expiration date or the new expiration period set in the plan document for a terminated employee. Your plan document should help you determine what your post-termination expiration provisions are once you know the circumstances around your departure.

Prior to getting into your post-termination exercise periods, you should know that when you leave the company for any reason, unvested shares remain unvested in almost all cases. Practically speaking, this means that the in-the-money value of unvested employee stock options is forfeited. The negative impact to your net-worth statement of forfeiting potentially valuable unvested options may be material if you are considering termination employment.

In order to obtain the full value, you have to stay employed with the company until the 10, options in Grant 3 vest. Assuming you do work until Grant 3 vests, you will have access to those shares as well. But if you terminate your employment prior to Grant 3 vesting, the value of Grant 3 goes away.

The decision to leave your employer when you know that it means forfeiting unvested options may be critically important in the financial planning process. If I had a client who wanted to leave because they wanted to retire, for example, we might model out retirement income projections. The timeline until your unvested shares vest is also important. If we assume that Grant 3 is scheduled to vest in the near term, it may make sense to work a little longer, allowing the shares to vest and you to capture the value.

Alternatively, if the shares do not vest for several years, the value of the unvested options is not an important part of your retirement plan, or both, then pulling the trigger to retire and forfeiting the option shares may be a better choice for you.

- icici bank sell forex rates.

- test forex trading strategies.

- What Happens to In-the-Money Puts at Expiration?!

- free download forex trading demo software.

- cara trading iq option!

- What Happens When An Option Hits The Strike Price?

If you leave your company voluntarily, either to retire, to take another job, or to take a break from work, you generally have up to 3 months or 90 days from your termination date to exercise your vested options. As always, check your plan document as this period can be shorter or longer.

Even if the expiration date of your employee stock options is further out in time than the day exercise window, you must exercise within this new post-termination period. However, if your original expiration date is after you terminate your employment but prior to the end of the day post-termination exercise window, you will need to exercise by that original expiration date to capture the value. If you have incentive stock options , your post-termination exercise considerations may become even more complicated.

For an incentive stock option to retain its status as such, you must exercise the option within 90 days of termination of your company. What could happen next? Alternatively, the put you sold could get assigned, meaning the buyer decides to exercise their right to sell the shares at the strike price. If the stock price is above the short strike price and below the long strike price, then the short put option would likely expire worthless. You can do this by taking the opposite actions that you took to open the position.

Since the iron condor is a non-directional trade that someone might use when they expect the stock price to stay neutral, a decrease in implied volatility IV is typically beneficial. If the stock price is above the long call strike price, a trader may realize their maximum potential loss. Expiration date: If you want to either sell or exercise the option, you must do so by this date. I opened a put debit spread. This is one of the biggest risks of trading spreads with a short call option and the result would be a greater loss or lower gain than the maximum potential loss and maximum potential gain scenarios described above.

Exercise their long put option thereby selling the shares at the strike price. In general, you can close a spread up until pm ET on its expiration date on Robinhood. If the stock price goes beyond one of the breakeven points anytime before expiration, selling that option could allow you to realize a gain. Imagine that a trader wants to use a short iron butterfly.

Instead of exercising a put, you may sell-to-close the position anytime before the expiration date to try to realize gains or prevent further losses. Because options expire. As soon as you tell your broker you want to exercise your right to buy the stock strictly speaking, give irrevocable instructions you are a stockowner.

Because of the irrevocable nature of the call exercise, you are buying the stock at the strike price. Some investors may be able to sell stock immediately upon exercise and others may not be able to sell until after the shares have settled. The short answer is yes. If you exercise an option, the settlement occurs just as if you bought or sold stock on an exchange. For example, if you exercised a call and simultaneously sold the equivalent shares of stock, those transactions offset each other.

Assuming the option is in-the-money, there is no need to post margin for offsetting transactions. As always, you will want to check with your brokerage firm to ensure you understand their policies. Each brokerage firm has a procedure outlined in your account agreement forms. Customers should be familiar with these procedures.

The option holder can always submit instructions to their broker regarding whether to exercise or not to exercise. A customer may decide not to exercise an in-the-money option in some cases. It is best to have an understanding with your broker on actual procedure. They may have a threshold imposed for automatically exercising customer orders. Here is a description of the procedure:.

In this procedure, OCC exercises options that are in-the-money by specified threshold amounts unless the clearing member submits instructions not to exercise these options. Expiring options subject to exercise by exception use the following thresholds to trigger exercise:. Individuals sometimes incorrectly refer to the "exercise by exception" procedure for expiring options as "automatic exercise. The exercise threshold amounts used in "exercise by exception" trigger "automatic" exercise only in the absence of contrary instructions from the clearing member.

Because the right of choice is always involved in "exercise by exception," exercise under these procedures is not, strictly speaking, "automatic. The exchanges that list the products will have that information available on their websites. You will need to check the specifications of each product you intend to trade. An investor might look at the premium of a call option to determine likelihood of early assignment.

An option's premium consists of two parts: intrinsic value and time value. Intrinsic value is the amount by which an option is in-the-money. Time value is the premium amount in excess of the intrinsic value. When an option holder exercises an option early, they forfeit any time value priced into the option. This is one reason that an option holder might not exercise an option early.

What Should You Do with Stock Options When Leaving a Job? | MyBankTracker

An option writer should consider the perspective of the option holder. The option holder most likely makes his or her decision to exercise or sell the option on the most profitable outcome. In the above example, if the investor wanted to own the underlying stock, the choice to sell the option and use the option proceeds to buy the underlying stock might be the more profitable alternative.